I don’t know if it’s just my feed of X posts and research, but the chorus of analysts pushing back on the amount of cuts priced into the market was deafening this month. Last week we saw a number of Fed speakers push back on the market pricing in a full cut for March and over six 25 bp cuts for 2024. Even Fed Governor Waller tempered his enthusiasm over cuts, caveating that they should be measured. The market responded, chopping 36 bp off pricing of cuts this year and lowering the probability of a March cut to less than 45%.

Now we are seeing the pushback against the pushback - Morgan Stanley and JP Morgan both recommended on Monday to go long 5 year Treasuries. Former Fed governor Bullard said last night that he believes the Fed will cut before inflation reaches 2%, and that a cut could come as soon as March. Bullard is no longer on the Fed anymore, but he was one of the most influential governors during his tenure, and the market weighs his opinion perhaps even more than some of the current sitting Fed board members who less influential. 5 year yields are now looking toppy within the context of their recent range.

The Quarterly Funding Announcement and the next Fed meeting are approaching next week. With market pricing of cuts back to a reasonable level and Trump looking ever more likely to win the Republican nomination, my high conviction view is that Yellen and Powell will provide a double whammy dovish surprise that will trigger another rally in fixed income and risky assets. Yellen will either announce less Treasury supply than expected, effectively drawing down the Treasury General Account and providing liquidity to the market, or announce less issuance of coupons (vs bills) than expected, which would support the long end of the Treasury market while drawing down the RRP faster. Powell’s potential dovish moves would be maintaining his dovish stance and hinting at a March cut and/or a start to QT tapering in the March meeting. For this reason, I want to continue betting on lower yields and higher risk assets from here, especially long duration risk assets like growth equities. Paid subscribers know that my portfolio has been trading in this direction for a while, and I plan to deliver an update on those positions within the next few days.

Without a stronger economy and consumer sentiment, Biden’s chances of defeating Trump are slim. If you think that I’m being a conspiracy theorist for believing that the Fed and Treasury would conspire to pump the economy and get Biden re-elected, then consider this - Trump publicly threatened to fire Powell multiple times when he was president, and the Fed board and staff is filled with a majority of Democrats, most of whom believe that Trump is an existential threat to the survival of the United States. As for Yellen - she works for Biden, so it’s obvious where her allegiance lies.

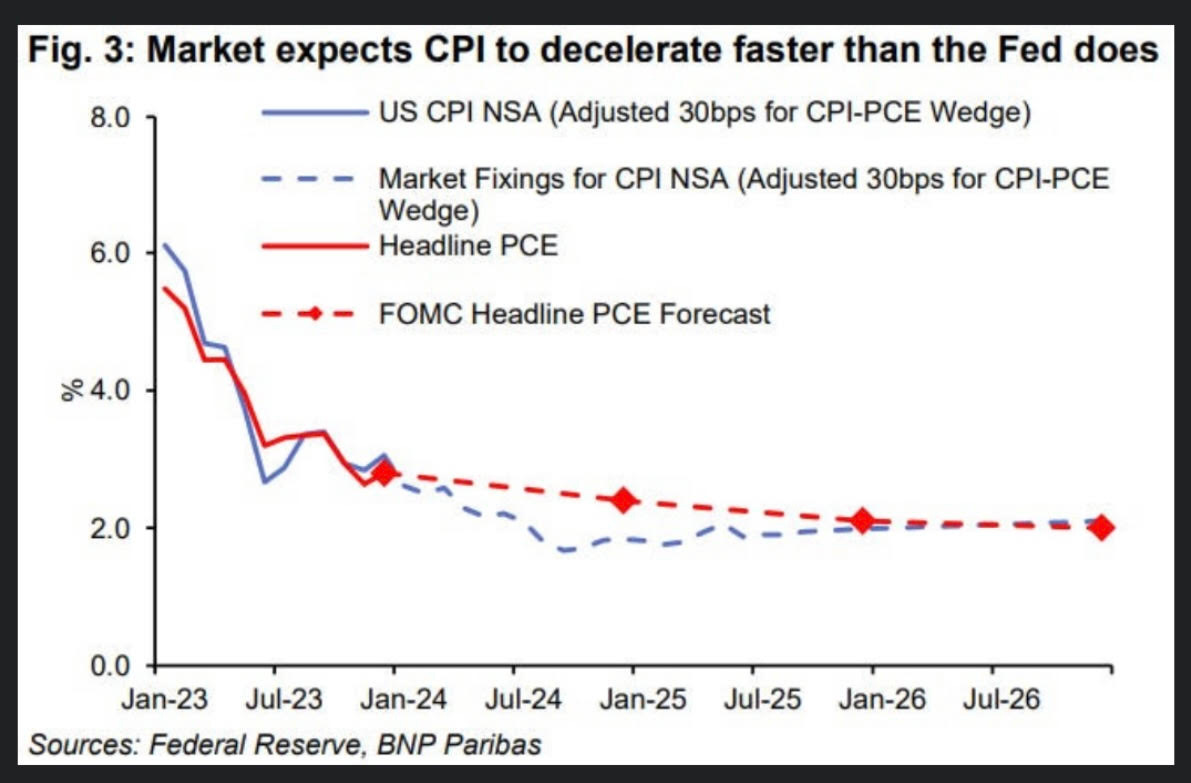

One of the key variables is what happens to inflation from here, as inflation is the main constraint to how quickly and deep the Fed can cut. The inflation swap market has predicted the path for inflation much better than the Fed and the “higher for longer” financial pundits on X and CNBC. Market pricing for inflation shows a gentle glide in CPI to 2% by Q3 without a reacceleration higher any time in the near future.

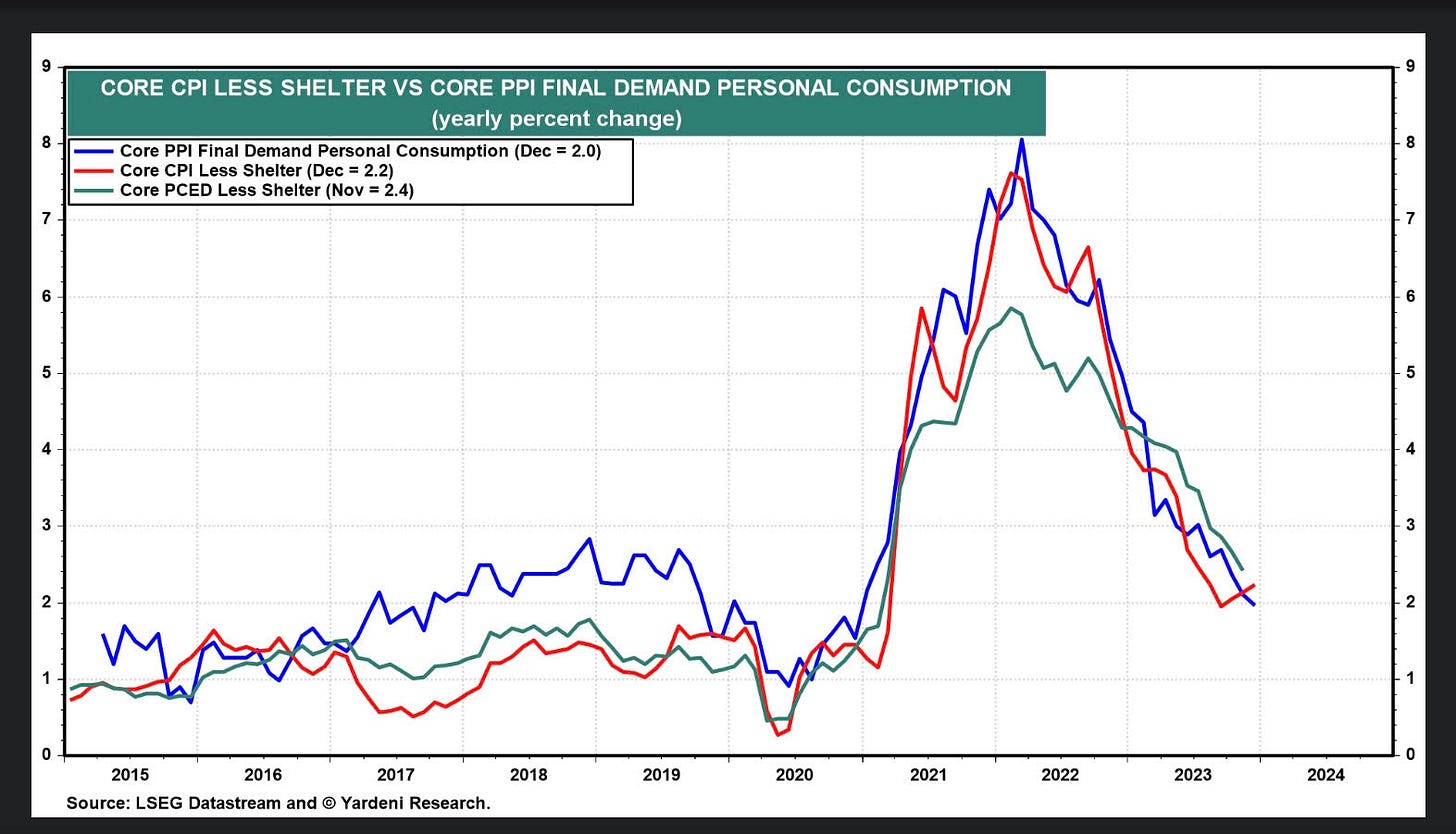

This inflation path isn’t that difficult to fathom as core CPI is already close to 2% when you remove the shelter inflation component, which is trending towards 0% but lags by at least 12 months.

Meanwhile, alternative real-time measures of inflation have nose-dived below 2% already.

I believe that inflation will not only surprise to the downside this year, but that the global economy will remain in a low inflation environment for longer than expected. I point to many of the factors that inflationistas are citing (deglobalization, geopolitics, climate, and fiscal dominance) and argue that those factors all working against inflation at the moment.

Consensus thinking points to deglobalization as a driver for inflation, but I believe that this logic should be turned upside down now that we are past the peak of supply chain disruption. Deglobalization resulted in a manufacturing renaissance in the US and the installation of excess capacity around the world that is now putting pressure on goods prices. Deflation in goods has been a driver for disinflation and it’s likely to continue, if my theory proves to be true.

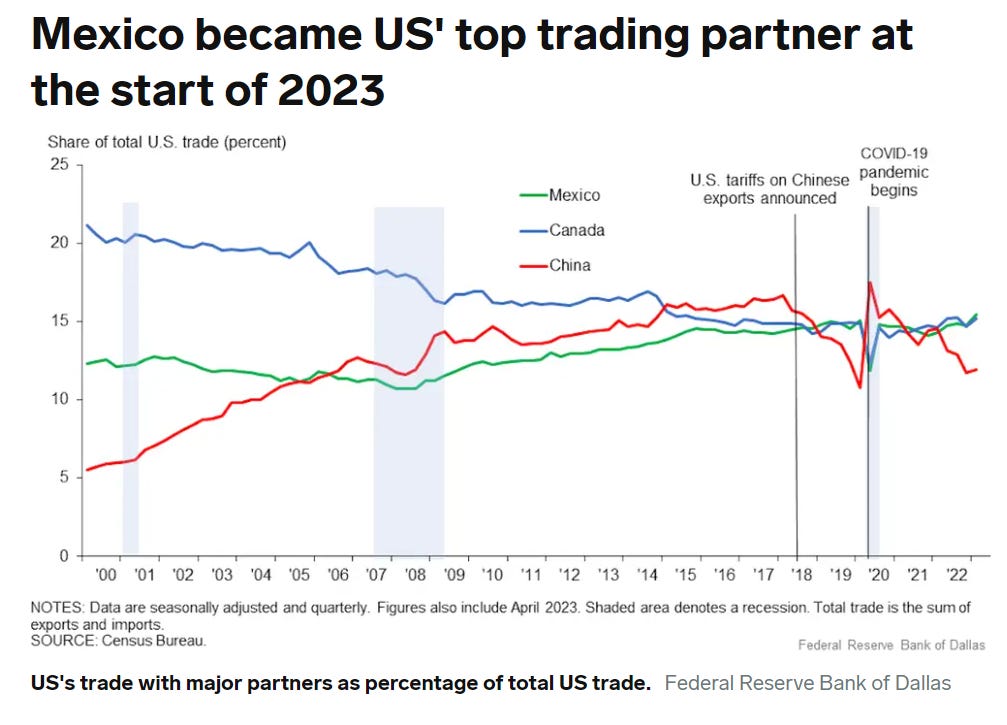

Consensus thinking blames the slowdown in China for exporting good deflation to the US, but China’s role as a trading partner has diminished over time. Mexico has overtaken China as the largest trading partner to the US, the result of conscious efforts to diversify supply chains away from China and to a friendlier partner. When new supply and capacity gets built in someplace new, the factories and workers in the displaced exporting countries still need to produce output. If five years ago the world had ten factories making the widgets in China, and today another ten factories get built in Mexico making the same widgets, you have double the amount of supply that will push prices lower on a global scale.

As for geopolitics and climate, the double whammy of the war in Ukraine and El Nino (which caused droughts and floods around the world) did cause commodities to soar in 2022. Seasoned commodity traders know that high prices invite more supply, which in turn brings about lower prices. Look at a chart of oil, natural gas, or grains today and you’ll see a picture of commodity deflation, not inflation. We once asked ourselves whether there is enough nickel and lithium in the world to supply the manufacturing of electric cars, yet both markets are now in pronounced bear markets. US production of oil has surpassed most projections to the upside, while Russia has been producing at max capacity and skirting sanctions by selling to China. OPEC, after agreeing to multiple production cuts over the past year, now has space capacity of over 2m barrels per day that would come online if oil prices were to ever rise.

US fiscal spending was indeed a significant driver for inflation in 2022 and 2023, but the fiscal impulse is due to contract in 2024. The US will still incur a sizable budget deficit this year, but it is the relative change from the previous year that determines the government’s contribution to GDP and inflation on a percentage growth basis.

If one believes that inflation will continue trending lower, then one has to question why the Fed needs to keep the real Fed Funds rate (vs core PCE) at 2.86, a level of tightness that previously triggered the 2000 and 2008 recessions.

The neutral level of real Fed funds is estimated by the Fed to be 0.5%. Each month the Fed doesn’t cut, the real Fed funds rate creeps higher as core PCE trends lower. If Powell wants to prevent another Trump presidency, he would front-load cuts this year to reach neutral, which is almost 250 bp below the current level. When you apply this framework to the rates market, the 140 bp of cuts priced into the market right now doesn’t seem like enough.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

I'm italian and when I think of Trump I can't believe that such a (fill with an insult you like) could become POTUS once again.

Then I remember Berlusconi and Renzi and Conte and 5stars and Lega and PD etc etc

Democracy is doomed

CPI showed a 25 percent reduction in health insurance? Every employment report the last 13 months was revised upwards after the fact? $1,000,000,000 increase in the defect each quarter? Sure inflation is going away...