The four quadrant global macro framework (part 1)

80% of global macro trading is figuring what regime you're in

When I tell the average layperson I trade global macro, I sometimes get a response that goes like “Wow, it must be hard to keep track of all the different markets and what’s going on everywhere in the world!” Believe or not, there is a method to the madness that is global macro. The market tends to organize itself around four global macro regimes, and figuring out which regime we are currently in is the key to finding order amid the chaos of the markets.

The two variables in the regime are market expectations of growth and inflation, which can be visualized as a four quadrant graph, with growth on the y-axis and inflation on the x-axis:

For the sake of convenience, I’ve numbered the quadrants so I can refer to them throughout this post. Quad 1 is when market expectations of inflation are falling while expectations for growth are rising (aka disflation, or Goldilocks). Quad 2 is otherwise known as reflation, while Quad 3 is known as stagflation. Quad 4 is a traditional risk-off regime. I have referred to these regimes in my previous posts, but this is the first time I am laying out the logic of why these regimes are so important.

By the way, the four quadrant framework isn’t an idea that I came up with. Ray Dalio was the first investor I’ve heard to use this framework, and numerous global macro strategists (such as Darius Dale from 42 Macro and Keith McCullough from Hedgeye) now use this as a model for how they view the markets.

In Part 1 (this post), I will discuss what assets tend to outperform and underperform in each quadrant and why, and provide examples from recent history. In Part 2 (a future post), I’ll discuss how I trade regime shifts, which is how the real money in global macro is made.

Quad 1 (aka Disinflation or Goldilocks) - rising growth and falling inflation

Every global macro trader should get familiar with Quad 1, as this is the regime that we have spent the most time in over the last four decades. Since 1980, inflation has been in a steady downtrend while growth has been in a steady uptrend (with some exceptions such as 2022-23).

Quad 1 is characterized by middling but steady growth, with stable or falling yields and little fear of central bank tightening. The correlation between equities and Treasuries tends to be positive. Falling yields tends to suppress volatility, luring the markets into a sense of calm. Risky assets such as equities, corporate credit, crypto, precious metals, and EM assets tend to outperform. USD tends to trade sideways to lower against most currencies (although that has not been the case as of late). Cyclical commodities tend to underperform during quad 1.

For global macro traders who trade directional trends and thrive on volatility, quad 1 can be a difficult regime trade due to the lack of volatility in asset classes such as FX, equities, and bonds. Strategies that are long risky assets, long carry, or short option and risk premium tend to do well during quad 1. However, this can be be a double-edged sword as the occasional bout of risk-off can cause sharp drawdowns in these positions.

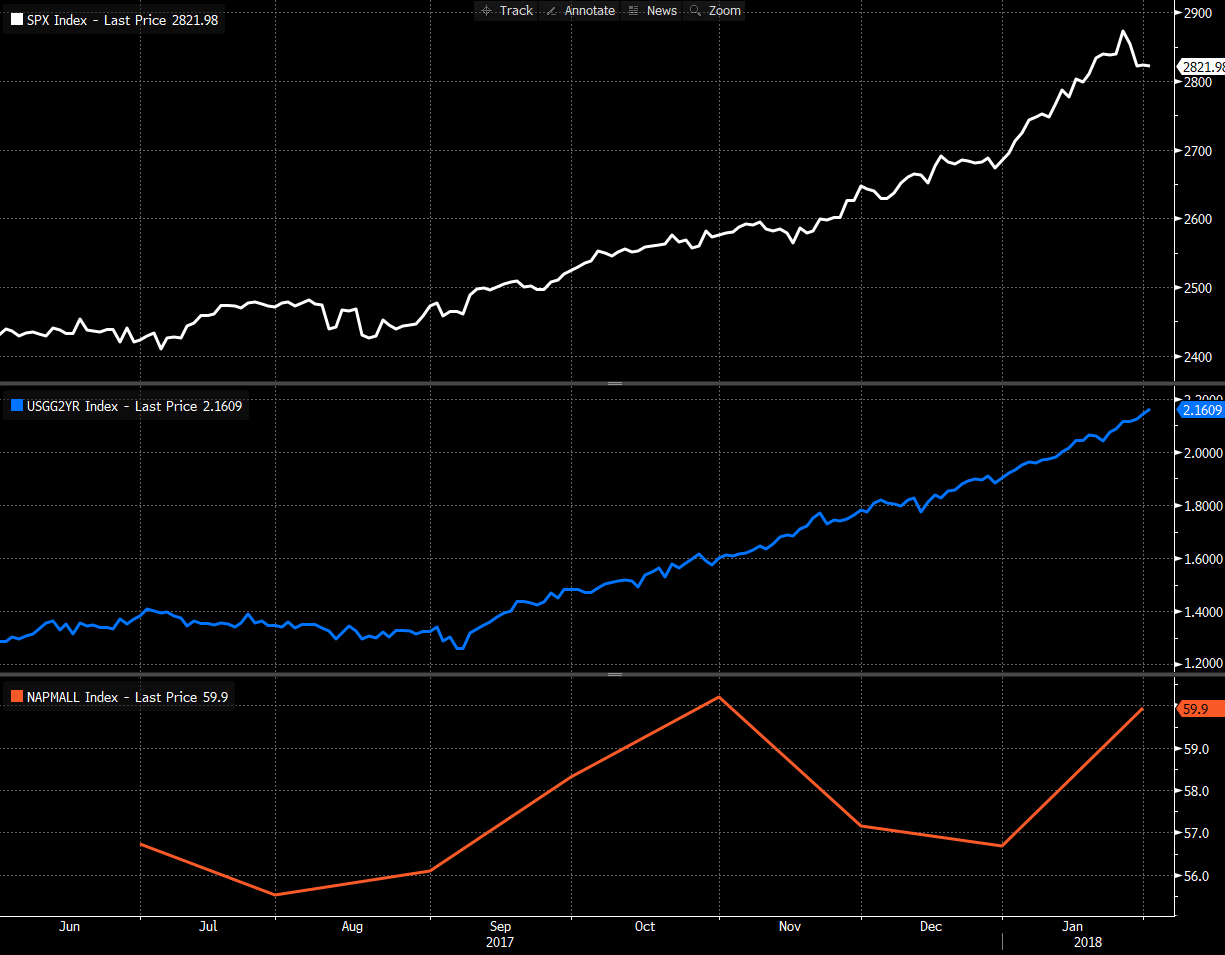

Ever since the Fed pivoted from a hiking stance to a neutral, and then a cutting stance, quad 1 has dominated the market and has contributed to the S&P 500’s outsized return this year. Another example of extended periods of quad 1 are 2019, when the Fed funds rate dropped from 2.5% to 1.75% and the SPX returned 28%.

Quad 2 (aka Reflation) - rising growth and rising inflation

Quad 2 is an exciting regime as it’s when everyone is making money, but it doesn’t happen very often. It is when growth runs hot and inflation starts to pick up, but the market isn’t worried too much about central bank tightening yet. Quad 2 is characterized by risk-on conditions in equities, commodities, crypto, and risky currencies against USD. Precious metals tend to go sideways or lower. Equities tend to rise alongside yields, and can exhibit explosive upside price action as bullish animal spirits take control.

Quad 2 regimes usually happen after Quad 1 as a result of stimulative monetary or fiscal policy, and end in Quad 3 regimes. As the economy overheats, yields and expectations of Fed tightening rise in response. While it may take a while for risky assets to react negatively to the rise in yields, at some point a tipping point occurs, causing the market to roll over into Quad 3.

The last two crypto bull markets of 2017 and 2021 occurred during Quad 2 regimes. 2017 was the culmination of Trump’s tax cuts and easy Fed policy, and then transitioned into 2018, a year when almost every asset class declined due to fears of Fed overtightening. 2021 was another period of frothy financial conditions when retail Reddit traders ran rampant and the economy was fueled by helicopter money from the Fed and Treasury. Based on where we are in the economic cycle and what I’ve read about Trump’s policies, we will likely enter Quad 2 at some point in the next two years. The key to trading Quad 2 is to ride the bull market as long as possible, and get off at the right time.

Quad 3 (aka Stagflation) - falling growth and rising inflation

Quad 3 is almost always an ugly surprise for the market when it happens. By the time it comes along, the market will have been enjoying an extended period of risk-on and building bullish sentiment and positioning. Quad 3 then appears and snuffs it out in the space of a few weeks. Quad 3 is the zone when tops form, selloffs turn violent, and volatility explodes.

Technically it’s not rising inflation that the market is worried about during Quad 3 - it’s the central bank tightening response that the market fears. At the tail end of Quad 2 regimes, the market extrapolates never-ending growth and prosperity indefinitely into the future by bidding up valuations and building up positioning to historical extremes. Not only is this extrapolation mathematically unlikely to play out in reality, but tightening monetary policy also becomes a headwind to future growth. As growth stalls out and the prospect of further tightening weights on the market, risky assets experience a Minsky moment and roll over. Accumulation of excesses results in blowups and violent positioning unwinds that can make Quad 3 an exciting regime to trade for global macro traders.

2022 was the most recent Quad 3 regime and is fresh in the minds of every trader. Some hawkish comments and concerns about inflation during the Dec 2021 FOMC triggered a sharp rise in yields, which spilled over into the new year. Stagflation regimes are characterized by positive equity to bond correlations. Treasuries no longer served as hedges against equity drawdowns, as stocks and bonds both sold off in tandem. USD tends to rise against most currencies, while commodities (except for precious metals) tend to rise as hedges against inflation. In 2022, precious metals went sideways to lower due to tightening financial conditions, but this type of price action is not always the case during stagflation.

The equity/bond correlation remained positive well into 2023, as the Fed continued hiking rates despite inflation peaking in June 2022. Fears of a resurgence of inflation continued to haunt the market, causing bouts of stagflation-induced selloffs. However, the start of the Fed’s cutting cycle in 2024 brought the equity/bond correlation back into negative territory.

Q4 of 2018 was another Quad 3 regime that saw SPX draw down by 20%. The Fed was well into a hiking cycle, and they continued hiking even though growth was slowing down. During the Dec 2018 FOMC, Powell said that the Fed was “still far from neutral”, indicating that they were far from the end of the tightening cycle. Equities didn’t like this and sold off hard into the holidays. This resulted in the Powell pivot where Powell signalled that further hikes were off the table.

One of the best performing trades during the initial stages of Quad 3 regimes are short Treasury futures, and by extension, long USD. Shorting equities is difficult as they tend to have violent squeezes. Equity selloffs are conditional on weakness in Treasuries, so being short Treasuries is often the better expression of a stagflation view.

Quad 4 - (aka traditional risk off) - slowing growth and slowing inflation

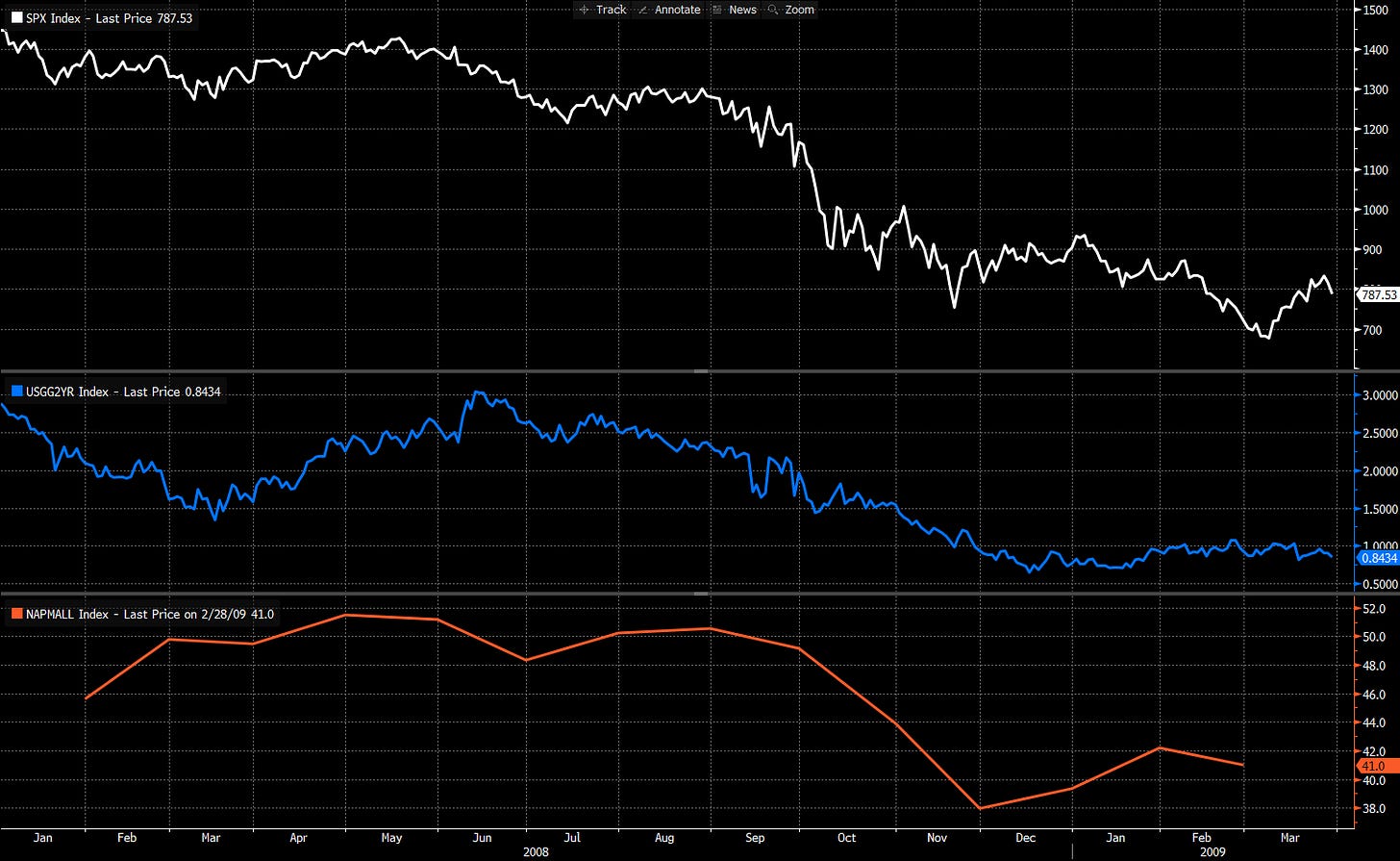

Quad 4 is a traditional risk off regime when risky assets and yields sell off in tandem, volatility explodes, and markets scramble for safety and liquidity. Quad 4 events are rare, as they are usually triggered by existential threats to the global economy and the financial system. Quad 4 is the most volatile regime of the four quadrants, and trading them can be transformative for global macro and traders’ careers.

The 2008 Financial Crisis was the biggest risk off event in the past several decades, and probably will remain the biggest for some time to come. I was an FX trader at a bank in 2008 and that year ended up being my best year at the time.

The covid selloff in March 2020 was another historical Quad 4 event, and the speed and violence in which it unfolded created phenomenal opportunities for traders who positioned ahead of it. I was trading my own money in 2020, and that year’s pnl surpassed my bank trading pnl in 2008 by multiples.

Just this last August we had a mini Quad 4 event with the Japanese Yen carry trade unwind. It started with a surprisingly weak non-farm payrolls employment report that triggered recession fears in the US. Front end Treasuries rallied to price in significantly more cuts, while equities sold off. The ensuing selloff in USD/JPY (which is correlated to yields) triggered a unwind of leveraged carry positions that were long risky assets and short JPY as a funding currency. This led to a 8% drawdown in SPX over three days - nothing catastrophic compared to March 2020 or 2008, but scary by recent standards.

During Quad 4, USD tends to strengthen against risky currencies and weaken against safe havens. Commodities tend to sell off, including precious metals despite their safe haven status. Prices may trade at levels that don’t make sense, as owners of risky assets are often forced to sell to raise liquidity. Often this creates tremendous opportunities to go long assets at fire sale prices, if timed and sized correctly. Historically I’ve found that long short end Treasuries or SOFR futures has been the best trade during Quad 4, as it is a bet that the Fed will be forced to come to the rescue of the economy by cutting rates. It can be a superior trade to shorting equities, as equities at some point will reverse and recover thanks to the monetary stimulus, whereas rates will remain at their lows for a while. In other words, bet on the cure, not the symptom.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

Thanks. I always viewed the quadrants in isolation, never zoomed out to view it as a cycle. Good insights thank you

Always learn a ton from you Geo thanks for your hard work brother!