Before I begin, I want to let readers know I am providing access to my last post “Should you quit your job to become an independent trader?” to free subscribers. I received positive feedback from readers, some of whom said that it was a much-needed warning for people who are attempting to trade PA full-time with insufficient capital and experience. I have a perspective that is unique in the world of trading, and I would be doing my readership a disservice by restricting access to the post.

Yesterday the Fidenza Macro portfolio took profit on its long oil trade, which was first established at 73.07 and closed out at 91.58. It was established back on July 10 (in the blog and on the paid subscribers Telegram chat), when oil was rangebound and few people were really talking about it. Today, the relentless rise in oil and fuel prices is front and center in the financial press, while price is overbought on every time frame. This is a signal to take profits, even if it means leaving the last bit of the move for other traders to ride. On a risk-adjusted basis, it has been one of my more profitable trades of the year and has made up for the small losses taken in this challenging market.

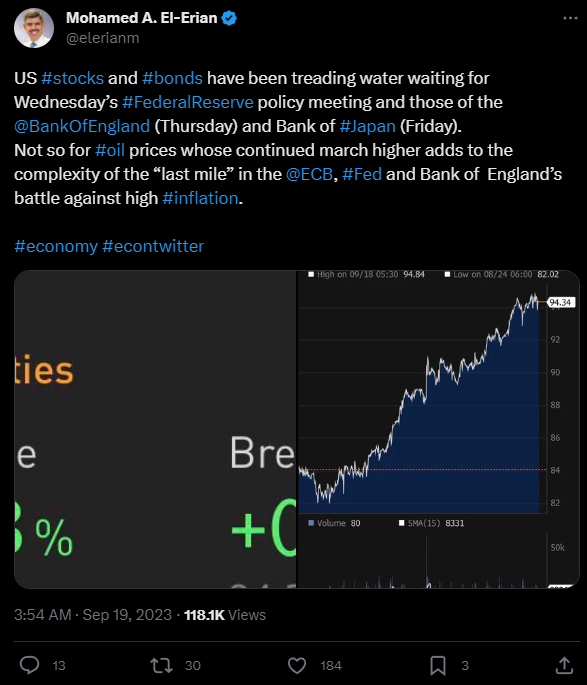

The uptrend in oil has made many financial pundits alarmed about its effect on inflation, yields, and economic growth.

The question we should all be asking ourselves is how much oil matters in the global macro equation.

Below is a correlation matrix which measures the daily correlation between oil (USO), 10 yr Treasury yields (USGG10), S&P 500, US 10 yr real yields, and US 10 yr breakeven yields. Oil has little correlation with nominal and real 10 yr Treasury yields, and a small positive correlation to S&P 500 and 10 yr breakeven yields. Based on this, a rise in oil prices shouldn’t be too alarming.

One can argue that oil doesn’t directly affect Fed policy either, as the price of energy goes into headline CPI and PCE, whereas the Fed uses core PCE as its main inflation indicator.

The below analysis by Piper Sandler shows that higher gasoline prices used to hit consumer spending much more in the 60’s and 70’s compared to the last three decades.

As for its effect on PCE super core services, it’s hardly noticeable.

Morgan Stanley sees little passthrough of energy prices to core CPI.

Overall, my view of rising energy prices is that it acts like a minor tax on consumers. It has a negative effect on real spending, but the pass-through is too small for oil to be the primary cause for recession or a risk-off event. Current spending and employment are too hot for the Fed to be comfortable in its fight against inflation. A slightly weaker consumer would not be a terrible thing for risk appetite as it would strengthen the Goldilocks/disinflation regime.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.