Central banks just got more hawkish

We’ve had some big moves after Jackson Hole, and most of the trades I highlighted on Aug 19 are now well in the money. Stocks have traded lower, USD has risen, and bonds have sold off because mispricings are getting unwound and there have been three hawkish developments since my last post.

First, Fed speakers George and Mester both called for rates above 4%. You might have missed this among the cacophony of Fed comments last week, but here they are, in Bloomberg black:

Keep in mind that prior to last week, nobody on the Fed was publicly talking about moving rates above 4%. In the latest dot plot, there are 4 dots forecasting rates above 4% for 2023, but the market did not take them seriously. With Mester and George publicly hinting that 4% is no longer a ceiling, the Overton window on how high the Fed could hike has just shifted higher.

Second, Powell in his Jackson Hole speech invoked the lessons from the 1970s and 80s. Those who have been following me for a while know that I’ve been teaching history lessons from the 70s and 80s here and here. You can’t read this and walk away bullish risk and think the Fed will pivot any time soon. He mentions the word “pain” in his speech twice:

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

You know what he doesn’t mention? The possibility of a soft landing or avoiding recession. That slim glimmer of hope, which he offered in previous statements, was notably absent. This shift in tone cannot be ignored, and I think the interest rate market will move dramatically this month to price in a much more hawkish path of interest rate hikes.

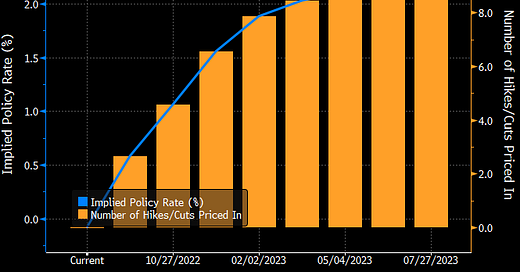

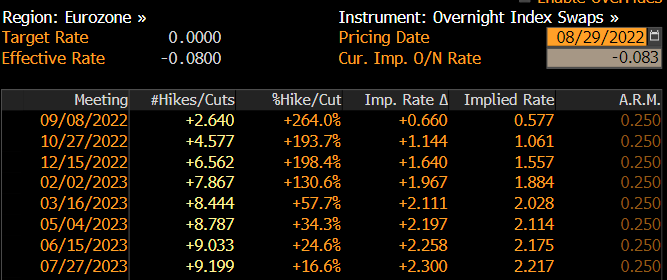

Third, it was revealed on Friday that the ECB is now debating a 75 bp hike, instead of the previous 50 bp that was priced into the market.

This comment by Knot below is a doozy because until Friday, market pricing was assuming the ECB would hike until Dec and then significantly slow down the pace of hikes to less than one per meeting.

If the ECB is shifting its focus to inflation instead of on growth, rates have A LOT of upside to go. The market today is pricing in a 60% chance of a 75 bp hike in Sept (vs 50 bp) and 50 bp in Oct and Dec. If the ECB embarked on a Fed-style campaign of front-loading hikes to stifle inflation, they would have to hike 270 bp just to catch up to the Fed by the end of the year.

The way to play this is to short Euribor Jun 2023 futures or German Schatz futures (2 yr bonds). I highlighted this trade in my post on Jun 8, but I was early and got stopped out after German 2 yr yields retraced 115 bp off the highs. Now is the time to get back in and we should see a more persistent move if the ECB decides to get serious about inflation.

Back to the US, economic data surprises have been recovering since July. I’m expecting stronger than expected data to continue pushing the hawkish Fed narrative further.

US Economic Surprise index

Jobless claims have been stabilizing at levels that suggest a tight labor market. Expect labor market tightness to show up in this Friday’s non-farm payrolls and wage data. US CPI on Sept 13 will also be a big event as usual. The trades I highlighted in my previous post are only about 30-50% towards my targets so I’ll continue to hold them.

For the new subscribers from the crypto community, my expression of my short term bearish crypto view has been to short MSTR, which is now 31% down from the highs (vs 30% for ETH and 22% for BTC). I’m targeting $150, another 40% lower, so there is still a lot of juice on this trade.