Every quarter I summarize the trades that I did for the Fidenza Macro portfolio and talk about what went right and what went wrong. Every trade is called out in real time in the Substack chat (accessible via the mobile app and browser website). I’m exploring the idea of sending every trade as an email post instead of posting it on the app’s chat function. My initial hesitation with doing this was that this would flood the inboxes of paid subscribers. Every trade requires an alert for its open and another for its close, so this would have resulted in over 40+ emails in Q1, in addition to my regular posts. However I also understand that not every paid subscriber wants to keep tabs on the Substack app all the time, and may miss a lot of these alerts. If you are a paid subscriber and prefer receiving the live trades over email, post a comment below.

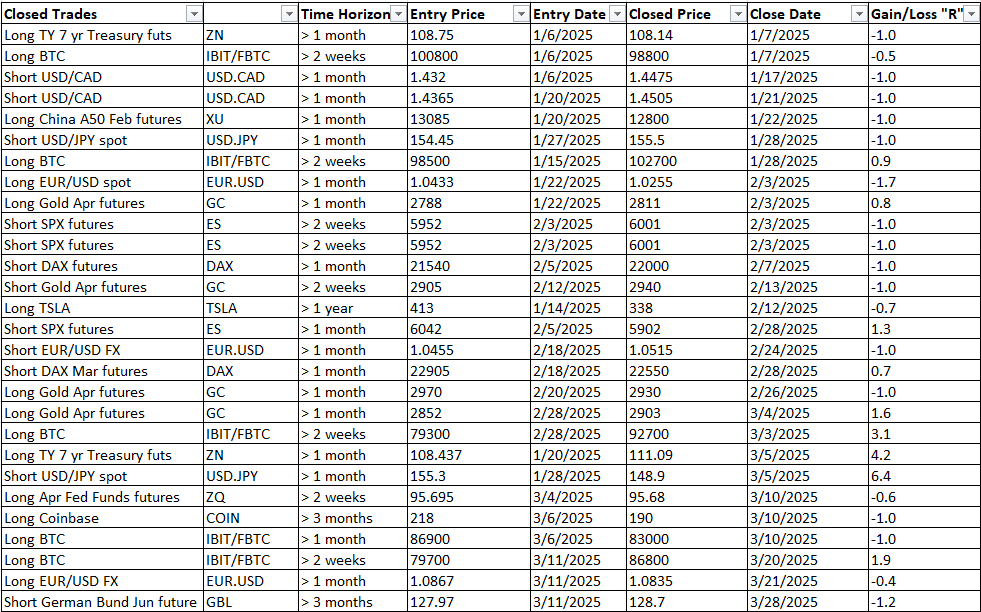

All the trades I closed in Q1 are at the bottom of this email. My total “R” for Q1 was only 2.8, meaning that someone risking 1% of capital on each trade would have achieved a low single digit return in Q1. Not spectacular, but it could have been worse, as Q1 was a tough environment for global macro trading. For an explainer of what “R” is and why I measure my results in R, see the bottom of this email.

The quarter was carried by only a handful of trades. Long TY Treasury futures and short USD/JPY also delivered large multiples of R. Buying extreme dips in BTC and selling on the subsequent rips worked out well. Sorry to brag, but my track record in trading BTC alone is pretty damn good, with a 54% hit rate over the life of this newsletter and a profit factor of 2.44 (meaning my winners make 2.44x of what I lose on losing trades). Paying attention to what I do in BTC alone makes the paid subscription worth it.

What the trades below didn’t reflect was the fact that I was bearish equities and had a bearish trading bias in S&P futures for much of the quarter. I was outspoken about my bearish view on stocks in various posts and interviews and traded as such in my shorter term S&P futures trading strategy. Someday I’ll write a post describing my strategy in S&P futures, if I can find the time.

Explainer for the right hand column “R”

When I enter a trade, I set a predetermined stop loss and risk a percentage of my trading capital towards betting that the market will move in my favor and won’t trigger my stop. If I do get stopped out, I lose that predetermined amount of capital, represented by “R”. If I take profit and make four times what I would have lost if I got stopped out, the trade is a 4R winner. The goal of trading is for the sum total of the R column to be as high as possible. The reason I track my gains and losses in R terms and not in percentage or dollar terms is to account for the fact that I trade many different assets with varying volatility, and the only constant between those markets is the percentage of trading capital I risk on each trade. Two traders who choose to copy my trades would have vastly different results if one of them uses five times more leverage than the other. A mediocre trader who makes a few lucky trades in volatile assets can boast of better percentage returns than a more skilled trader who trades less volatile assets. “R” is the one measure you can’t obfuscate and is one of the best determinants of the skill of a trader.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

Would love to read about your S&P strategy! As for the trade updates, I enjoy them in the app/web browser and for quicker updates, when I'm out, I've vibe coded a script that fetches them automatically and translates them into machine readable actions. If you're interested in providing such service or sth similar for all subscribers - happy to discuss further!

Email I think is also good