The road to recession passes through Goldilocks

Exiting 5-30 Treasury steepener and long BAX futures

“As long as the music is playing, you’ve got to get up and dance.”

Chuck Prince, the former CEO of Citigroup, famously said this quote in July 2007, a year before his company nearly went bust in the GFC. In mid-2006 the Fed had hiked to 5.25%, where it would stay on hold for 14 months. Despite the tighter financial conditions and weakening housing market, the S&P 500 was up 10% and near the peak of the cycle when Prince delivered this infamous quote.

However, I’m not here to ridicule Prince - in fact I sympathize with him. 2007 was a textbook Goldilocks regime (when the economy is neither too hot nor too cold) - a regime that can be confusing for investors. Bears lose money from shorting a rising market and bulls get ridiculed for overstaying their welcome. Goldilocks is the transition period from a hot economy and a rate hike cycle to a recession and a rate cut cycle. This is the regime we are in right now.

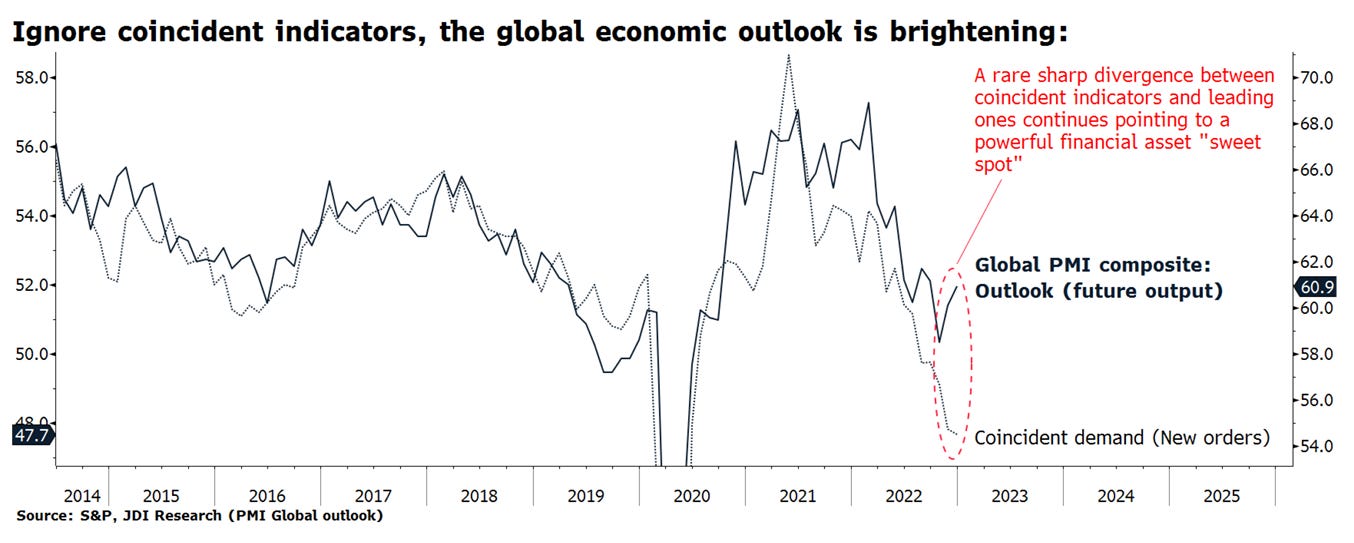

In some of my previous posts I wrote about how I thought a recession was imminent. We have seen some recessionary-looking data, but we are not yet in a textbook risk-off scenario where unemployment surges, volatility explodes, and asset prices sell off. As long as inflation is falling faster than growth (allowing for PE expansion), asset prices have an excuse to grind higher, especially given the amount of cash sitting on the sidelines. This is a period when consensus bearish positions get squeezed (US growth, crypto) while underinvested asset managers are forced to re-enter the market to avoid falling behind their benchmarks.

Still a long way to go before 2022 Fed tightening regime trades get unwound (courtesy of Vanda)

Global equity positioning is still at rock bottom (Vanda)

Data outside of the US is not looking so bad (courtesy of JDI Research)

Sentiment is turning higher, even in the US! (courtesy of JDI Research)

I’m not saying one should pile into equities and risk-on trades. I just think it’s dangerous to be short, or aggressively positioned risk-off. If you are long, be nimble and watch out for the following warning signs of an impending risk-off regime - jobless claims surging above 300k, China and Europe equities rolling over (as they have been the leaders this year), and credit spreads widening again.

As for me, my position in long ETH reflects my view that one can keep dancing and make some money on the long side this year. However, I am exiting two positions I’ve had on since last November - long 5-30 Treasury steepeners and long Dec 23 BAX futures. These trades work best in an aggressive recession and risk-off scenario - a regime I no longer believe will arrive for another few quarters. As long as the labor market is still tight, a central bank rate cut cycle will remain elusive. The steepener is a negative carry trade (about 1.5-2 bp per month) that will be costly to hold on to while waiting for the Fed to cut rates. Today’s exit is at a 20 bp paper profit, but negative carry cuts it to roughly 15 bp of actual profit. It might also take the Bank of Canada a long time to cut rates, which makes the Dec 2023 BAX futures a less attractive trade.

What’s left is a lean portfolio focusing on short USD with a risk-on tilt. After today’s FOMC I’m slightly regretting taking profit on gold, but it is just really overbought and there should be better levels to re-enter.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.