I’m finally back from my travels after capping off the winter break with a side trip to Bangkok to celebrate a friend’s birthday party. I’m now back in rainy Singapore, where my attention is fully back on the markets and work.

Ever since the Fed did their hawkish cut in December, bond yields and USD have trended higher and risk assets have retreated. The S&P 500 is below election day levels, while BTC has made multiple excursions below support at 92k. Concerns over excessive fiscal spending and inflationary tariffs have driven bond yields higher. We’ve seen a string of hot data (ISM manufacturing, ISM services, and NFP) suggesting that the economy unexpectedly heated up last month. Perhaps the rising markets in November and the lifting of election uncertainty pushed business confidence higher, resulting in stronger data. The frontloading of goods imports and the raising of prices to get ahead of tariffs may have also contributed to higher PMIs. On top of that, oil has woken up and rallied over 10% from its December levels, reinforcing the stagflation regime. None of this bodes well for CPI tomorrow and the FOMC later this month. These risk events may surprise towards hawkish and stagflationary outcomes, putting more pressure on risk assets.

Trump’s first day of his presidency may be the biggest risk event of the month. Expect a flurry of executive orders around tariffs, border control, and crypto. One potential outcome would be a bifurcated macro response where crypto rallies on positive regulatory news, while bonds and equities sell off on tariff news.

The magnitude and breadth of the tariffs is a question mark that I’ve been grappling with. A report in the Washington Post last week suggested that they might be targeted and less broad-based, but this rumor from an unknown source was quickly denied by Trump. We learned last night that Trump’s economic team will be proposing a plan of graduated tariffs that will result in less market disruption but still give the US negotiating leverage with its trading partners.

On the flip side, Trump is a true believer in tariffs and their ability to deliver a renaissance in American manufacturing. Although he respects the views of his team, Trump ultimately has his own convictions and makes his own decisions. Trump could very well ignore his economic advisors and begin his presidency with heavy universal tariffs and force his trading partners to negotiate them lower.

My inclination is to go into next Monday with a small position betting on the former scenario (light, graduated tariffs), as that will garner the largest market reaction. Yields and USD have already risen to partially price in heavy universal tariffs, so the latter scenario might result in only a temporary and smaller spike in yields and USD, while light, graduated tariffs should trigger a sharp reversal lower in yields and USD.

Looking out at the big picture, I believe that we are still in a bull market. The market found itself in this same situation in Oct 2023 and April 2024, and both rallies in yields and USD were great opportunities to buy risk assets. The tightening in financial conditions will dampen economic sentiment, which in turn will cool down data and lead to lower yields and USD. If Musk and Ramaswamy show any early success with DOGE, Treasury term premiums should contract from their elevated levels. When this happens, we will transition from a stagflation regime to a risk-friendly disinflation regime (see explainer on regimes). The only question for us traders is timing this inflection point.

The following is a shortlist of trades I want to put on over coming days or weeks and my execution plan:

Short USD/CAD

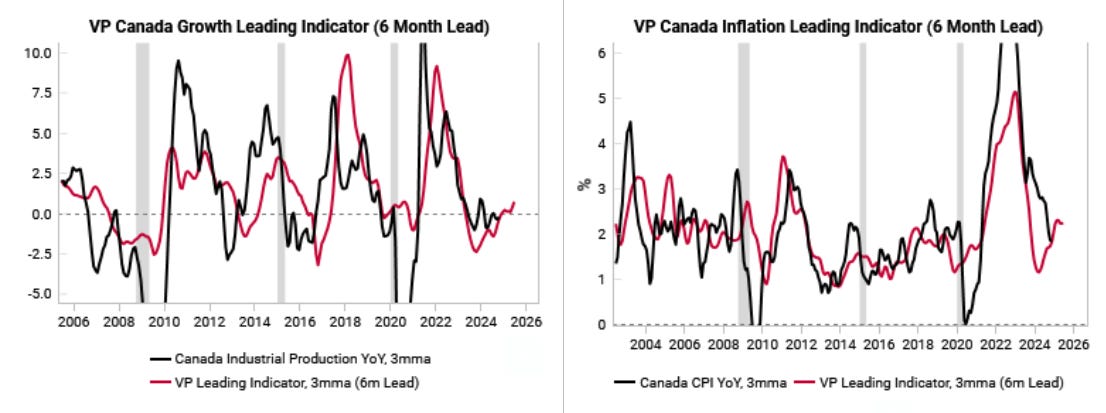

When yields top out, they should take USD lower with it. CAD is one of my favorite longs against USD for several reasons. First, I think the tariffs that Trump has threatened against Canada are mostly a negotiating tactic, and that the endpoint will be that the US and Canada negotiate tariffs down to a less impactful level. Second, Trudeau will be stepping down, and the candidate who is expected to replace him (based on Polymarket) is Pierre Poilievre, a business friendly politician who believes in a small government and philosophically aligns well with Trump. Third, the market has already priced in an aggressive cutting cycle for Canada, while economic surprises are inflecting higher (based on the Citi economic surprise index). Variant Perception’s leading indicators for Canada’s growth and inflation are also inflecting higher.

Finally, the futures market in CAD is the shortest it has been in over a decade, setting the stage for a potential dramatic reversal.

I prematurely went short USD/CAD last week, as highlighted in the paid subscriber chat in the Substack app. The position is taking some heat, but if I get stopped out, I’ll be looking for setups to get back in. If Trump announces heavy tariffs, I’ll sell into USD/CAD strength, and if he announces light tariffs, I’ll be chasing weakness.

Long Tesla

I believe the coming years will see the current equity bull market take on a more frenzied and speculative nature, and that Tesla will be at the center of it. Tesla is a speculative and divisive stock, with many ardent bulls and haters. For the bulls, Tesla embodies the current technological and cultural zeitgeist, with the richest and most powerful person in the world at the helm. Like crypto, it trades in long cycles of bullish and bearish sentiment driven by the promises (or disappointments) of future innovation. Valuation metrics are irrelevant to the price. I believe that Q3 2024 marked the beginning of a new bull cycle that will run until 2026 (similar to the bull cycle that lasted from 2020-2021).

The last bull cycle that took Tesla’s price from a split adjusted $15 to the Nov 2021 high of $414 was driven by the dream that Tesla could go from nothing to the leading electric car company in the world. Tesla indeed achieved this milestone in 2023 (but was later eclipsed by BYD). Tesla was one of my top holdings during that bull run, and I fortunately managed to get out near the high. The Tesla I currently drive was funded by the profits from that trade.

The current bull cycle will be driven by the dream of Tesla’s advances in autonomous vehicles - Full Self Driving, robotaxis - and AI robots (Optimus). Tesla has been the biggest MAG7 beneficiary from Trump’s election, as the market believes that Musk’s partnership with Trump will result in regulatory roadblocks falling away for Tesla and clearing the way for innovation to reach the market. However, if Musk falls out with Trump, that may stop Tesla’s bull run in its tracks.

Tesla is my largest equity holding, and my target is 3-5x in two years. I am already long a core position, and also have a trading position in cash and options which I took off at 475 and reentered on the current dip at 410.

Views on BTC, my favorite altcoin, and Treasuries behind the paywall…

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.