The markets have been choppy lately. One day you get weak US data, and my pnl goes up. The next day strong data comes out, and then weak data, and then a hawkish Fed nukes all dovish/risk on/short USD positions. The US employment data just came out strong and we had price spikes in both directions within a 10 minute period. I believe we are in a sideways and choppy consolidation right now, where positioning prevents further progress of the prevailing trend, but fundamentals don’t yet warrant a complete reversal. However I stand by my thesis that the US sliding into recession will be bullish for the market, and that the next emerging trend will be yields and USD rolling over and risk assets recovering. It will just take patience.

I haven’t spoken about asset allocation enough in this blog, so I feel like I should do that today. Most readers are probably not active traders who can assess the merits and follow every trade that I put on. Most people probably just want a portfolio that you can set and not have to look at too often. I don’t consider myself a stock picker, but I do have opinions on what sectors will do well in the long term that I would like to allocate to on a 1-3 year time horizon.

The bedrock of my asset allocation is based on the following thesis - we have entered a decade of rolling inflation shocks, where commodities will be in short supply relative to demand, where governments will borrow and spend beyond their means, where competition and war between superpowers result in rapid deglobalization and near/on-shoring, and where central banks will have to hike rates to levels we haven’t seen since the 70’s and 80’s. What I think will perform well are hard assets like commodities, real estate, and energy. What I think will perform poorly are growth and high P/E or Price/revenue long duration assets that will take a long time to become profitable. What I think will work over the next decade is the complete antithesis of what has worked for every investor for the last two decades. Over the past month, as I’ve been getting more optimistic that markets are bottoming out, I’ve been accumulating long, unleveraged exposure to the following asset allocation:

40% Energy ETFs (majority XLE, some XOP, and PSCE)

20% Russell 2000 (IWM)

20% Gold (GLD)

5% Silver (SLV)

5% Uranium (Sprott Physical Uranium Trust)

10% T Bills

Note that this doesn’t include any crypto, which I invest in separately as it’s hard to get direct exposure in a traditional brokerage account.

I’ll go through each allocation and provide the TLDR on why I like each:

Energy ETFs: Global demand for oil will grow, even through this coming recession, and there isn’t enough supply. The shale revolution has been tapped out and production is declining out of the US and OPEC despite politicians calling for more oil. Not enough capital is investing in new production because of ESG, previous investors getting burned due to poor risk management and capital allocation by oil companies, and because investors think oil producing assets will be stranded assets as clean energy takes over in coming decades. Underinvestment in oil over the past decade will result in a secular boom in energy.

I expect the blue and orange lines below to converge over the course of this decade. (Credit: Bespoke Investment Group)

Russell 2000: This gets me broad US equity exposure without the expensive growth stocks and megacaps that I’m trying to avoid.

Gold: Gold does well when monetary policy is loose and getting looser, and it does poorly when monetary policy is tight and getting tighter. The Fed’s hawkish rampage has put gold under pressure, but when the recession gathers speed and Powell is forced to pivot, gold will rip. The downside has been limited as central banks have been buying the dip in gold, which is why gold hasn’t cratered as much as other currencies against USD. As the US’s rivals wean themselves off the US-dominated financial system, gold is the only reserve asset they can turn to that can be a store of value and can’t be confiscated (bitcoin is too small and illiquid to be a viable reserve asset but hopefully it gets there someday). During the inflationary period of 1970 to 1980, gold went from $35 to $835. During the commodity boom of 2000-2008, gold went from $260 to $1000. It’s also a nice hedge against war!

Silver: Same reasoning as gold. Silver is 2-3 times more volatile than gold, and over half the global demand comes from industries such as solar panels and cars.

Uranium: The world has realized that you can’t transition away from fossil fuels without the reliable baseload energy supply of nuclear. Countries like Germany, which was heavily against nuclear due to political and social activism, are finally warming up to nuclear as an energy source. Nuclear plants that were slated for decommissioning are now being brought back online around the world. There is a large supply/demand imbalance that will persist for a long time.

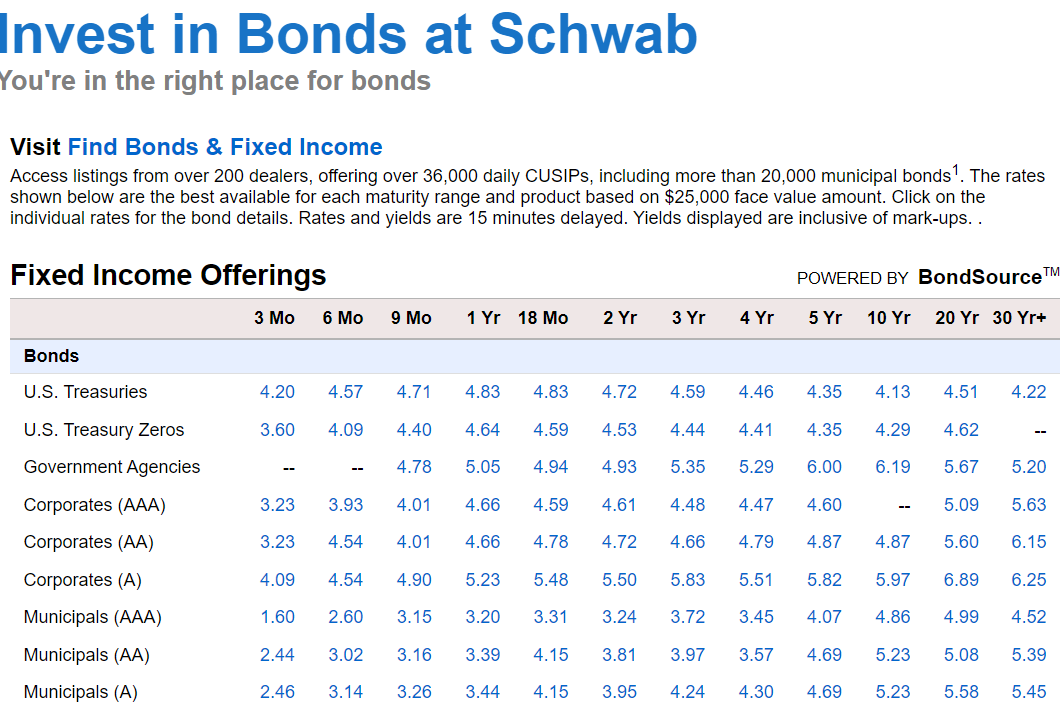

T-bills: This is US government debt that matures within one year. You can get yields as high as 4.8% today, risk free. Most investors are not aware of this, and think the only way to earn interest is in a money market fund, CD, or high-yield savings account, all of which yield only 3% right now. Just move that money to your brokerage account and buy T bills with it. Here’s a step by step of how to do it in Schwab:

Find out where they offer bonds at your brokerage:

Don’t be intimidated by all the different offerings. Focus on US Treasuries and select a maturity between 3m to 1 year. If you are bullish short term yields or need that money sometime soon, stay within 3m. If you think the Fed will pivot soon, lock in that 4.83% yield at the 1 yr maturity.

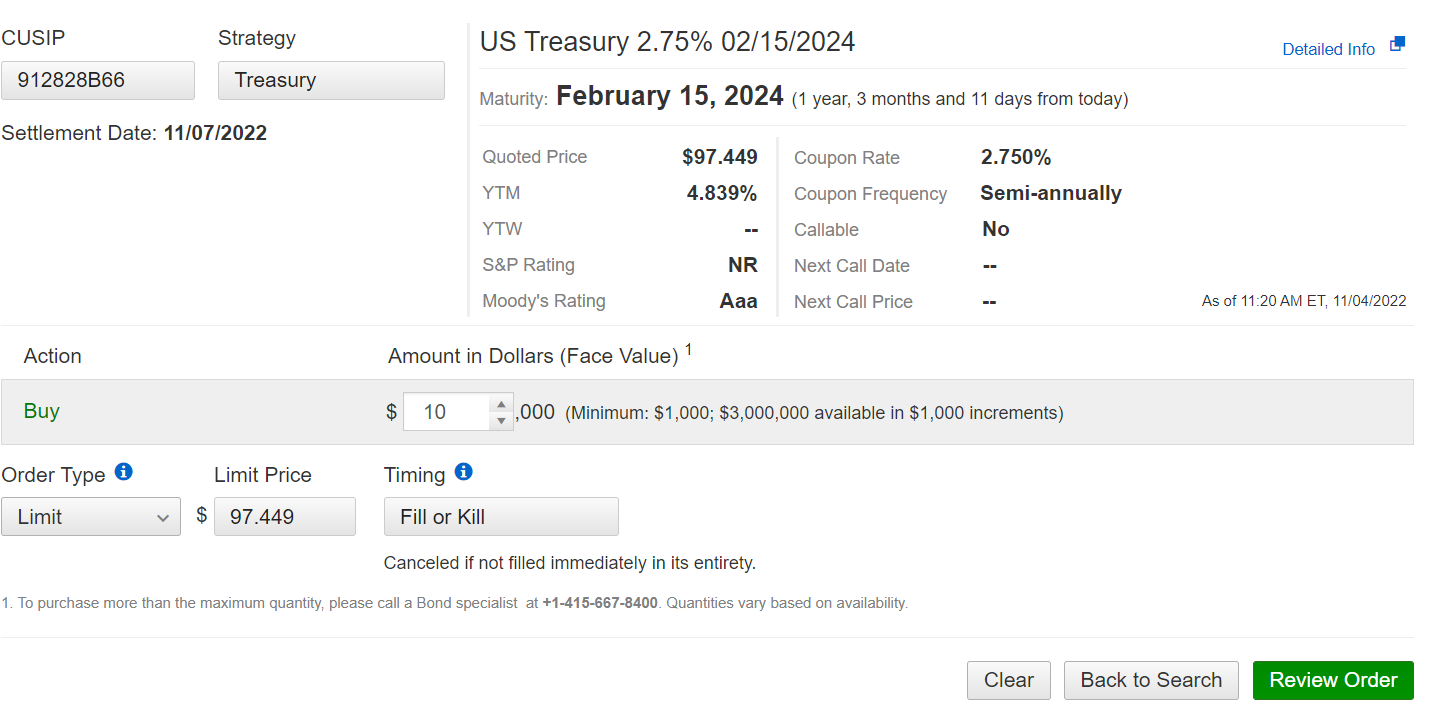

There will be a lot of T bills on offer. Don’t just buy any one. Sort by YTM (yield to maturity) and select the highest one. Some might have a minimum size that you must trade.

Enter the amount you want to buy. Keep in mind that the amount is based on a $100 face value, not current price. If you select $10,000 face value but the current price is $99, you will end up with $9900 worth of bonds, not $10,000.

When the T-bill matures, rinse and repeat and buy another one (this is called rolling). If you realize you need the money before the T-bill matures, you can always sell it. In the time between when you buy the T-bill and when it matures, the price can fluctuate based on what the Fed is doing. For example, if you buy a 1 year T-bill and the Fed hikes 50 bp more than expected the next day, the price will drop. However as the T-bill nears maturity, the price should converge towards the face value of $100, helping to cushion the impact of surprise rate hikes.

What’s absent in this allocation is exposure to the S&P 500 and the megacap tech names. I believe the megacaps will be disrupted over the course of the next decade as inflation and wage growth compress margins (Amazon) while tensions with China obliterate entrenched China businesses (Apple and Tesla). Netflix and Meta are mature businesses whose years of fast growth are behind them and are now taking outsized business risks in search of the next driver of growth.

What’s also absent in my portfolio is China exposure. Everyone has been trying to pick the bottom in China equities this year and has had their fingers burned. Valuations have gone cheaper beyond what most people imagined. Policy risk and geopolitical risk are the two things that keep hammering Chinese equities. President Xi cares about common prosperity and reunification with Taiwan, two goals that work heavily against a portfolio of Chinese equities. Sure, we could get a rally if China exits its zero covid strategy, but gambling on a reopening isn’t a long term allocation strategy. Even if you invest in China and are up 100% within the next two years, the day China decides to make a move on Taiwan (which I think will happen within a seven year time horizon), those returns will get nuked pretty quickly.

My hope is that this asset allocation delivers an IRR of 20% or more over the next decade. During the inflationary 70’s and 80’s, an allocation like this delivered monstrous returns. Sometimes I wonder if I should just stop trading and let my long term portfolio do the heavy lifting. But then I wouldn’t have as much to write about in this blog!

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.