As most of my readers know, I was long equities and bitcoin in the Fidenza Macro portfolio since late June and early July, and recently exited those positions at a loss. Three months was a long time to sit with those positions, frustratingly watching them chop up and down and ultimately end with a loss. In this post I’m performing a postmortem on those trades, and explain why I have conviction in the opposite, bearish view.

These were the results of the trades:

I’ve broken down the long equity post-mortem into three decision components: view, entry, and exit.

Long equity view

My long equity position was based on the view that inflation would undershoot market expectations while growth would hold up. The leaders of the bull market would be the megacap tech names and AI chip companies. I was right about inflation undershooting and growth holding up, but I missed two key developments that ended up being the undoing of the position - increasingly bearish supply/demand dynamics in the Treasury market, and the FOMC being more hawkish than expected. I did not expect yields to be impervious to downside economic data surprises and to relentlessly rise the way they did. Treasuries are no longer trading on fundamentals, but instead are being dominated by the $11B of supply that the Treasury needs for its funding needs.

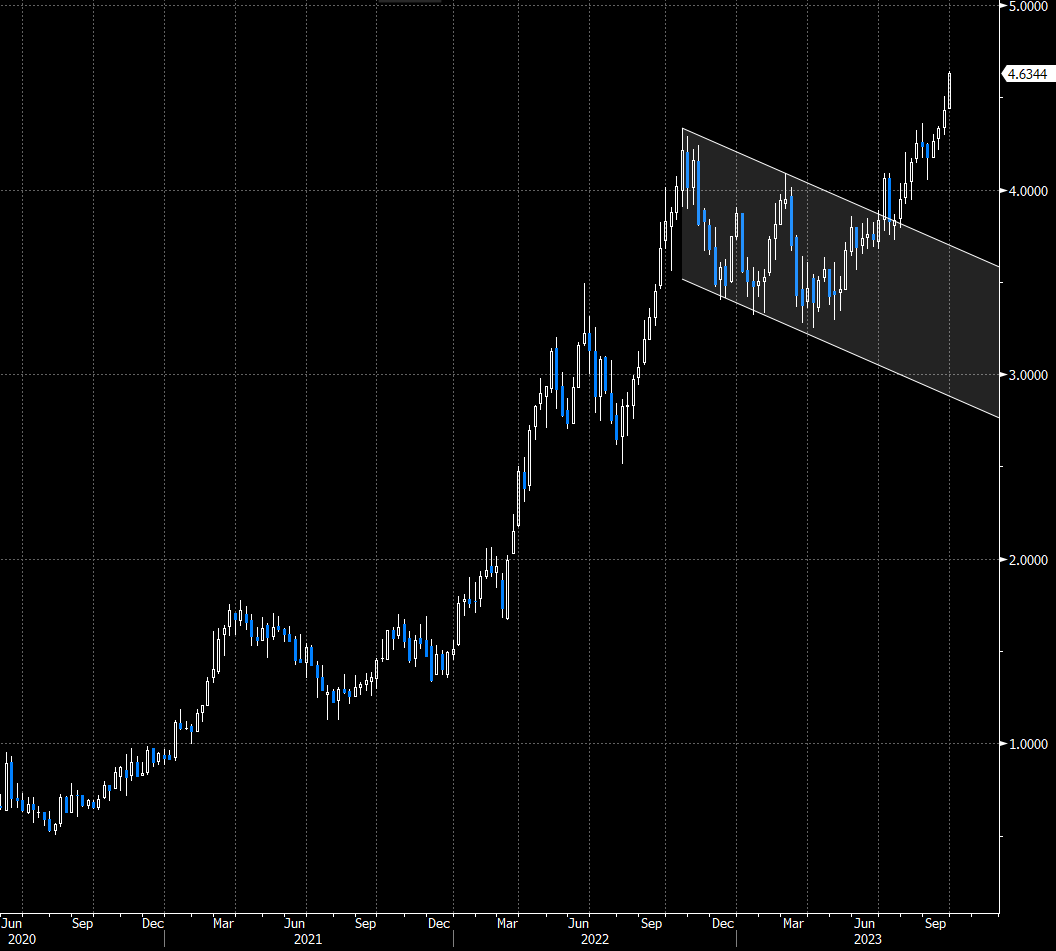

I’ve concluded that the supply/demand picture will continue to weigh on Treasuries and expand term premium, and that the Fed will not stop until they engineer a recession or a bear market in equities (whichever comes first). During 1980 -2013, term premium traded in a 0-4% range due to higher inflation and lower debt to GDP. Post 2013 term premium went negative and stayed negative due to an excess of savings by Asian economies that had large trade surpluses with the US and therefore accumulated a lot of USD reserves, all of which needed to be invested in risk-free assets. We also had QE 1, 2, and 3, which systematically removed a lot of the supply of Treasuries from the market. We are reentering the 0-4% range, which means yields can continue higher to 6-7% this cycle. This process will be very painful for risky assets, which is why I turned bearish on equities (which I wrote about last week).

Long equities - the entry

I had been wavering between bullish or neutral the equity market since we bottomed out last October. I didn’t act on this view in the Fidenza Macro portfolio due to concerns about Silicon Valley Bank and commercial real estate. In Q2 I came to the view that inflation would continue trending lower while growth would stay robust - a bullish backdrop for equities - but even then, I hesitated to go long due to the upcoming refilling of the Treasury General Account, which would result in a withdrawal of net liquidity. The relationship between equities and net liquidity decoupled for the first time since the pandemic, and equities ended up rallying in June despite the liquidity withdrawal. Only then did I decide to enter my long equity positions, but by then the market had already climbed the wall of worry and there was not much more upside to be had. If I had to identify a single reason for why this view did not make money, it was because I entered too late despite having the right view.

Long equities - the exit

The game changer for the equity rally was the FOMC last week. I did not expect Powell to close the door to the possibility of a soft landing/no landing scenario. Instead, the Fed seemed intent to engineer a hard landing when presenting the hawkish dot plot in the September FOMC. This came at a time when the Treasury market has been especially sensitive to hawkish news, and when there have been signs of weakness in the US consumer and labor market. Consumers are facing a combination of higher interest rates, a higher dollar, and higher energy prices along with record student loan, auto loan, and credit card debt levels.

I’ll give myself some credit for making a timely exit from the equity market on the day following the FOMC, just as S&P futures broke support at 4400. As a trader I need to make hard and decisive decisions and not let emotions like loss aversion or confirmation bias get in the way.

My view now is that we have seen the top of the rally and that higher yields will result in a 20% peak to trough drawdown in SPX that forces the Fed to pivot to a neutral stance. What happens from there will depend on how much downside momentum there is in the economy, and whether exogenous shocks (financial or other) are in play.

For as long as the Fed keeps a hiking bias, I think 10 yr yields can reach 5.5-6.0%, while 30 yr yields may reach 5.8-6.3%. This equates to a term premium of 1-1.5% in 10 yr Treasuries, and provides a small premium in yield above Fed funds. Long end bonds are now a “risky” asset, as the marginal buyers (hedge funds and bank dealing desks) are subject to VAR limits and would be forced to deleverage in the event of a volatility shock.

Despite the difficult trading environment this year, I am optimistic about what lies ahead. Global macro traders thrive on volatility and crisis, and we are now entering a new regime where there will be lucrative opportunities for traders who navigate the volatility well!

Now, on to the paid subscriber section, where I share premium content, such as discussing positions have entered to express the views above, along with risk levels and targets. Paid subscribers also get access to the Telegram channel where I discuss trades I’m entering or exiting in real time, along with the rationale for the trade.

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.