Before I begin, don’t forget to follow me on Twitter, where I provide commentary on market events and share interesting news and charts in between posts.

When we look back on this year, we might find that the banking crisis triggered by the collapse of SVB and Credit Suisse was the demarcation line between when the economy was “hanging in there” vs diving into recession. In last week’s post I talked about how the Fed’s rapid hiking cycle broke the plumbing of the financial system and how it will lead to a severe tightening in credit. I want to zoom in on where I think the credit tightening will hit the hardest - in the commercial real estate (CRE) market.

Small banks have ramped up their CRE lending over the past decade.

Small banks now make up 70% of all CRE loans

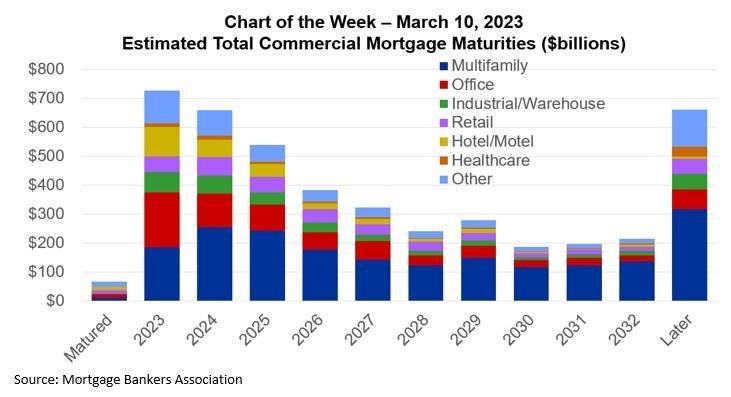

There is over $700B in CRE debt due to mature this year, most of which will need to be rolled over at much higher interest rates.

Unfortunately, vacancy rates are surging higher, impairing the cash flow available to support the higher debt servicing costs.

Office vacancies look worrisome.

The MSCI US Office REIT Index is trending lower.

My concern is that the economy enters a feedback loop where CRE loan defaults cause weakness in property prices, which in turn impairs loan collateral and the quality of loan books on bank balance sheets. This further discourages banks from extending credit and damages the market’s confidence in the banking system.

Instead of putting out fires in the banking system left and right, the Fed could snap its fingers and fix the root of the problem by cutting interest rates aggressively. Cutting rates pushes up the value of the portfolios of debt that banks hold, as well as steepens the curve to restore profitability to the banking business model. It also attracts deposits back into the banking system by making bank deposit rates more competitive relative to money market funds and Tbills.

There is this pesky thing called inflation which is preventing the Fed from swooping in to rescue the economy. The persistence of inflation means the Fed needs to allow the recession to take its natural course. They need weak inflation and labor data to give them the green light to pause and eventually cut. Following are some charts that suggest the labor market is deteriorating faster than we think:

The breadth of rising jobless claims by state is reaching a level consistent with previous recessions.

In the US, employers with more than 100 full-time workers are required to provide written notice to the state and the employees themselves 60-90 days ahead of mass layoffs. These are called Worker Adjustment and Retraining Notices (WARN).

WARN notices are now at a level consistent with previous recessions.

Momentum in Challenger Announced Job Cuts are also reaching recessionary levels

If employment looks so bad, why isn’t it being reflected in jobless claims? Variant Perception explains that seasonal adjustments in jobless claims might be masking underlying weakness in the job market.

What seasonal adjustments are and why they’re necessary: Calendar events such as school vacations, holidays, and changes in weather create distortions in jobless claims data. Without seasonal adjustments to take these distortions into account, jobless claims data would be difficult to interpret. The BLS seasonal adjustment methodology observes the previous 5 years of data to determine a coefficient for each week of the current year to be adjusted by.

What’s interesting is that jobless claims data were thrown out of whack during the covid years of 2020-2022. The volatility in the data did not reflect regular seasonal patterns at all, and therefore distorted the seasonal adjustments the BLS is applying to subsequent years.

Variant Perception compared the seasonal adjustments for 2022 and 2023 against the adjustments from 1999-2019 (which are more reflective of non-covid times) and noticed that the adjustments are causing jobless claims to be understated in January to May of this year, making the job market look tighter than it actually is. This process gets reversed later in the year, where seasonal adjustments will overstate jobless claims.

Variant Perception’s conclusion is that in a normal year where covid did not throw the BLS seasonal adjustments out of whack, jobless claims would be at 250k today instead of 198k! And if the labor market weakens like I expect it to, the adjustments will accentuate the weakness from May onwards.

What all this means is that we are closer than we think to recession. History shows that whenever jobless claims rise 100k from the lows, they tend to keep going a lot further. We bottomed at 183k on Jan 27 and would be at 250k today if it weren’t for covid seasonal adjustments - only a 33k rise away from triggering that rule.

The Sahm rule (named after former Fed economist Claudia Sahm) observes that whenever the 3-month moving average of the unemployment rate rises 0.5% above the cycle low, the economy has always gone into recession. We ticked up from 3.4% in Jan to 3.6% in February, so it would not take much more of an increase to trigger that rule.

If you’ve managed to get through all the charts and wonky statistical stuff, congratulations. I go even deeper for paid subscribers and explain how I’m expressing these views in trades. I’m also hosting an AMA (Ask Me Anything) session over Zoom for paid subscribers on Wed April 5 at 9:30 AM Singapore time (Tues April 4 9:30 PM EST/6:30 PM PST). I’m currently offering a 33% discount until April 15, after which the price will increase permanently.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

I forgot to record it last time, this time I'll try to remember!

Will you record the session?