Today’s US CPI number will be another hotly contested data point that will determine where market direction goes for the next few weeks. Before the number is unveiled, I want to share some thoughts about the whole debate between whether we will have a hard landing or a soft landing and disinflation or sticky inflation, because that gives us context on what this number means for the debate and how to trade it.

Hard landing vs soft landing?

To define a hard landing, I mean a traditional risk-off regime where unemployment surges, volatility explodes, USD strengthens from safe haven flows, and credit spreads widen significantly. A soft landing scenario is where we get a durable economic expansion and inflation-less bull market without first suffering from the aforementioned risk-off events. From my experience of trading the late-cycle markets of 2000, 2007, and 2019, we are simply biding our time until we get a hard landing. It could happen in H2 2023, next year, or even further out. Until then, we will muddle through a Goldilocks regime, characterized by fierce public debate about whether we are experiencing a soft landing or a recession-less recovery.

A Fed tightening cycle is usually not the direct cause of a recession, but rather creates the conditions for an exogenous shock to tip the global economy into recession. In 2020 the exogenous shock was the global pandemic, 2008 was the US financial crisis, and 2001 was the bursting of the dot-com bubble and the 9/11 attacks. What will be the exogenous shock this time around? An escalation of the Russian-Ukraine war, a flareup in the Middle East, or a debt crisis in China or Europe would be my best guesses, but it really could come from anywhere. Prior to 2008, very few people knew what a mortgage-backed security was, just like how nobody foresaw a global pandemic in 2020.

Fortunately, the Goldilocks regime is a friendly one for risky assets. You can choose to squeeze some return out of the market by participating, or sit it out while you wait for the hard landing to happen. The key is to stay liquid and nimble, knowing that risky assets are rallying on borrowed time.

Disinflation vs sticky inflation

This debate reminds me of the transitory vs accelerating inflation debate in 2022. There were huge gyrations in the equity and Treasury markets while the market swung between the two narratives. By the time it was clear that the transitory camp had lost, there was no more money to be made by betting on accelerating inflation. Those who made money trading global macro last year were the ones who navigated the gyrations and managed their risk despite the competing narratives.

In December the world was worried about recession because data was looking pretty shitty, and China was still mired in their dual crisis of zero-covid and a real estate debt bubble. Within a span of 45 days, China reopened, we got a monster unemployment number, and incoming data magically started to look less shitty. During that window we’ve somehow gone from “OMG it’s a recession” to “OMG inflation is about to accelerate again”.

Non-farm payrolls and ISM services (the two data points that helped trigger the move higher in yields) are notoriously volatile pieces of data. In my 20-plus years of trading, I hardly remember either number driving the market narrative for more than a week. Perhaps it’s because those numbers were huge upside surprises and we haven’t had any tier 1 data since those numbers were released.

The Fed projected Fed Funds moving up to 5.12% in their last dot plot in December. The market previously didn’t believe Fed Funds would reach that level due to heightened recession risks, which have receded since then. I believe the recent moves in US interest rate markets are just a repricing towards the Fed dots due to the strong uptick in new data, and not the beginning of a new uptrend in Treasury yields. Going forward, the Fed projection of 5.12% should act as a soft ceiling for the market. There were at least two instances last year when the market pricing significantly overshot the Fed dot plot, and Fed officials actually pushed back against that pricing, resulting in a market reversal.

Green: Fed funds curve 2 months ago. Orange: Fed funds curve today pricing in a terminal rate of 5.21%.

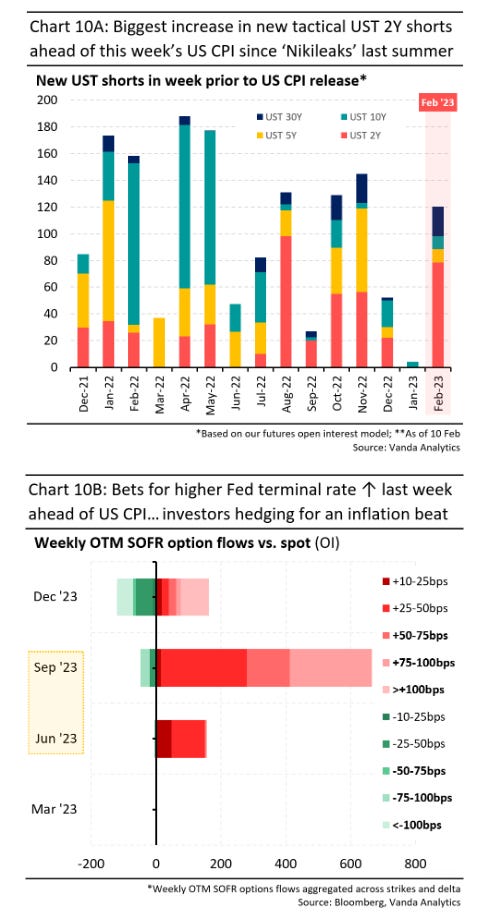

One can make a case that the sticky inflation camp will not gain much traction from where we are today. Yes, the CPI data could come in hotter than expected today. However, I think the market has moved to price in a hotter number already. Research from Vanda shows a significant buildup of positions betting on a more hawkish Fed this year:

Vanda also cites alternative data that shows that US employment is still softening, pushing back against the narrative created by the strong employment number.

Data shows that services sector employment is weakening faster than other sectors.

Conclusion: The sticky inflation camp is extrapolating too much from this month’s strong data. Regardless of where CPI lands today, we are not likely to see significant upside for yields and USD from here. The Goldilocks regime will remain in place.

With that note, I am going long gold again. I previously mentioned on Twitter that I wanted to get long at 1850 in spot. We got within $2 of that level today, so I went ahead and triggered the buy order at 1853.

Current positions:

Original trade ideas:

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

ooo you are jumping into battle action far too quickly imo