First of all, I have big news to share. I have a lot of fun writing this blog, and have been spending a lot of time on it. If you get value out of reading my content, you now have the opportunity to support my writing with a paid subscription! The price of a subscription will be $30/month, or $300 for an annual subscription. My hope is that my ideas, whether they are trades or insights about the market, helps you in your trading and investment decision making enough that the subscription pays for itself. Don’t see the cost of a subscription as an expense - consider it a financial investment.

To show appreciation for those friends, peers, and early adopters who have been reading and subscribing to my blog, I am offering you 33% off the regular price. This offer is good until April 15.

If a paid subscription isn’t for you, not to worry. I will still be posting about trader education and about broad market views to free subscribers. The trade ideas and portfolio updates will be accessible to paid subscribers only.

Now, back to the markets -

Jerome Powell is giving his Senate testimony right now. In his prepared remarks, he said “We are prepared to increase pace of rate hikes if needed”. In other words, remember when he said they were going to slow their hikes to 25 bp? Don’t hold him to it. The market seems to underestimate the Fed’s ability to change their mind. Changing up the pace of hikes based on incoming data doesn’t “ruin their credibility”, like market pundits tend to think. The only credibility the Fed cares about is their ability to fight inflation.

The US dollar is surging on Powell’s hawkish comments, but it was already gaining momentum before the testimony. Horizontal support and the 200 dma at 1.1900 are breaking in gbp/usd today:

I’ve gone short here at 1.1882 with a stop at 1.1960 and a target of 1.1200. The time horizon is 2-4 weeks as long as the stop stays alive.

The trigger for this trade is mostly technical, but there are strong fundamental drivers too. I mentioned in my last post that the stagflation regime which favors USD is not going away any time soon due to strong economic momentum feeding directly into inflation. After Powell’s testimony, we are pricing a roughly 50/50 chance that the Fed will hike 50 bp this month vs 25 bp. USD should benefit from the Fed being the most credible inflation fighter among the central banks (vs the Bank of England, which has worse credibility due to the UK’s poor fiscal position).

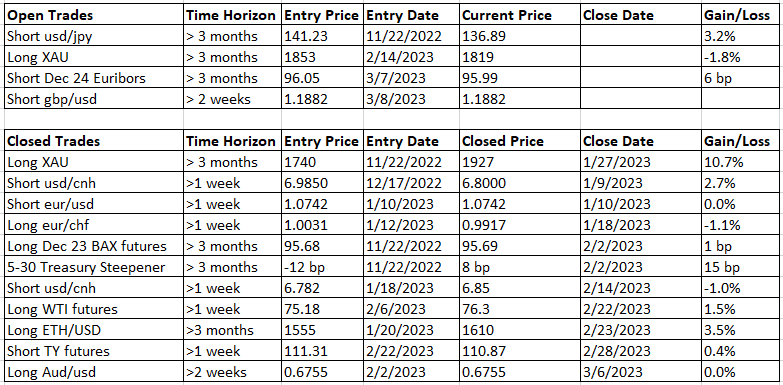

Current portfolio:

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.