Tariffs on hold, bond vigilantes at bay, and how Trump can buy BTC for the BSR without Congressional approval

I was going to write a post about how I think Trump’s tariffs won’t be as bad as the market feared, and was in the middle of a call with my friend and fellow Substack writer Sam at Clark Street Capital bouncing ideas about what currencies would be best to be long against USD. There had been plenty of leaks about Trump’s incoming executive orders (examples here and here) but no leaks about heavy tariffs. The lack of bearish leaks on tariffs made me want to lean towards being short USD and long Treasury.

In the middle of our call, I saw USD trade sharply lower. Sam mentioned he saw this headline come across the wires: “TRUMP TO LAY OUT TRADE VISION BUT WON'T IMPOSE NEW TARIFFS YET - WSJ”. I abruptly hung up and rushed to sell USD FX and buy Treasury futures.

Further headlines came out confirming the veracity of the earlier one - “TRUMP OFFICIAL CONFIRMS WSJ REPORT THAT HE'LL STOP SHORT OF IMPOSING DAY-ONE TARIFFS”. By then I had fully executed the trading plan I laid out in last week’s post - short USD/CAD, long Treasury futures, and long BTC (among others). Trump is pursuing a pro-market agenda first and choosing to negotiate with his trading partners before imposing tariffs. With USD longs at crowded levels, the lack of clarity on the timing and size of tariffs will put those positions under pressure.

If you want real time alerts the moment I put these trades on along with details how I risk manage the position, you should upgrade to a paid subscription.

Trump and Xi had a friendly call last Friday, which led to me going long Chinese equity futures this morning on the break of an inverse head and shoulders pattern. I believe this has bigger implications than just Chinese asset prices. My friend Louis has a credible theory that the “bond vigilantes” who have been ruthlessly selling Treasuries are actually China’s central bank, which has trillions in USD reserves and is the biggest foreign player in the US Treasury market. China sells Treasuries and pushes up the cost of financing for the US government when they want to put political pressure on the US and kneecap the US government’s available policy options. This indeed has worked, as high yields have prevented Trump from imposing tariffs (which are perceived as inflationary) and rolling out expansionary fiscal policy.

We saw this in action after Pelosi visited Taiwan in 2022, and again in Sept 2024 when Trump’s odds of winning the election started to rise. When Xi and Senate majority leader Chuck Schumer met and smoothed over US-China relations in October 2023, the Treasury selloff reversed into a rally that lasted several months and 120 bp. Official data shows that selloffs and rallies in Treasuries correspond with declines and rises in China’s FX reserves, corroborating the theory that China does indeed push the Treasury market where it wants with its massive holdings.

I believe Trump is holding back on tariffs because he is in the process of striking a deal with Xi, which will likely lead to China stopping its selling of Treasuries, and possibly reversing back to buying. This phone call between Trump and Xi may mark the bottom of the Treasury market for the time being.

It’s getting late here, but I can’t finish this post without writing about Trump’s audacious move of launching his own memecoin at the Crypto Ball, an event that took place over the weekend that cost up to $1m per ticket and featured Snoop Dogg as a performer. If you are hearing about the official TRUMP token for the first time here, make sure you catch up on what happened.

Trump has no shame or fear of consequences when it comes to grifting and enriching himself and those around him. This goes to show the lengths at which he is willing to go to pump crypto prices. If you thought a Bitcoin Strategic Reserve (BSR) was unlikely to happen because Congress won’t approve it, or because it doesn’t make sense, or because it’s a money grab….well, think again. Anything is possible, and I have a theory about how Trump can make it happen without Congressional approval.

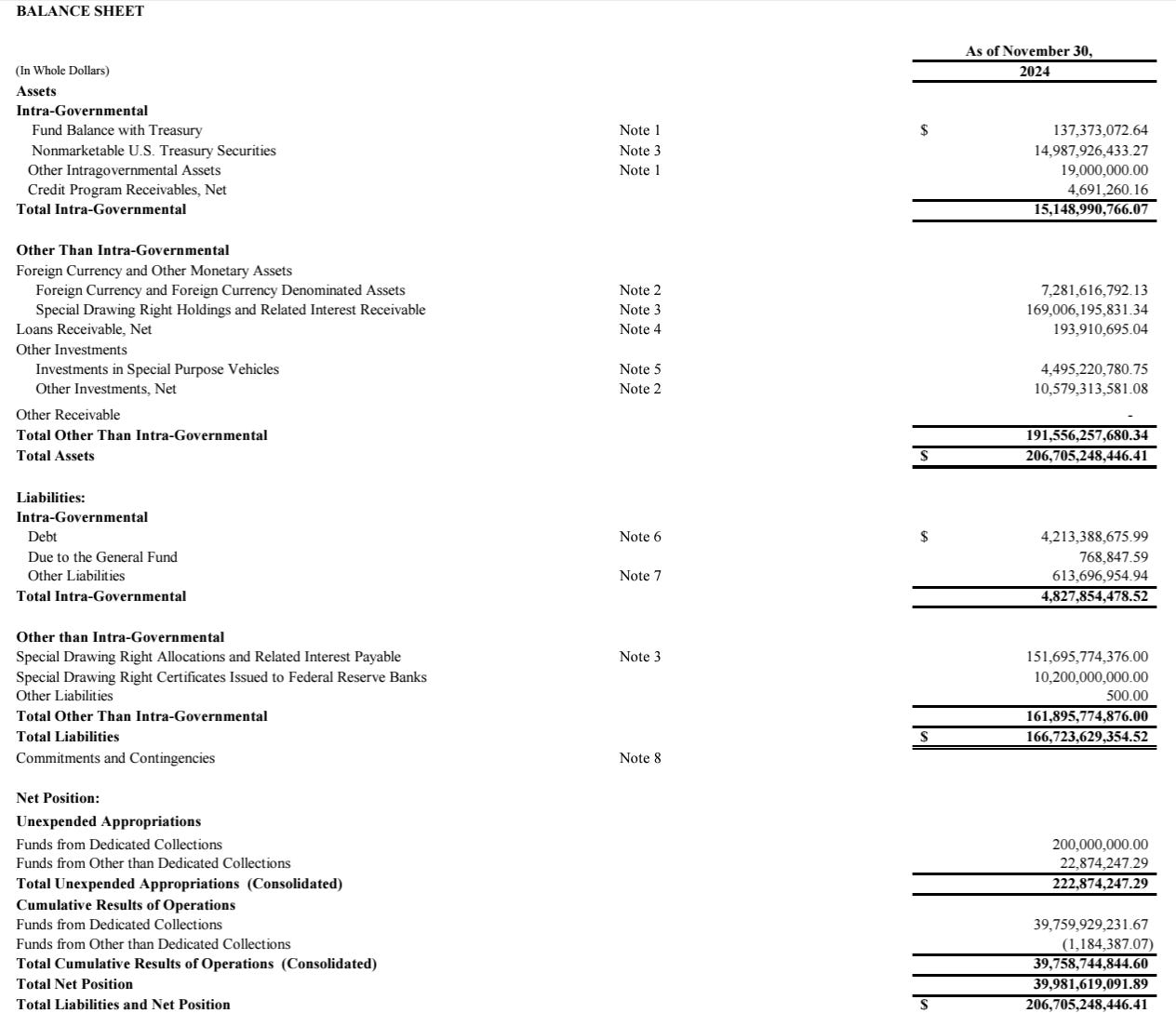

There’s a part of the Treasury called the Exchange Stabilization Fund (ESF), which contains US dollars, IMF special drawing rights (a basket of currencies), and foreign currencies. It has $207b in assets and $166b in liabilities, with a net asset value of $40b.

The ESF was originally created in 1934 to intervene in the dollar, and later was used to conduct the sale and purchase of gold during WWII. The ESF was used throughout the 1980’s to 90’s to support or sell USD in FX intervention, and was last used in 2000 to purchase EUR FX in coordination with the ECB. Since then, it has been barely used as the US has not seen a need to conduct FX intervention in the dollar.

The authority to use the ESF lies with the US Treasury, which is controlled by newly appointed Treasury Secretary Scott Bessent.

The ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments. All operations of the ESF require the explicit authorization of the Secretary of the Treasury ("the Secretary").

The Secretary is responsible for the formulation and implementation of U.S. international monetary and financial policy, including exchange market intervention policy. The ESF helps the Secretary to carry out these responsibilities. By law, the Secretary has considerable discretion in the use of ESF resources.

The legal basis of the ESF is the Gold Reserve Act of 1934. As amended in the late 1970s, the Act provides in part that "the Department of the Treasury has a stabilization fund …Consistent with the obligations of the Government in the International Monetary Fund (IMF) on orderly exchange arrangements and an orderly system of exchange rates, the Secretary …, with the approval of the President, may deal in gold, foreign exchange, and other instruments of credit and securities.

There is nothing on the Treasury website that says the ESF can’t be used to buy BTC, nor is there anything that says that Congressional approval is required. Although a net asset value of $40b is only 2% of BTC’s market cap, there is a gross asset value of $206b which can be partially liquidated to purchase BTC. I envision Trump using the ESF to seed the BSR to buy him time to garner support from Congress to approve ongoing purchases from the Treasury’s budget.

List of current positions (paid subscribers only)

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.