My views on the current economic and market regime have evolved dynamically on a monthly basis as we get new incoming economic data and shifts in how asset classes correlate with each other. I came into 2024 positioned for a disinflation regime that would keep growth muted and monetary policy easy for a while. On Feb 1, I pivoted towards betting on higher yields, which paid off, but also warned against a pullback in risk, which did not materialize. The market went from pricing in six cuts in 2024 to only three, and global equities did not flinch. The flip in stock/bond correlation from positive to negative is a signal that we have exited the previous state of the market from 2022-2023 where we flip-flopped between stagflation and disinflation regimes and yields dictated where equities went. It’s a sign that economic growth and corporate earnings are no longer vulnerable to excessive Fed tightening, and that inflation is now a secondary concern.

The chart below shows how SPX (in blue) correlated with Dec 2024 SOFR futures (yellow) until mid-January, when they started to diverge drastically. Equities up and bonds (or SOFRs) down is characteristic of reflation regimes, which is defined in the four quadrant framework by strengthening growth and increasing inflation.

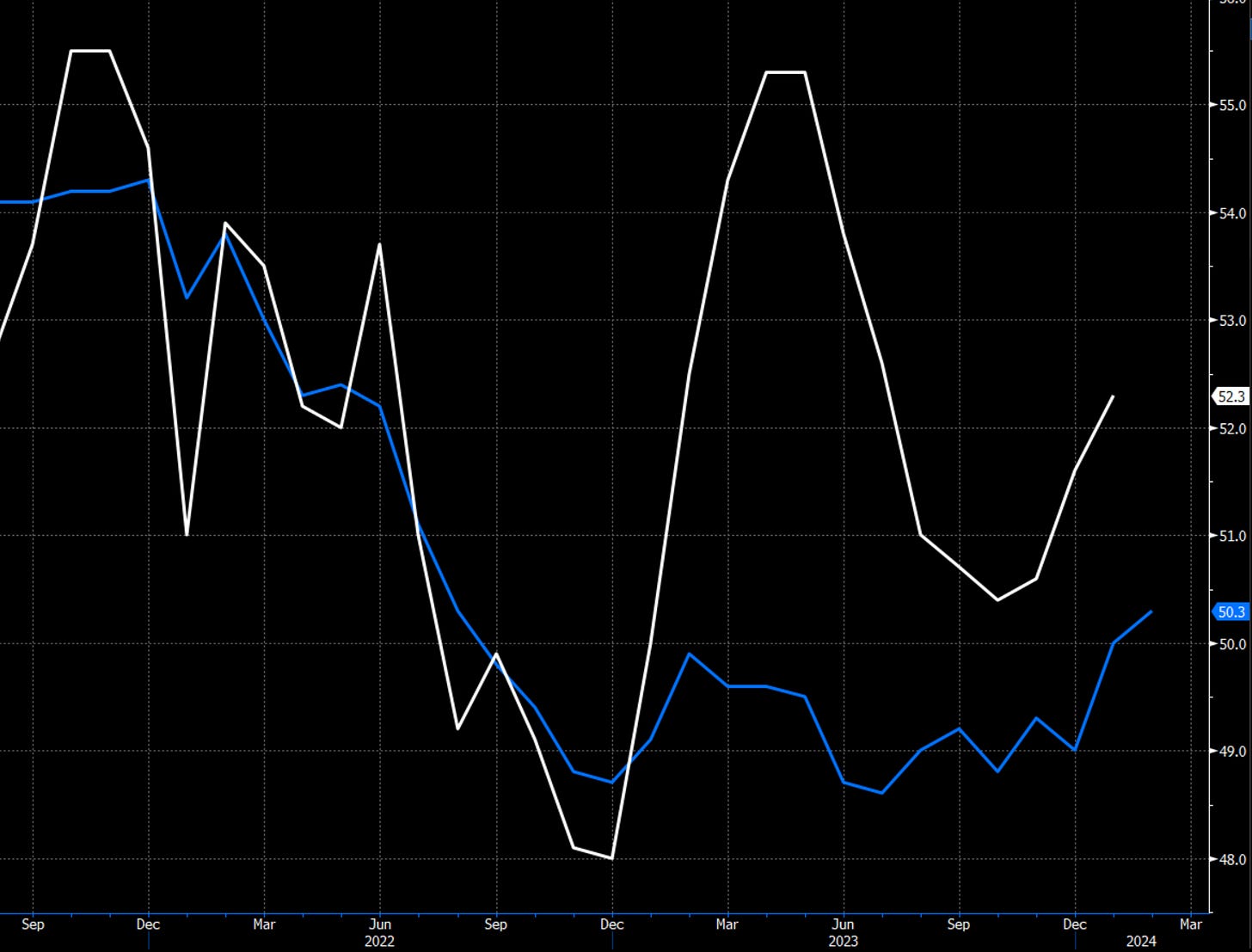

On the growth side, we are seeing a recovery in global manufacturing and service PMIs.

Global economic data surprises are at highs not seen since last May.

The big question mark is whether inflation will accelerate and cause the Fed to tighten the screws on the economy again. My answer is more nuanced - yes inflation will accelerate, but not fast enough to threaten the current cyclical growth cycle. I see core PCE stabilizing around 2.2-3.0% for the next 12 months - above the Fed’s target, but not hot enough to spur another aggressive hiking cycle.

Those who will believe inflation will come roaring back point to the chart below, and warn that we will see another supercycle of inflation similar to what we saw in the 1970’s and 80’s.

The belief that we will see inflation anywhere close to what we saw in the 70’s is simply fearmongering. There are significant differences between today and the environment of the 70s:

Nixon closed the gold window in 1971, essentially unpegging the value of the dollar from gold and allowing it to depreciate uncontrollably. From 1971 to 1980, the dollar (and other global currencies that were fixed to USD) depreciated by 99% in gold terms. The inflationary pressures of USD being debased by 99% over a decade would obviously be much greater than today’s current environment.

We saw a series of global energy shocks in the 1970’s that were not easily surmountable by increased production. We did see an energy supply shock in 2022 when Russia invaded Ukraine, but global energy supply chains and US shale drillers adjusted quickly, resulting in a bear market in oil and natural gas. Energy as a share of global consumption was also multiples higher in the 1970s than it is today.

Reshoring was originally thought to be an inflationary driver, but after the initial shock it has actually turned out to be deflationary over the past year. The reshuffling of supply chains has resulted in the duplication of manufacturing capacity in both China and the rest of the world, causing persistent and deep goods price deflation.

China’s popping real estate bubble has resulted in a deflationary bust that will last for at least several years. Their previous demand for global commodities to fuel its real estate boom will take a while to return to previous highs.

Elevated fiscal spending has contributed to inflation and growth, but the offsetting deflationary impact of industrial fiscal policy has been overlooked. Much of the fiscal spending by the US and China went towards subsidizing and building more manufacturing capacity in clean energy, chips, and electric cars. As a result, the cost of solar panels and electric cars has plummeted much faster than analysts have predicted. Biden’s Inflation Reduction Act is doing exactly what it has advertised. The disinflationary benefit of the increased capacity in these sectors is only in its first inning as many of the factories have not been completed yet.

How will the Fed respond to inflation stabilizing in a range higher than their target? The starting point is that they anchored the market to expecting three cuts in 2024. As inflation takes longer to reach their 2% target, I can see the first cut getting pushed out further- if not June, then July and maybe even September. Perhaps the three promised cuts gradually turns into one or two in 2024. Directionally, this would constitute a modest tightening from current financial conditions, but the magnitude is tiny compared to the string of monstrous 75 bp hikes that we saw in 2022. This incremental tightening of monetary policy is typical in reflationary booms and does not limit the economic expansion until the overheating phase, which we are nowhere close to.

How do asset prices behave in reflationary boom regimes, and how will I be positioning my portfolio in this environment?

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.