The US data over the past week have sounded alarm bells over how quickly the US economy is weakening. The prevailing narrative still revolves around how inflation remains too hot, how government spending is propping up the US economy, and how the Fed needs to stay higher for longer and maybe even hike. Those still positioned for this version of reality are about to get caught wrong-footed.

According to Citi’s US economic surprise index, economic data is undershooting expectations at the fastest pace since Q1 2023.

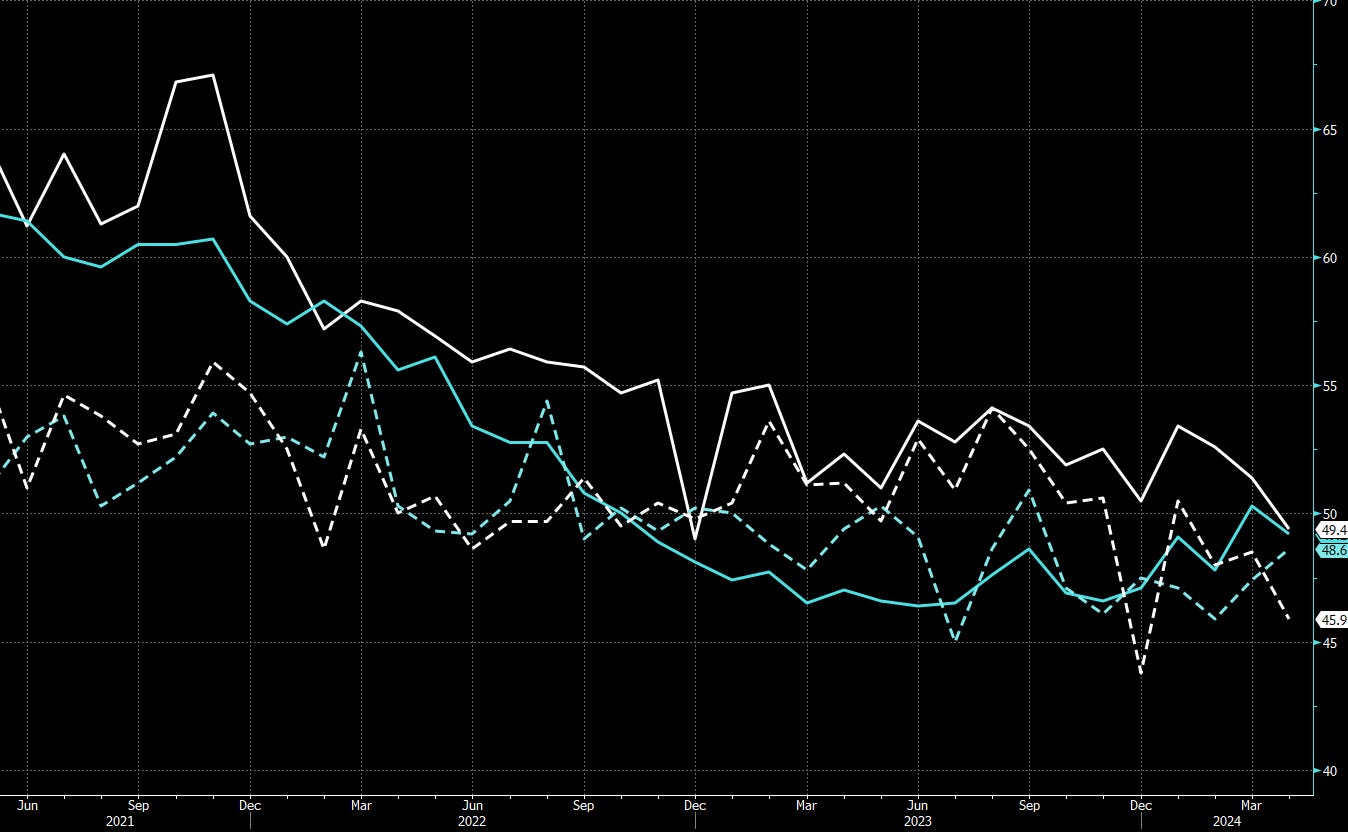

Not only did both ISM manufacturing and services headline numbers decline into contraction territory, but the employment subcomponents are now in contraction territory as well.

Private payrolls was the softest since last October, when the markets were more worried about recession than an inflationary boom.

Meanwhile public payrolls (government jobs) fell off a cliff. This is what worries me about employment going forward. Vanda Research explains why this is alarming:

As we’ve been arguing for months in this publication, the growth rate of public sector job gains is on the verge of collapsing (chart below).

April witnessed this deceleration in spades. Compared to +55k and +72k gains in Feb and March, public sector payrolls climbed a mere +8k last month (chart below). And as the chart above illustrates, this deterioration will only continue into the next couple of quarters as 2022’s weak tax collection environment begins to more materially impact hiring activity. This will serve as a major drag on overall payrolls figures in Q2 and Q3, as this segment accounted for upwards of 30% of NFP gains in recent years despite comprising only 15% of the total workforce.

Piper Sandler’s own 10% recession rule just triggered last week:

Today’s unemployment data triggered our simple 10% recession rule - where the YoY change in the 3mma of unemployed persons is above 10%. Every time our measure has hit 10% we’ve had a recession. We expect the UR to continue to grind higher, not fall off a cliff, and help propel a rally in bonds and stocks. This is note is not about the economic call on recession ... it's all about catalysts for stocks and bonds to rally.

The totality of this data tells me the economy is about to enter a soft patch, and incoming data will force the Fed to turn more dovish than the market is pricing in. I mentioned in my last post that the 5 yr Treasury yield is in restrictive territory at 4.50%, and if the Fed wants to stave off a recession, 5 yr yields need to drop below 4.0%.

A loosening of financial conditions back to Jan 2024 levels should be bullish for assets such as equities, crypto, and precious metals. The current Fed is more sensitive to downside growth risks, which means they will proactively loosen policy in response to any weakness in the data and prevent a recession from happening. I wrote to paid subscribers last week that I went long BTC, looking for a rebound back towards $70k:

I went long BTC last night as it dipped below $59k, which is the average cost basis of all short-term holders (based on Glassnode). The onchain cost basis of short-term holders represented by the red line below historically has been support on uptrends and resistance on downtrends.

Global macro has been a headwind for crypto for over a month, and we finally saw some ETF holders capitulating. May 1 saw the biggest outflow from BTC ETFs since they were launched.

Now that weak longs have sold and global macro is “less bad” for crypto, I’m willing to put on a tactical long with a protective stop below $56k to position for a short squeeze.

JPY repatriation flows to ignite a bull market in JPY

The combination of lower US yields and the BoJ intervening to support JPY make for a potent combination that could drive USD/JPY lower from here. I’ve heard rumours in the market that GPIF - Asia’s biggest pension fund - has been contributing to the recent JPY strength by selling foreign currency and buying JPY. I remember when I was an FX market-maker during USD/JPY’s historical run from 75 to 120, the GPIF was often a buyer of USD/JPY on dips and contributed significantly to the uptrend. Japan’s leading party is also considering a tax holiday for domestic corporates to convert their foreign currency holdings back into JPY. What we are currently seeing is likely a concerted effort by Japan Inc. to take profits on their structural short JPY exposure.

The size of this flow would be hundred of billions worth of USD spread over coming months and years. I expect it to trigger a wave of violent short-covering by carry traders (many of whom are Japanese retail traders) and CTAs. The trend following ETF DBMF, which mirrors the largest CTA’s holdings, shows that some short-covering has occurred, but JPY shorts continue to be a large volatility-adjusted position for CTAs.

If I am right about weaker US economic data and Japanese JPY repatriation flow ahead, then we are still very early on these trends and today’s prices offer excellent entry points. The Fed funds curve is only pricing in 80 bp of cuts over the next 12 months, while carry traders are still selling rallies in JPY expecting weakness to continue. In the paid subscriber section I’ll discuss how I’ve been positioning my portfolio for this view. I recently moved the Telegram chat over to Substack, and paid subscribers can now ask questions about my trading decisions and global macro views. The two-way communication provides better value to subscribers who are trying to learn from my winners and mistakes.

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.