Gold bugs are going to hate me for saying this….but I’m taking profit on the long gold view I’ve had on since last December. Gold has outperformed a lot of assets in global macro, and kept pace with the S&P 500 (both up 23.5% during the time I was long). It benefited from worries that the Fed would tighten the economy into recession, and have to reverse their tightening by embarking on a cutting cycle.

Another reason is that gold price action is stalling as it attempts to break above a daily upward sloping trendline. Since April it has had a habit of sucking in new buyers as it broke to new highs, only to fall back into the range.

Another reason I’m taking profit is because net positioning in gold futures is the longest it has been since March 2020, when the Fed embarked on QE infinity. As you can see from the chart below, anytime net longs in gold rose to the 0.3m level (denoted by the vertical red lines) over the past ten years, it has underperformed or gone sideways for a long stretch.

Because of this lopsided positioning, gold is now a great tactical short candidate. I will be updating paid subscribers in the Substack chat and blog when I decide to go short gold.

Gold benefits from monetary accommodation and liquidity, and my view is that market pricing for accommodation from the Fed is near its peak. The SOFR curve is pricing in over 200 bp of cuts, but I think the economy will end up only needing half of that before the Fed pats itself on the back and congratulations itself on achieving a soft landing. I wrote a guest post in AlphaPicks a few days about this, and I’ve included the article in its entirety below in case you were missed clicking through to the link.

The following content appeared in the AlphaPicks blog on Sept 1.

Over the past month, asset managers have been piling into bonds, while CTAs and global macro funds have been building longs in Treasury futures. The main catalyst for this aggressive shift in positioning was the surprisingly weak unemployment rate print of 4.3% on Aug 3. The release triggered the Sahm rule, which observes that in every previous instance when the 3 month moving average of the unemployment rate rose 0.5% from the cycle low, the economy was in the early stages of a recession. I believe that the economy is not as weak as what the bond market suggests, and that the coming Fed rate cut cycle will be slower and shallower than expected.

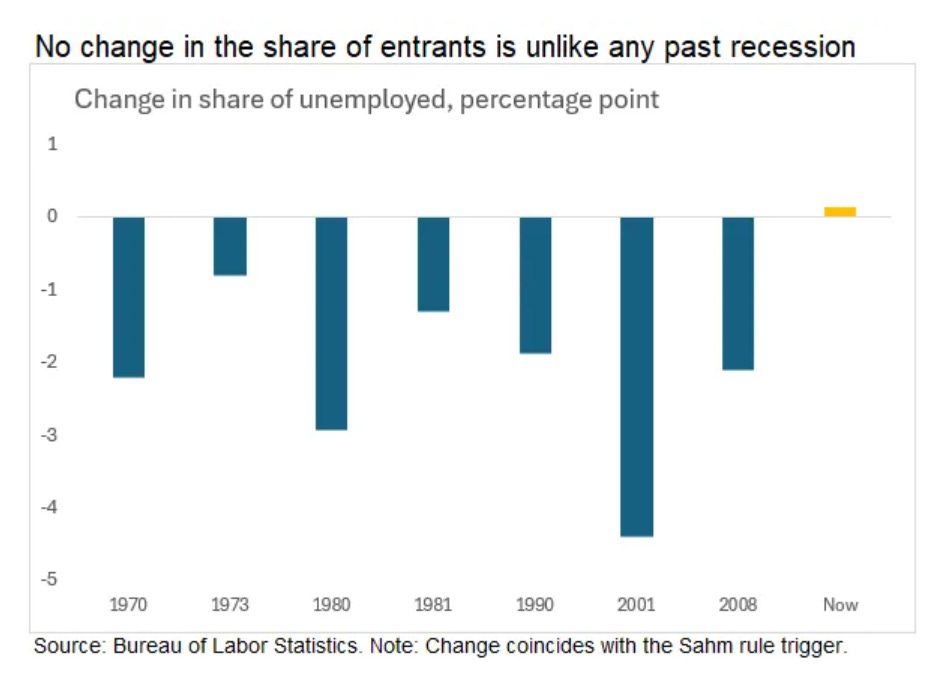

This economic cycle has been different from many cycles that came before it, which makes it difficult to rely on tried and tested recession indicators that have worked previously, such as the Sahm Rule and the yield curve. Claudia Sahm, the inventor of the Sahm rule herself, pointed out that the labor market is in much better shape at the moment than in previous recessions. Labor market recessions are usually caused by a sharp increase in layoffs, yet right now the increase in laid off workers is smaller than most recessions.

Previous recessions also saw fewer people enter the labor force and an increase in workers leaving it, resulting in lower participation. This time around, there has been no drop in net entrants into the labor force.

Thomas Barkin, in a recent interview on the Bloomberg Odd Lots podcast, said that in his conversations with companies, they are telling him that they are in a "low hiring, low firing mode." This suggests the economy is in a state of equilibrium and not on the verge of recession. Since unemployment data is often subject to large revisions, I like using jobless claims as a source of truth, and that data is not pointing to a significant increase in firings that is typical of a recession.

Against this economic backdrop, the Fed is set to deliver on some of the rate cuts that the market has eagerly priced into the forward curve. Expectations of cuts have resulted in a similar magnitude of easing in nominal and real yields as the Oct-Dec period of last year. The chart below shows how the decline in 5 yr nominal and real yields last year was followed by a jump in the US economic surprise index over the coming months. The improvement in data was accompanied by a reversal in yields higher, as well as a rally in risky asset classes such as equities, commodities, and crypto. I believe that the upcoming round of Fed easing will have the same reflationary consequences for the market.

It's likely that we are in a mid-cycle rate cut scenario, which tends to be very bullish for both growth, inflation, and for risky assets. The last mid-cycle easing happened in Q4 of 1998 following the Russian debt default and the Long Term Capital Management crisis. The Fed responded to the crisis by doing an emergency inter-meeting rate cut, followed by two 25 bp rate cuts months later. The market had been piling into Treasuries in a flight to safety, similar to today, but 10 yr yields bottomed out the same month the Fed delivered its first cut. In the height of the crisis, the eurodollar futures market priced in a terminal rate as low as 4.18%, but the Fed only cut rates to 4.75%.

Drawing this parallel forward to today's environment, it's likely that Treasuries have overshot to the upside, and are already in a topping process. The current elevated long positioning and bullish sentiment in Treasuries creates a compelling contrarian setup for shorts. The Fidenza Macro portfolio will be establishing a short in ZN futures (10 yr Treasury futures) next week.

Risk assets shouldn't fear higher yields. We are back in a risk-parity friendly environment, where good economic news equates to good news for the market, and where higher yields are a symptom of stronger growth and improving earnings. The few cuts that the Fed delivers should be enough to jumpstart the interest rate sectors of the economy back to life.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.