So this happened today:

To recap, I first reported that I was shorting euribor futures and Treasury futures almost a month ago. I was looking for the ECB to start turning hawkish and focusing on the soaring inflation in their member countries. I also shorted JGB futures expecting the BoJ to lift their 25 bp yield cap. These positions immediately went in my favor and were looking pretty good for a while.

Sold June 2023 Euribor futures on June 9

I designed the risk management around these open positions such that I hoped to exit at flat if they didn’t work out. Those conditions were met today, so I closed the positions (euribors at a small gain, Treasuries roughly flat, JGBs small loss). It looks like economy and market have entered the final phase of the inflationary cycle - the recessionary phase, where economic indicators weaken in unison, risky assets sell off (including commodities), inflation rolls over, and bond markets start pricing in rate cuts. I’ve ridden a pretty sizable round trip in my pnl, which is extremely frustrating, but at least it’s not a loss from where I put the positions on in the first place.

In hindsight, I could have reduced my risk as the market moved in my favor. Of course hindsight is 20/20, so I’m not going to beat myself up about that. Even at the extremes of the rates moves, I was looking for many more hikes than what the market was pricing, and the risk reward for staying in the positions seemed favorable at the time.

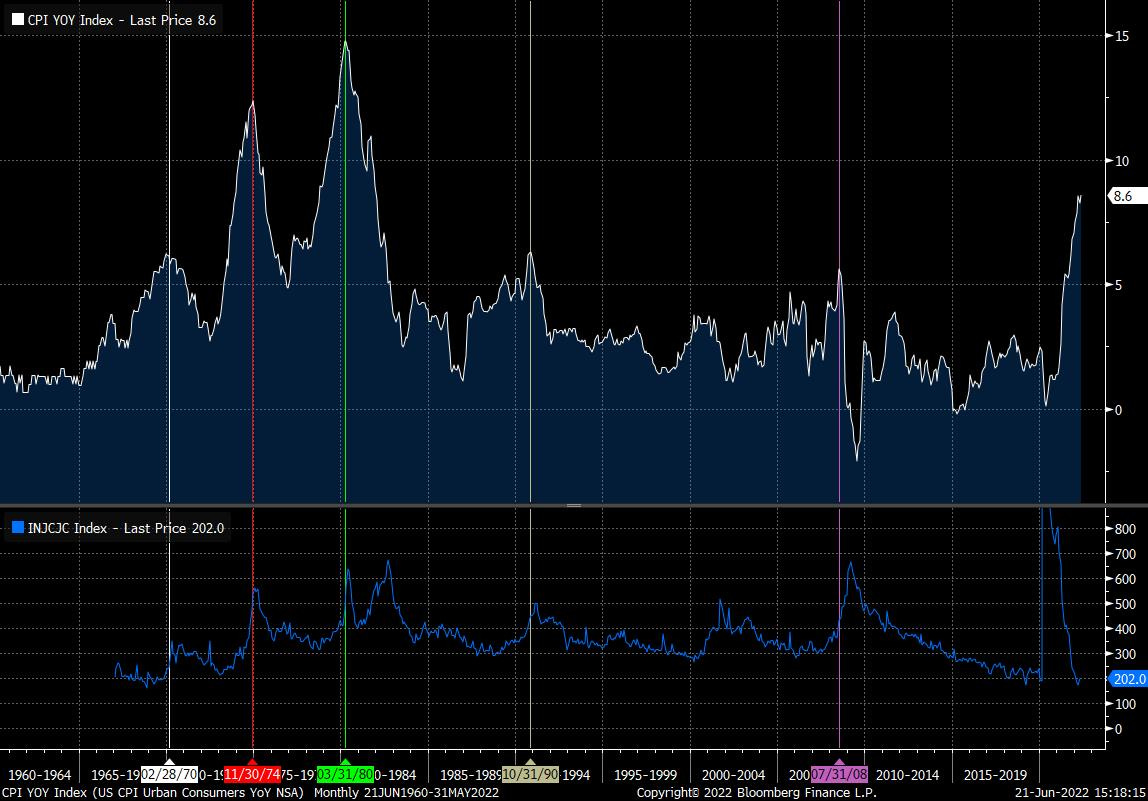

One reason the reversal in the market caught me by surprise was that I was looking for stronger recessionary signals to signal a peak in CPI and interest rates. In previous inflationary cycles, peaks in CPI and yield were triggered by jobless claims reaching 400k.

US YoY CPI (top) and weekly jobless claims (bottom)

Today we are at 230k, nowhere close to triggered that condition.

You might remember from my previous post that during the 70s, peaks in CPI tend to occur after US ISM crosses 50. The exception was in 1979 when CPI kept surging well after ISM crossed 50.

White=Fed funds, blue= CPI YoY, orange=5 yr Treasury yield, purple=US ISM manufacturing

US manufacturing ISM hasn’t crossed 50, but regional PMIs are pointing to it crossing that mark soon:

Credit: Piper Sandler

Compared to the 70s-90s era, we are seeing economic indicators fall off a cliff faster and earlier than what would be expected for the current level of yields. Why is that? Perhaps it’s the higher level of government debt to GDP compared to the 70’s. Perhaps it’s the fact that corporates and households are levered up on debt much more than previous decades. Perhaps it’s because a rise in yields from 0% to 3.5% creates a larger drop in the prices of bonds (and by extension long duration assets like growth stocks) than a move in yields from 3.5% to 7.0%. The amount of deleveraging that occurs when the value of collateral takes such a massive hit (as it has this year) can have a powerful effect on the economy. Unfortunately none of these theories can be empirically proven to be the reason why this cycle is different.

How I plan to position for the final phase of the inflation cycle is to be short risky and cyclical assets like equities and commodities. I’m keeping it simple and will be selling SPX and copper futures on rallies. In this phase, even the winners of the inflationary cycle sell off hard. Long government bonds and betting on rate cuts won’t be a great expression of risk off coming out of an inflationary boom because the fear of inflation still lingers, and central banks still need to present a hawkish face to maintain credibility. They also can’t cut rates back to zero, because inflation would come roaring back if they did. As you can see from the chart above, 5 yr yields drifted lower to sideways during periods when the ISM was below 50. The bang for buck in long government bonds just isn’t there.

Even though inflation may be peaking, I don’t envision the Fed declaring victory on inflation and reinstating the Fed put anytime soon. I think a rate cut only happens after at least one of the following conditions are met - US YoY CPI back below 5%, jobless claims > 400k, or significant distress/dysfunction in the credit or Treasury markets. Weakness in the labor market is an important precondition because of the need to stifle any remnants of a wage-price spiral mentality. People need to stop quitting and asking for higher wages, and in order for that to happen, they need be scared of losing their job. They need to be in a financial state where they feel the need to cancel their upcoming vacation, stop dining out, and forgo buying nice things. We are not seeing that yet, and for that reason, we are probably still in the 6th to 7th inning of this bear market.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.