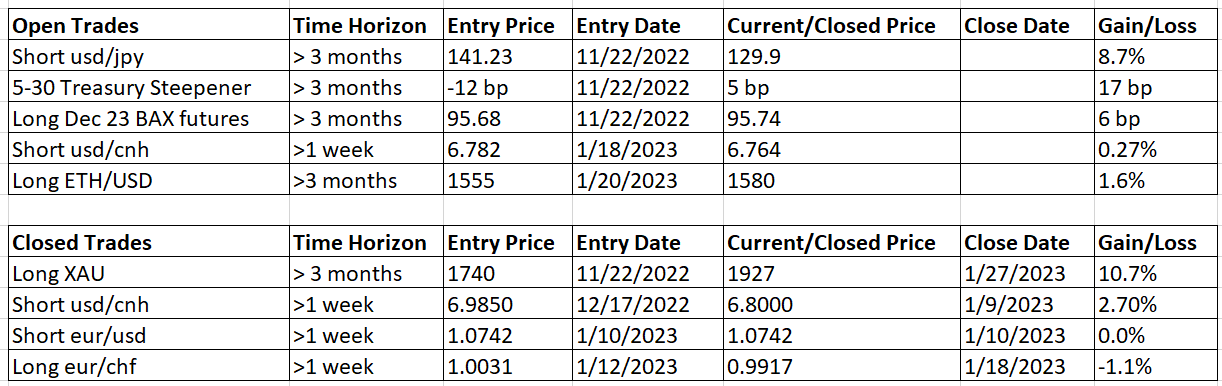

I went long gold last November, with the view that gold would do well over the course of the next 6-12 months. However, thanks to the central bank of China going on a buying spree, a strong downtrend in USD, and seasonal demand for gold, this position has outperformed my expectations by moving over 10% within a short amount of time.

Sometimes when the market gives you a strong trending move without a commensurate move in the fundamentals, you should accept the gift and move on instead of getting greedy and hoping for more.

The strongest drivers of gold are real Treasury yields and the US dollar. Real yields have only moved modestly in favor of gold.

Yellow = gold, Blue = inverse of 10 yr real yields

Most of the move in gold has been driven by a strong downtrend in USD. However even against the DXY dollar index, gold has overshot a bit.

Yellow = gold, Blue = inverse of DXY dollar index

Gold is overbought on the daily RSI index. The indicator has a strong record of predicting counter-trend moves.

If I were a long-term investor averse to turning his positions every few weeks and months, I’d hold on to the position. However, the trader in me wants to take profit and wait for better levels to re-enter. While gold could certainly keep pushing higher on weaker inflation data and Fed pivot expectations, it’s getting vulnerable to a pullback.

From a fundamental perspective, PMIs around the world are turning higher, led by Asia and the China reopening. US forward-looking indicators are hooking higher as well, suggesting the recent bout of weak data is transitory. Employment in the US refuses to budget from its current tight levels. All this suggests that the Fed will not surprise to the dovish side anytime soon and is far away from cutting rates, despite inflation trending decisively lower. I previously was leaning toward the recession camp, but recent data point to the global economy remaining in a Goldilocks environment longer than I expected. More on this in my next post.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.