US equities are slightly off their highs, and I think we are about to have a 5-10% pullback in the S&P 500. I’ll just rattle off a bunch of reasons why:

NVDA earnings get released today and the market has likely already priced in strong revenue growth at 38 EV/sales. The last two earnings results were both strong beats, yet the announcements marked local tops in the stock. Since AI has been the leader in the most recent bull market run, a pullback in NVDA would likely drag the rest of tech lower.

Speaking of AI, we got a massive key reversal candle in Super Micro Computer, a leader in the recent AI bull market.

Positioning is long, especially in semis:

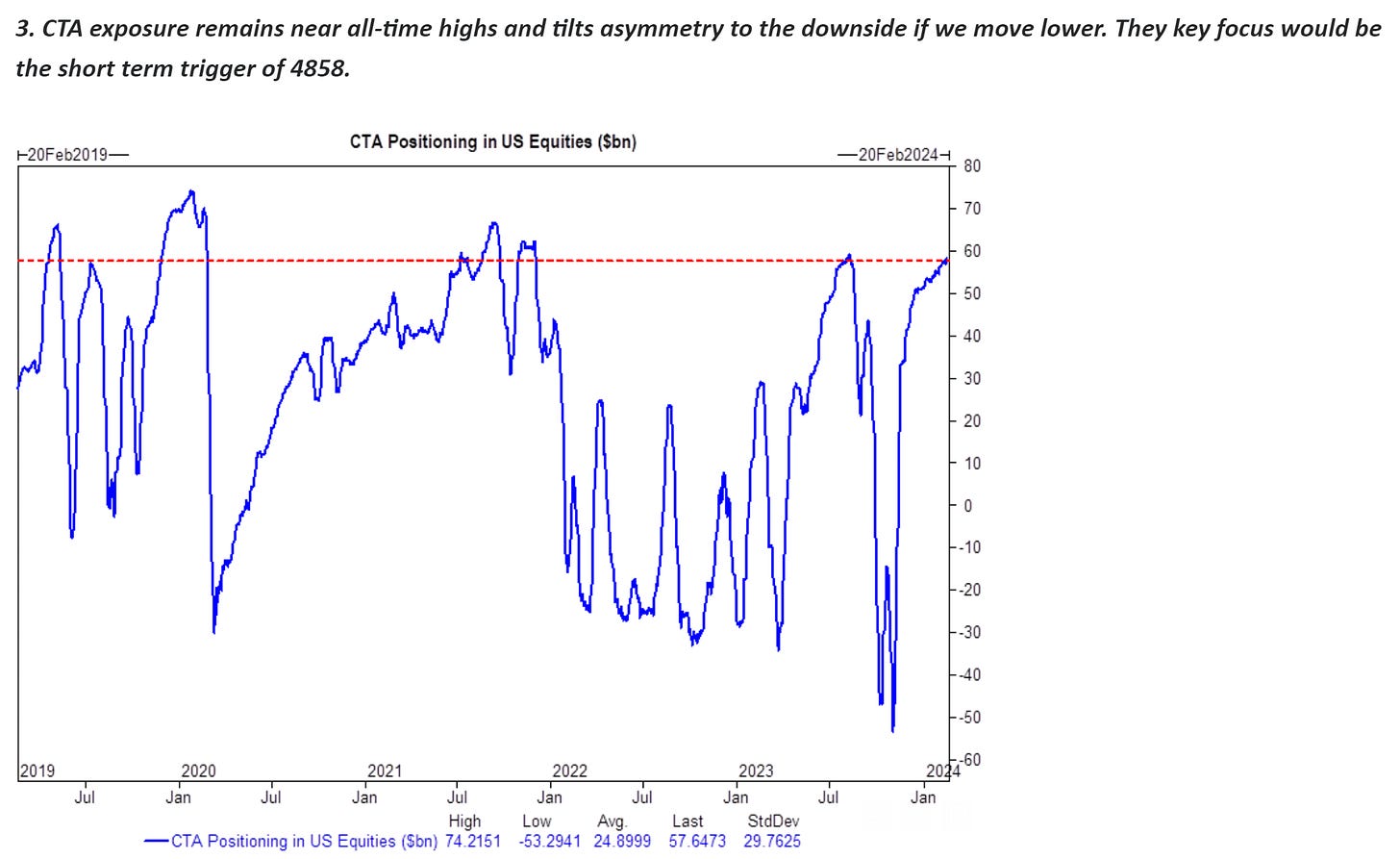

CTAs are max long. Typically this isn’t an impediment to further upside, but it exacerbates selling pressure if momentum rolls over.

The spread between the AAII Bulls vs Bears index is at elevated levels from where we got pullbacks last year and in 2021.

The amount of call volume has spiked, indicating excessive bullishness.

Call skew, which is how much buyers of calls are willing to pay vs buyers of puts, is also the widest since 2021.

Meanwhile, yields and pricing for Fed rate cuts are tightening monetary conditions, as I warned in my last post.

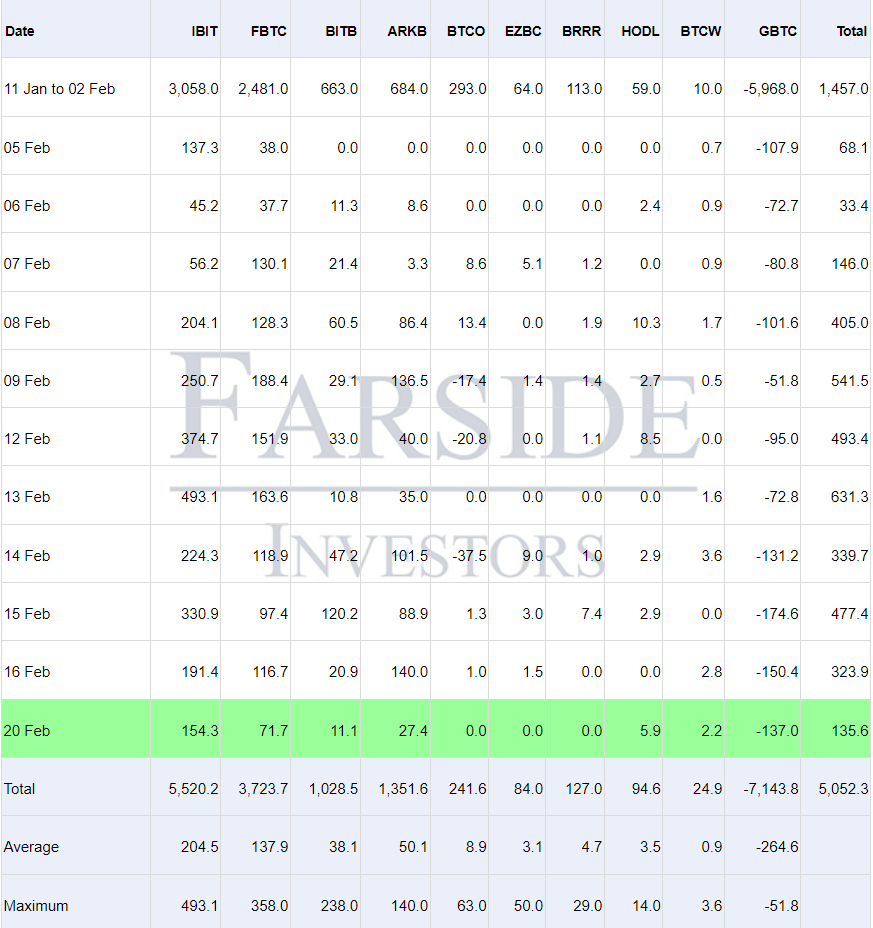

Bitcoin has benefited from the tailwind of ETF inflows, which created a reflexive move higher that is now overbought. $400-600m of inflows can’t last forever and they are in fact slowing this week to a modest $135m/day:

Given all the potential warning signs, does it make sense to be even more bearish and look for a selloff of more than 5-10%? I don’t think so, and the reason is that a deeper selloff and a surge in volatility would result in a sharp rally in Treasuries, bringing about the easier financial conditions needed to stabilize the market. I’m also of the view that the recent upside surprises in economic data will moderate after 1-2 months. The Jan data was a bump higher in the context of an overall downtrend, not a new reacceleration of inflation.

In the paid subscriber section I’ll discuss the changes I’m making in my portfolio to capitalize on my views above.

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.