Trading results from Q1 2024

Here are the results of all the trades I’ve closed in Q1. The prices where I enter and exit (and the levels where I place my stops) are entered in the Telegram channel in real time.

Summary:

I closed 19 winning trades out of a total of 30, with a 63% win rate. This is much higher than my long term win rate of 45%. I’m also thankful that I didn’t suffer any outsized losses, thanks to strong discipline and trade management.

Crypto: +61%, thanks to trading BTC from the long side.

Commodities: +22%. Some nice gains from trading sugar and XAU/AUD.

Rates: +46 bp. Had a handful of tactical wins in 2 yr and 20 yr Treasuries

FX: -0.5%. FX was boring and choppy in Q1

Equities: -2.3%. Tried to trade from the long side several times, but kept getting stopped out.

I split up my results by asset class, as not everyone trades every asset class and some people only care about what I’m doing in some markets and not others. These results don’t include the long term allocations I put on last year in gold, bitcoin, and various options, and they don’t include the positions I still have open, most of which have unrealized profits.

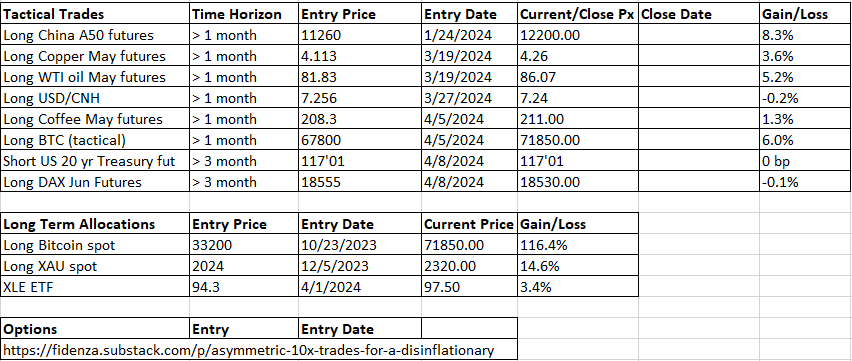

Current positions:

The market has been treating me well lately, but I don’t expect this to be the case all the time. Trading global macro is a feast or famine endeavor, and one can only hope to capitalize as much as possible when the market provides a lot of opportunities. In this blog I take a view on the regime and environment we will be in, and express that view via trades. Fortunately I was early to this reflationary boom, which gave me the confidence to go long commodities and cyclical assets when the charts aligned with my view.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.