Lemmings diving off a cliff, by Dalle 2

I’ve maintained in previous blog posts that equities will remain in a bear market, and that we haven’t seen the lows of the year yet. Last month I acknowledged we are in a powerful bear market rally, and therefore I’ve kept my equity shorts light and nimble through it all. Bear market rallies are known for eviscerating shorts and sucking in fresh longs. They usually don’t end until bears throw in the towel and a lot of participants get bullish the market again. I believe we are at that end point now.

Credit: Piper Sandler

The conditions for rallies are created when sentiment gets excessively bearish and when the market is already positioned for further downside. This was the case back in June, when sentiment indicators hit rock bottom and the S&P hit a gamma floor around 3700, making it difficult for bears to push the index lower. Gasoline prices started coming down, and we got a slew of bad economic numbers that the market interpreted as good news for equities, since it would cause the Fed to pivot their tightening cycle early. Chairman Powell gave bulls hope by saying he thinks the Fed has reached the neutral rate, so the market was given just enough to weave together the narrative that inflation is peaking, any recession would be a mild one, and that the Fed would start cutting rates by Q1. CTAs (trend following strategies) also piled into equity futures and Treasury futures as volatility compressed and momentum turned higher in each. Yields rolled over and confirmed the narrative of peaking inflation.

The fundamental picture today is different from where we were last month. Fed board members Daly, Mester, Bullard, and Bowman came out with hawkish rhetoric immediately after the FOMC to push back against the Fed pivot narrative, saying that they are nowhere close to letting up on their fight on inflation. Last week we also saw the unemployment rate tick down to 3.5% from 3.6% and average hourly earnings increase to 5.2% YoY from 4.9%. ISM services was also a smoking hot 56.7, while Q2 unit labor costs increased 10.8% (while productivity declined 4.6%, indicating corporate margin compression). If US CPI comes in higher than expected tonight, the prevailing narrative of peaking inflation and a Fed pivot will be shattered.

Meanwhile, the technical picture shows that equity market sentiment and positioning have reset to levels where another sustained selloff is likely to happen if stagflation fears return.

The difference between AAII Bulls and Bears is approaching levels from early April and early June where bear market rallies topped out.

VIX is back in the low 20s, signaling a capitulation by option protection purchasers and growing complacency by market participants.

Piper Sandler’s meme stock watchlist ripped on Tuesday, suggesting retail is FOMOing back into the market.

Retail is also FOMOing into the market via calls, and whenever this happens, the market tends to underperform afterwards.

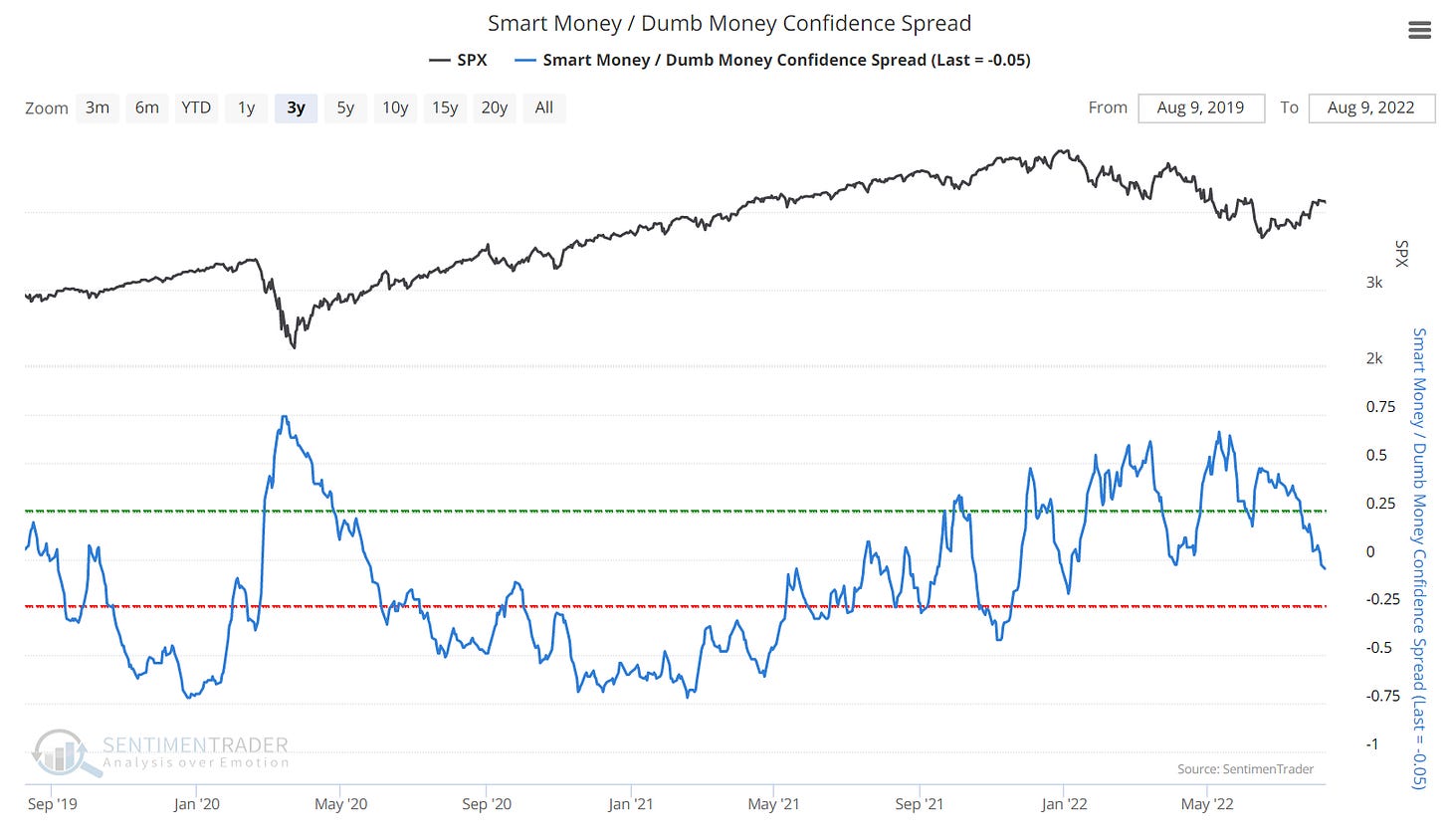

Sentiment Trader’s spread between Smart Money and Dumb Money is back below 0, a level that preceded the last two major selloffs this year.

Analysts are jumping on the bullish bandwagon. “While analysts always have more buys than sells, “they seem especially keen right now,” the strategists said. That has triggered a red flag in Citi’s “bear market checklist,” which otherwise has seen warning signs ease this year as markets have declined.”

Institutions are chasing the rally in tech. Credit: Daily Shot

Anyway, you get the picture. Sentiment and positioning are back to levels where being bearish is no longer a crowded consensus trade. The Fed will have to keep hiking and tightening liquidity to fight elevated and sticky inflation, and the economy will have to take a lot more pain before the Fed’s work is done.

Current positions going into US CPI tonight

Short Eurodollar Mar 2023 futures and long USD/JPY FX - these are expressions of the same view, which is that inflation will remain higher than expected, and that the Fed will have to respond by hiking rates faster and higher than expected. The market has had a track record of constantly underestimating inflation since last year.

The last time headline CPI came in below median expectations was Jan 2021!

Core CPI has come in below median expectations only twice in the last 12 months

Long Natural Gas futures and soybean futures - I’m back in these trades now that we’ve gotten significant pullbacks in both. Positioning and sentiment are cleaner, and these commodities are less cyclical than other commodities like oil and copper.

SPX Oct 3600 puts - My plan is to scale into this position in tranches before and after the CPI print.