First of all, I’d like to thank the new subscribers who have joined over recent weeks and months. This is a 100% free post for those who are just getting to know Fidenza Macro. What I’m doing is putting real money behind the views that I write about in this blog and sharing my thought processes and frameworks for why I’m positioning that way. If you just joined, the main theme I’ve been writing about has been the selloff in long end Treasuries, which I most recently wrote about in these two posts:

An interesting new development that happened yesterday was that Dallas Fed president Lorie Logan (a hawk and a voter) gave prepared remarks that implied that higher term premiums in the long end of the Treasury curve would reduce the need for Fed tightening. Here are some key quotes:

A rise in term premiums can itself have many drivers, including increases in the stock of debt relative to investors’ demand for debt, changing correlations between the returns on different asset classes—which can influence the portfolio diversification properties of long-term bonds—and reductions in expectations for the Federal Reserve’s asset holdings…

Higher term premiums result in higher term interest rates for the same setting of the fed funds rate, all else equal. Thus, if term premiums rise, they could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening to achieve the FOMC’s objectives…

Financial conditions have tightened notably in recent months. But the reasons for the tightening matter. If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate. However, to the extent that strength in the economy is behind the increase in long-term interest rates, the FOMC may need to do more.

I thought it was a great speech and it sent the message that the Fed understands why yields are going up, and are measuring and watching term premiums carefully. I recommend anyone who has an extra three minutes to read it in full.

Fed Vice Chairman Jefferson followed up Logan’s speech with some comments along the same lines - that they are taking into account the tightening in long end Treasury yields when determining Fed policy.

As I mentioned earlier, real long-term Treasury yields have risen recently. In part, the upward movement in real yields may reflect investors' assessment that the underlying momentum of the economy is stronger than previously recognized and, as a result, a restrictive stance of monetary policy may be needed for longer than previously thought in order to return inflation to 2 percent. But I am also mindful that increases in real yields can arise from changes in investor's attitudes toward risk and uncertainty. Looking ahead, I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy. I will be taking financial market developments into account along with the totality of incoming data in assessing the economic outlook and the risks surrounding the outlook and in judging the appropriate future course of policy.

The fact that both speakers highlighted concerns around long end yields was not a coincidence. They are communicating the Fed’s reaction function, which is that the higher yields go, the less hawkish they need to be. If yields stay where they are or go higher, the Fed will likely hold off on further hikes. If yields suddenly drop by 25-50 bp without a subsequent change in economic fundamentals, then a hike is probably back on the table.

What does this mean for my bearish view on long end Treasuries? It’s important to first establish what factors are driving moves in the short end (2 yr yields) and the long end (20-30 yr yields). The short end is driven more by expectations of Fed policy, and therefore economic data and fundamentals matter more. I do think that Tbill supply did play a part in 2 yr yields grinding higher from 4.30% in June to as high as 5.20% in September. Anyone watching the market on an intraday basis would have noticed that Treasuries sold off harder on strong US data and rallied less on weak data. Rallies were short lived and would often fail for no apparent reason. Fed policy tends to take its cue from the market (which is why the Fed almost never surprises the market when setting interest rate policy), so it is likely that record Tbill supply was a factor in keeping the Fed hikes going in Q3. That said, expectations are now anchored around a terminal rate of 5.35-5.5%, and with the latest comments from the Fed, I think we will stay here for a while. Although higher yields may prompt the Fed to stay on hold, the bar for cutting or ending QT is much higher.

Long end yields historically have been driven more by supply and demand factors, as there is not much that can anchor that part of the curve to Fed policy. Because the US budget deficit is the currently the highest it has ever been in a non-war and non-recessionary environment, and Treasury supply (between primary issuance, Fed QT, and foreign selling) is also at an all-time high, my view is that supply/demand is completely dominating price action, while expectations of Fed policy are secondary, and economic fundamentals are a distant third. In other words, when it comes to long end Treasuries, economic fundamentals don’t matter.

This may be difficult to hear for people who are bullish bonds because they believe the economy is on the verge of a slowdown or because they think the Fed is done tightening. The following statistics will make it easier to understand the magnitude of the supply/demand imbalance and why whenever the market buys long end bonds on some bullish catalyst, it’s like Sisyphus rolling a heavy boulder uphill, only to have to roll back down again.

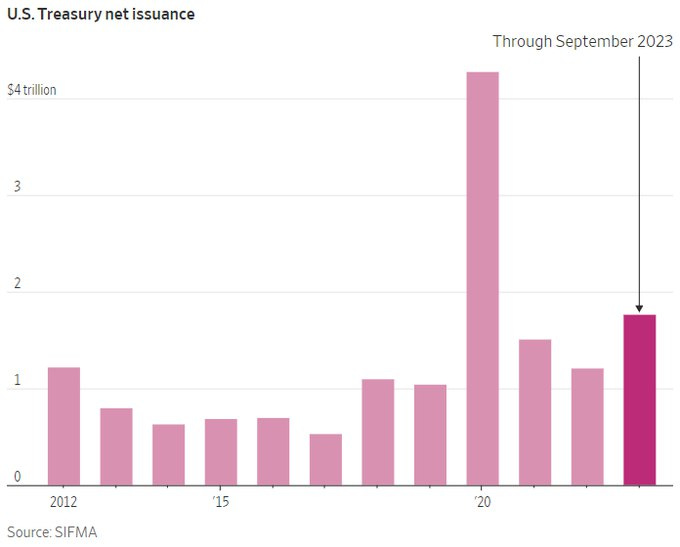

Never before have we seen so much net issuance when the Fed was not doing QE. This is about $10B of issuance per trading day in 2023. By the way, if people are right about a recession around the corner, the budget deficit will increase even more. QE or yield curve control will be necessary to help absorb all the excess borrowing.

China has also been a net seller. China reserves have been declining since July, and the share of Treasuries as percentage of reserves has also been declining.

Speaking of China, the amount of Treasury issuance during the first three quarters of 2023 is roughly 42% of the value of China’s reserves ($3.115T) and Japan’s reserves ($1.1T) combined.

Issuance of notes and bonds (as opposed to Tbills) will increase from $178B in Q3 to $338.5B in Q4. This includes a jump in issuance of 20 and 30 yr Treasuries from $89B in Q3 to $113B in Q4. In other words, just as the market starts to get concerned about the budget deficit, excess Treasury supply, and expanding term premium, the Treasury decides to increase supply of duration in Q4.

The 30 yr yield has soared from 4.3% at the beginning of September to 4.85% today, despite the 2 yr yield being relatively anchored at 4.9-5.2%. Yesterday’s comments by Logan and Jefferson moved the market’s expectations of the terminal rate by only 4-5 bp, and I don’t think this is meaningful enough to change the trajectory for long end Treasuries other than a short countertrend bounce. What would make me less bearish on the long end would be two things - expectations of a change in the supply/demand dynamic (either the Fed ending QT or the government borrowing less), or when long end yields reach a level where the market sees enough value to step in with enough demand to overcome the excess supply. I believe we are still far from levels where the market sees value in the long end, and in my next post (which will be for paid subscribers) I’ll provide some ideas on what those value levels may be.

If you’d like to upgrade to a paid subscription, you’d be helping to reward the time and effort I put into this blog, as well as supporting some of the costs of the institutional-grade research that goes into my ideas (which I often share). I would still write Fidenza Macro even if it generated no income, but the quality and cadence of posts would probably be diminished. Paid subscribers get access to paywalled posts where I go into detail about the trades I have in my portfolio, the archive, and the Telegram chat (which is more conducive to communicating trades in real time).

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

Fantastic newsletter Geo, so glad I found this. I value this newsletter greatly because of your background as a former trader at a bank.

Long bonds going up this fast are going to start having a major effect on the economy and asset prices if they stay here. The world economy was levered on zero rates from 2009-mid 2022. Residential real estate will slow to a crawl with 8%+ mtg rates (this has knock on affects for jobs in industries around RE). CRE is going to get demolished. CRE properties were valued & purchased at 3-4% rates for 13-14 years. Now they have to deal with 8% rates. Cap rates will rise, prices will fall dramatically. Credit cards, auto loans, business lines of credit, etc... ALL much higher cost.

My question is this.... higher long bonds are going to hit the economy soon & jobs, which will hit economic growth and spending, which will likely hit inflation. Can long bonds still stay high despite lower economic growth due to this avalanche of supply of UST? Because I think there is no question these high long bond yields are going to be an absolute wrecking ball though the world economy.

Up until recently its just been the short end of the curve that was high, this long bond move is very recent. So it has not had enough time to be the earthquake yet that it will be soon on the economy.