How a regional US bank run turns into a European government debt crisis

Over the weekend we saw UBS take over Credit Suisse for SFr 3B in a shotgun marriage forced by the Swiss government to avoid financial contagion. The deal was not possible without the Swiss National Bank providing a SFr 100B liquidity backstop to UBS, as well as a SFr 9B backstop for losses UBS might have to take. SFR 16B in tier 1 (AT1) bonds (designed to absorb losses alongside equity during times of financial stress) were also written down to zero. Despite the huge backstops provided by the SNB, the market still doesn’t think it’s a good deal for UBS. The price of UBS credit default swaps (derivatives insuring against a default) has risen 25 bp in European trading today, while their stock price is down 5%.

The big question looming on everyone’s minds is “What next?” Where is the next blowup going to be? Will we slide into recession? As a global macro trader and author of this blog, I try to answer these questions, and position myself before or as events are unfolding to profit from them. For paid subscribers, I take it a step further and alert readers when I’m entering and exiting trades, as well as providing rationale and risk parameters behind them. Those who have been following me for a while benefited from some timely calls, such as going long gold at 1740 and doubling down at 1844, going short usd/jpy at 141.23, and going bullish the equity market the day after the October 2022 low was made. I’m currently offering 33% off the regular subscription rate until April 15, after which it expires permanently.

Before I explain why a European debt crisis will be a likely downstream consequence of the banking crisis, it helps to explain the chain of events that got us to where we are.

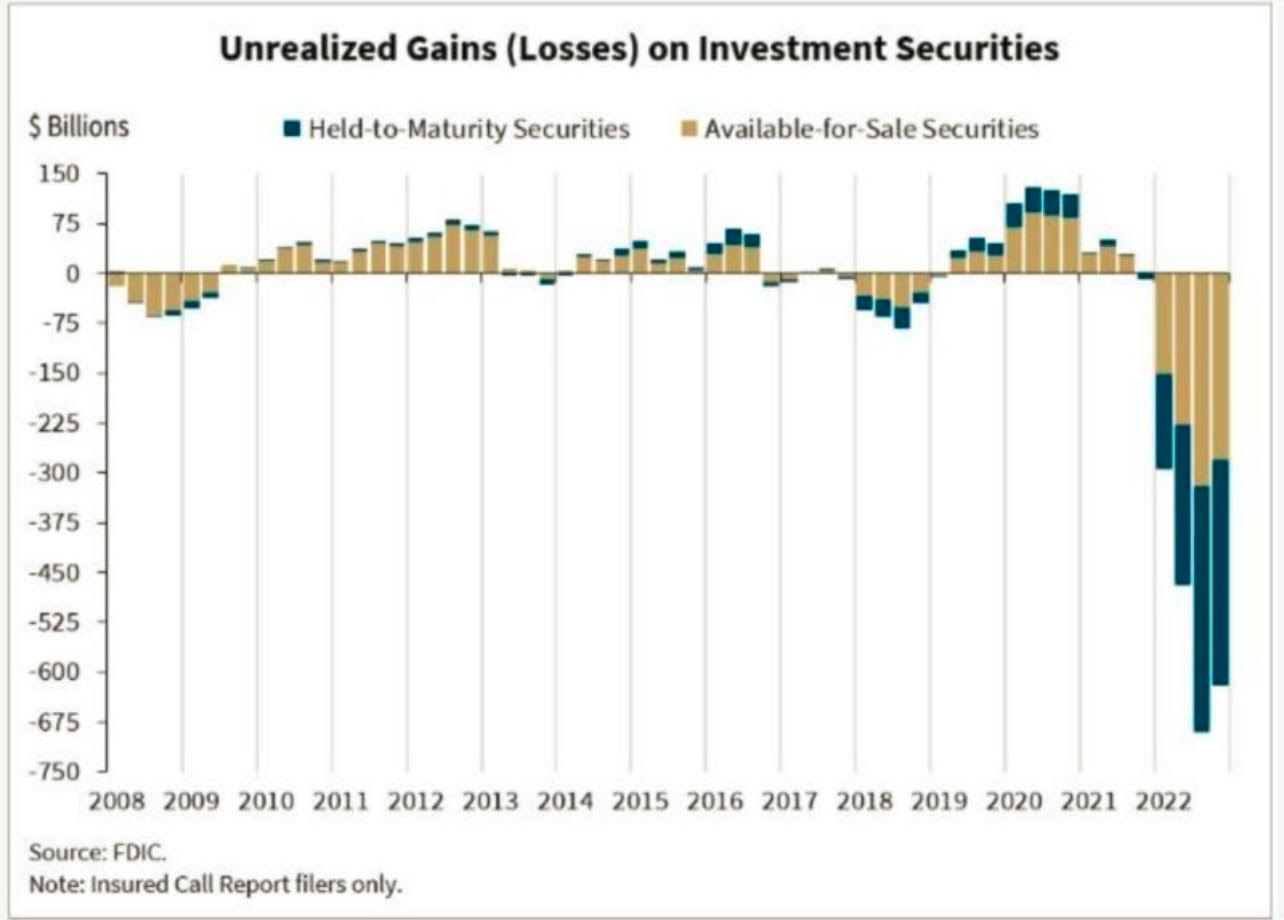

A rapid hiking cycle by global central banks resulted in giant marked-to-market losses on the balance sheets of banks that built up large bond portfolios when interest rates were at 0%

The rapid hiking cycle caused the yield curve to invert more than it ever has since the 1970’s and 80’s, making it difficult for banks to profit from their usual business model of borrowing short (from depositors) and lending long.

Impaired balance sheets and eroding profitability caused investors to have doubts about the liquidity position of regional banks, and prices tumbled.

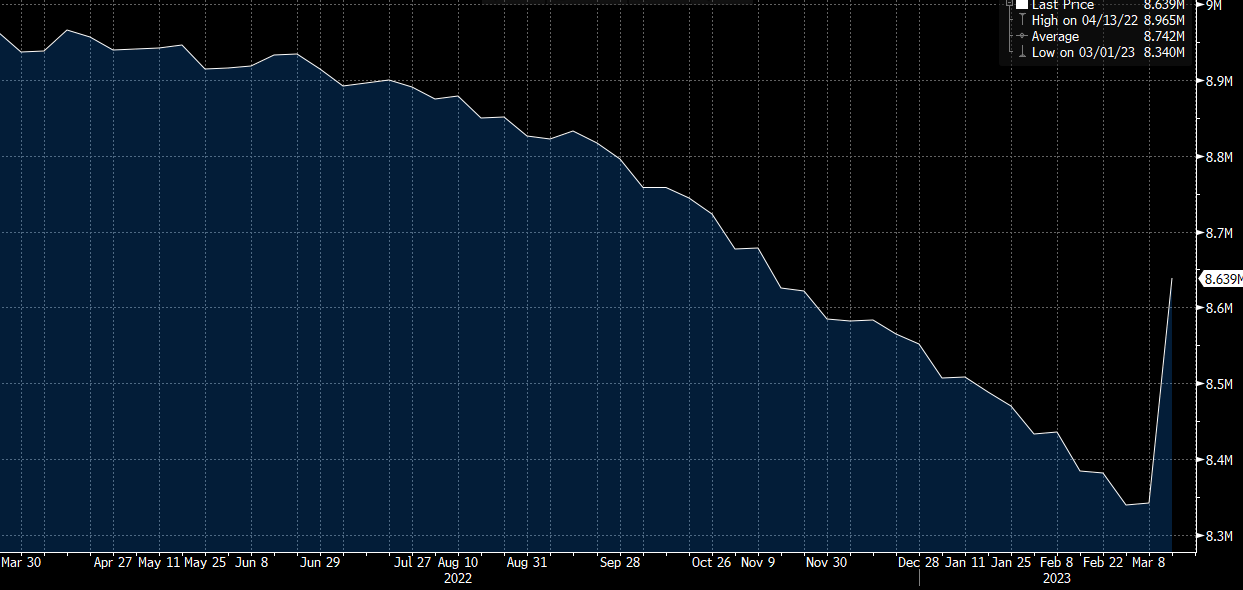

The rapid fall in price resulted in a feedback loop where depositors got scared and pulled money out from Silvergate, Silicon Valley Bank, Signature Bank, First Republic, and other regional banks. This accelerated a trend that was already well underway since Q1 2022, when deposits started to leave banks and move into money market funds and Treasury bills.

The Federal Reserve made depositors whole by opening the discount window and creating the BTFP facility to allow banks to borrow against the par value of their bond portfolios. This partially addressed problem #1 (impaired balance sheets) and #3 (liquidity), but NOT problems #2 (inverted yield curve) and #4 (depositor flight). Nor does it address problem #6…

Banks were already pulling back on lending due to the inverted yield curve. Now that banks runs are becoming a thing, I expect bank credit availability to grind to a complete halt. This is bad for the economy because the majority of commercial real estate loans are underwritten by regional banks.

US banks borrowed $165B from the Fed’s discount window and BTFP facility. The liquidity the Fed provided comes from printed money. Some people say this isn’t QE, but I believe it has a similar effect as QE as it removes the necessity for banks to liquidate their Treasury and MBS holdings into the open market and provides them with capital that can be lent out if desired. Additionally, I expect the liquidity to stay in the banking system for a long time as some of those loans will be rolled for multiple terms or never paid back at all.

The Swiss National Bank is also backstopping the UBS-CS deal with printed money. We are playing a global game of whack-a-mole, where moles are banks in crisis and the mallet is printed money. The annihilation of SFR 16B of AT1 bonds also makes the market question how much these bonds are worth, and whether they are sound investments. Going forward, it’s unlikely that European banks can use AT1 bonds to raise capital from the market.

Where do we go from here?

The EU is one of the places in the world where a government cannot just print as much money as they want to backstop their banks. It just so happens that European banks are in a vulnerable state, having suffered from poor profitability for years due to negative interest rates, and now suffering from balance sheet impairment from the rapid rise in interest rates.

Imagine if it wasn’t Credit Suisse in crisis, but an Italian or Spanish bank instead. Italy has a debt-to-GDP of 145%, and a bailout of half the deposits of Italy’s two largest banks would increase debt-to-GDP to a whopping 171%. Spain has a debt-to-GDP ratio of 120%, and a bailout of half of Banco Santander’s EUR 1T depositor base would increase that ratio to 157%. European member nations simply don’t have the fiscal space to deal with a banking crisis, having already borrowed prodigiously to fight covid in 2020 and then an energy crisis in 2022. If a major bank domiciled in a European member state goes the way of Credit Suisse, the government will have to make the impossible choice between becoming drastically more indebted (breaking some EU rules in the process) or letting the bank fail. Eventually the bank will get bailed out by the EU, but only after significant drama and infighting between member states.

Banking crises cause recessions, full stop. We have skipped the disinflation regime altogether and are entering a recessionary regime now, where risky assets underperform vs safe havens, volatility expands, and economic weakness spreads across the world. The only cure to this global bank run is for central banks to backstop banks with printed money, end QT, and re-steepen the yield curve by cutting rates aggressively. That is what I’m mostly positioning for.

A European debt crisis is nowhere close to being priced in, nor is it on the minds of many investors. It happens in the 6th or 7th inning of this crisis, and we are only in the 2nd or 3rd. This will be another exciting year for global macro, a year where fortunes will be made or destroyed.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.