First, a quick update on the terminology I will be using from now on to describe market regimes. Personally I think “Goldilocks” is a poor label for the regime that is better described as “disinflation” (which is the term Jerome Powell uses) to describe a regime where yields are falling, risk assets are well supported, and USD is trending lower. Why does the financial press perpetuate the use of a character from a two-century old fairy to describe a global macro regime? I am guilty of this as well, so from now on I will replace “Goldilocks” with “disinflation”. Its arch nemesis will be called “stagflation” - a regime where yields are rising, risk assets sell off, and USD is trending higher.

In my previous post, I put forth the hypothesis that we would return to a disinflationary regime due to some early US data that pointed towards economic weakness. Unfortunately China PMI and European CPI data all came out robust and therefore did not confirm that thesis. The reopening in China is still in full swing and the effects haven’t fully percolated through the global economy yet.

Fortunately most markets have been in a sideways choppy trend, so I got the chance to exit my long aud/usd at breakeven.

Long aud/usd ended up being a subpar expression of a disinflation view, as equities and gold both bounced hard while aud/usd did not.

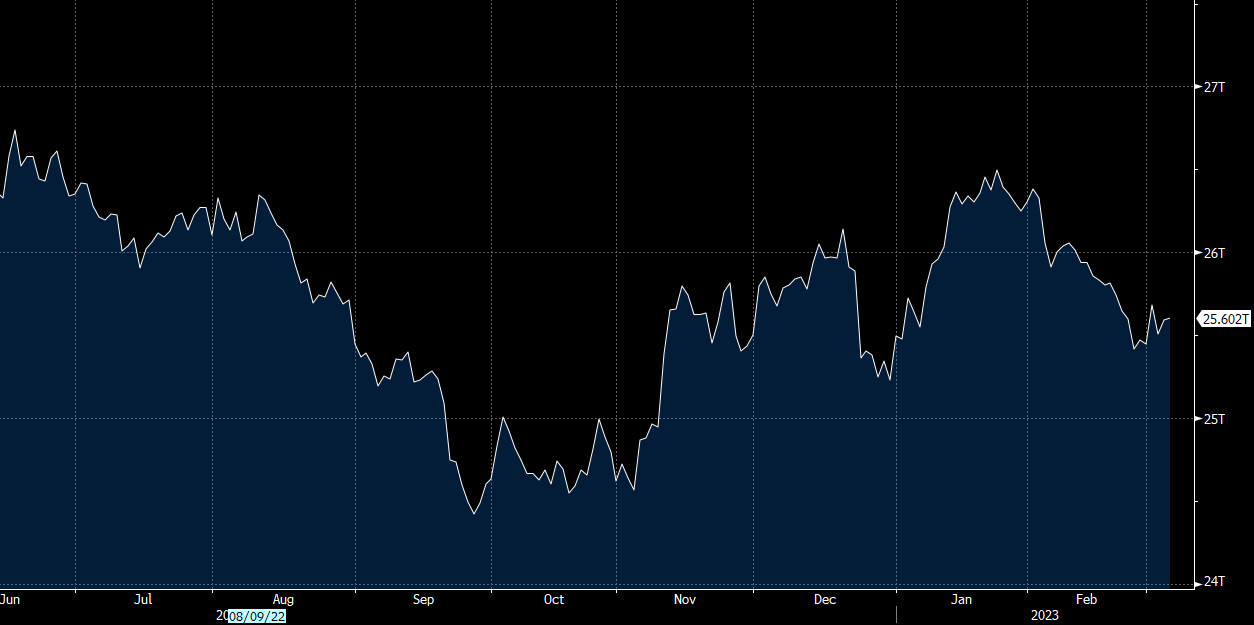

We are also seeing global liquidity tick higher as well, which should support asset prices but feed directly into global inflation in a few months.

USD liquidity - Fed balance - Treasury General Account - Reverse repo. The uptick has been led by the Treasury drawing down the TGA

Global liquidity is also stabilizing, which should cap the downside for risky assets.

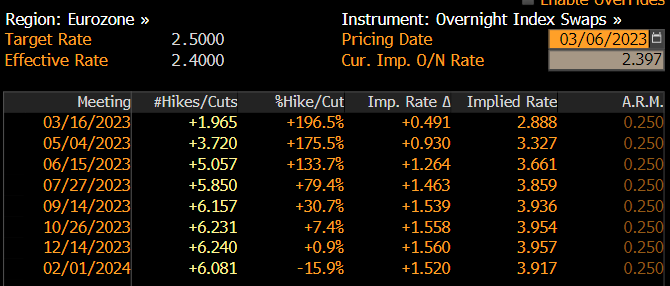

Given the choppy and uncertain global macro environment, is there any trade out there that has strong enough fundamental support to hold on to for a meaningful time horizon? Here’s an idea - short Mar 2024 Euribor futures (currently 96.05). My stop is at 96.25 and my target at 94.00. For those new to this futures contract, it’s basically a bet that interbank interest rates for the eurozone in Mar 2024 will be higher than what the market is pricing in right now. It’s a bet that the ECB’s terminal rate will reach 6%, vs 4% today. I discussed a similar view last year, and while I couldn’t hold onto the trade long enough, the fundamental view panned out well.

Here’s the breakdown of the thesis:

Eurozone core CPI is at 5.6% and rising quickly. Feb’s preliminary reading came in at a whopping 0.8% MoM.

Meanwhile, market pricing for the ECB’s terminal rate is just below 4%. The gap between inflation and the terminal rate is positive and getting wider. The ECB is chasing inflation higher by hiking 50 bp every meeting. The market thinks the ECB will slow down its pace of hikes by June, but that’s not likely if inflation is even higher by then.

Variant Perception’s leading indicator for Eurozone inflation is elevated and still trending higher.

In comparison, Variant Perception’s leading indicator for US inflation has already been trending lower for months. The ECB has a tougher road ahead than the Fed.

Europe is a direct beneficiary of China’s reopening, as their export economy is closely tied to Chinese demand. As long as China’s reopening remains a tailwind for the global economy, those winds will fan the flames of Eurozone inflation.

European nations have also been aggressively stimulating their economies by providing fiscal support to compensate for higher inflation. This is like fighting fire by dousing it with gasoline! An excerpt from an ECB bulletin: “The latest Eurosystem staff projections include a significantly larger amount of energy-related support measures than in the Commission’s baseline, pointing to an expansionary fiscal stance in 2023. The aggregate euro area energy support, as embedded in the macroeconomic outlook of the December 2022 Broad Macroeconomic Projections Exercise (BMPE), is estimated at around 2% of GDP.”

The long term portfolio is still short usd/jpy and long gold, so the short Euribor trade is a nice counter balance against those two positions as well.

Portfolio update:

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

Two questions if I may:

1. How did you express your short USD/JPY position? Futures? Options? CFDs? Asking because 3.9% P&L surely doesn't take into account negative carry, especially if you entered the position at the end of November.

2. I find your Euribor trade quite aggressive. Have you factored in recent lending data in Europe? Already contracting and TLTROs redemptions will further shrink CB balance sheet.