Today marks the last day of the 33% early adopter discount. Paid subscribers receive comprehensive reports on my market views (such today’s post, which I’ve made free) and find out how I’m expressing them in trades. After this, the price will permanently increase to $30/month or $300/year.

The Monday after Silicon Valley Bank closed its doors marked an interim low for the S&P 500. Since then, the index has been marching steadily higher, led by Apple, Microsoft, and Nvidia. Why do stocks continue to climb in the face of stress in the banking system, a Fed determined to keep hiking, and economic data screaming recession?

To begin with, I believe that shorting equities is rarely the best way to express a bearish view on the economy, and the strategy should be reserved for only the most tactical and nimble traders. Aggressive policy interventions and vicious short squeezes can wipe out profits and turn them into losses. In the case of the current rally, I believe there have been four main factors driving the strength in equities.

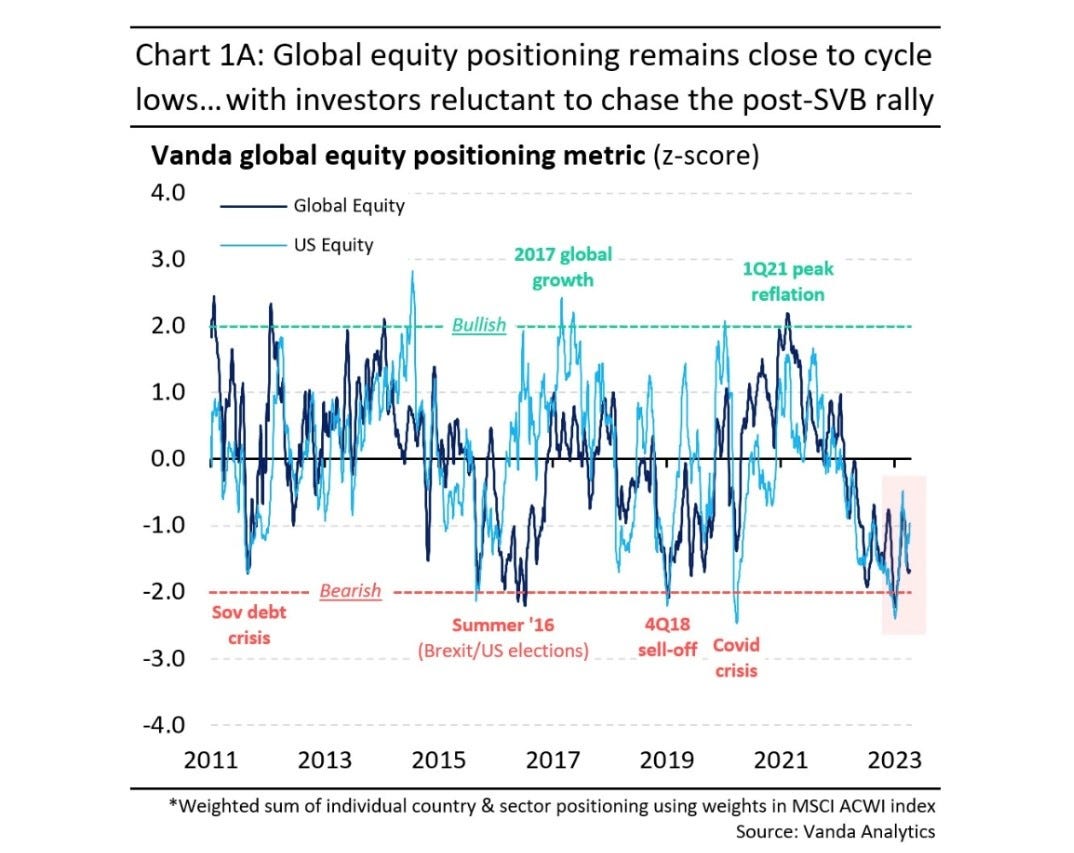

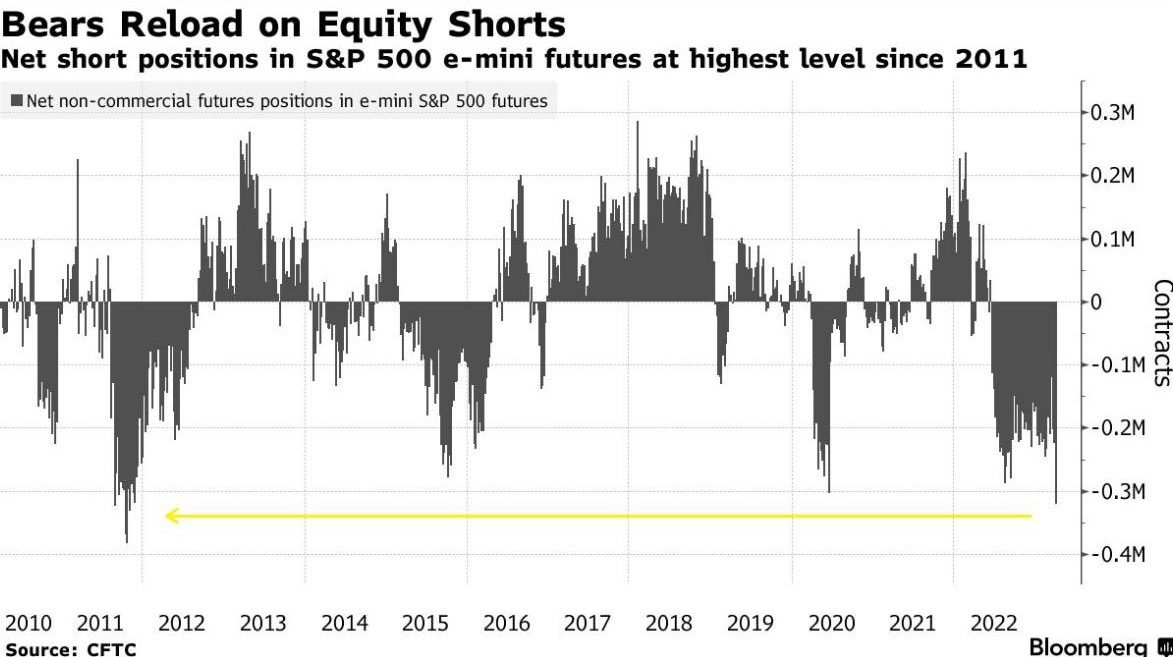

Positioning - We entered March with a market already flush with dry powder and sentiment at rock bottom lows.

Equity shorts have not capitulated despite the rally and instead have been doubling down, based on CFTC positioning data on S&P 500 futures.

Real yields have been grinding lower since March due to expectations that the Fed will pause hikes and eventually cut later this year. As you can see from the chart below, equities have simply been trending in the opposite direction of real yields since last year. If the Fed decides to continue hiking in the face of weakening data, we will see real yields trend higher and stocks roll back over.

Net USD liquidity jumped to the highest level in over a year. Granted, the jump in liquidity was due to an increase in lending to banks, and much of it won’t be transmitted to risk assets. Most of that liquidity will be kept as reserves to ensure against further deposit withdrawals, and some of it will be paid back (discount window loans have a max tenor of 90 days). However, it did relieve banks of the need to supply more fixed income to the market than if they didn’t have access to those Fed loans.

Trend following funds and option gamma - Systematic trend following and volatility targeting funds sold their equity longs in Feb and Mar and have been relevering modestly on this run up.

We’ve also seen evidence of large option strikes act as upside magnets for SPX - the first one being a large strike at 4060 during quarter end and then a large cluster of strikes at 4150/4200 this week.

The question is where do we go from here? If I had to guess how the above four factors will affect equities for the next month, I would say that positioning is still bullish, real yields will be bearish, net liquidity will be neutral (due to a slowdown in bank borrowing), and trend following/option flows will be neutral. Unfortunately, this paints a picture of a choppy, sideways market for the next month. In June to August we may see a perfect storm that will send net USD liquidity sharply lower, thanks to discount window loans getting paid back (reducing the Fed balance sheet) and a flood of Treasury issuance (to rebuild the TGA after the resolution of the debt ceiling). If positioning is more balanced and the Fed is still hiking when that perfect storm hits, we may see a more persistent selloff in risk assets.

One last observation on the rates and USD market. Short end Treasuries and SOFR futures have not been rallying very much on weak economic data at all. In fact, they sold off hard on last Friday’s in-line NFP number and today’s weak retail sales data. This is not the type of price action I like to see if I am positioned short USD, long Treasuries, or long Treasury steepeners.

Although I believe that economic data show that the US is in the brink of recession, the receding of the bank crisis from the market’s psyche is driving this recovery in risk sentiment. This may spur the Fed to resume its hiking campaign, pushing nominal yields, real yields, and USD higher for the next few weeks. I’ll be putting on tactical hedges in my portfolio, which I’ll highlight to paid subscribers in another post.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.