I have good news and I have bad news. The bad news is that I am raising prices from $30/month or $300/year to $35/month or $350/year starting Dec 1. This is the first time I have raised prices for the paid version of the newsletter. The newsletter started out as an experiment, but it has grown more popular than I ever expected. While this has been a pleasant surprise, it does take up time and mindspace to deliver the paid portion of the newsletter with the real-time alerts and tracking of positions.

The good news is that if you are a paid subscriber, you are locked into your current price for as long as you stay a paid subscriber. Those who are free subscribers can lock in the current price by upgrading to paid before Dec 1.

The paid subscription is for traders who are interested in the educational content that includes the exact timing and risk management of the trades I’m putting on. For the casual investor who just wants my broad market views, there is no need to upgrade to a paid subscription.

To recap what happened on election day, I entered the Trump trades I laid out in last week’s post (long BTC, long Russell 2000 futures) shortly after results from Florida and other early states showed no evidence of a surprise swing in Harris’ favor. I also went long USD/CNH (because it was slow to react) and bought the dip in 10 year Treasuries. Trading event risk is all about preparation and having a plan for every scenario so that time is not wasted thinking about what to do. In this case, preparation paid off in spades. Today I took profit on all of my Trump trades (except for USD/CNH), as I think that there is not much of an edge being positioned in these trades anymore. Sentiment is more bullish than I’ve seen in a long time, and I am hearing phrases like “melt up” and “long until inauguration day” in financial commentary that suggest a sense of complacency.

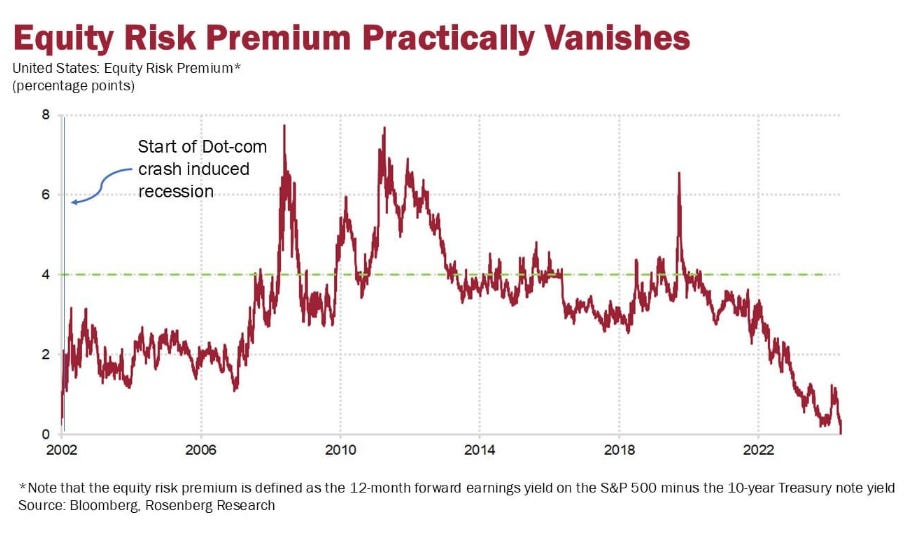

In 2016, Trump’s surprise win triggered a one-way move in equities for several months, and outsized returns for the S&P 500 in 2017. However, one can’t apply the 2016 playbook to this year. For one thing, Trump’s victory was not a surprise this time around, and was already partially priced into the market before election day. Equities are also more expensive today than in 2016, in equity risk premium terms.

When it comes to the reflationary effects of Trump’s likely policies, there is a large gap between Street expectations and reality. The 2024 Trump has a different set of constraints from the 2016 Trump. Today we are in a high inflation regime where inflation is more sensitive to fiscal spending than pre-covid. The debt to GDP ratio of 120% (compared to 100% in 2016) makes the bond market more sensitive to any sign that the administration intends to be fiscally irresponsible. One of the leading contenders for the Treasury Secretary post is Scott Bessent - a seasoned global macro investor who understands that the US needs to spend and borrow within these constraints. The fiscal hawks in the Republican party will require Trump’s tax cuts to be paid for by reduced spending in other parts of the government. This is why Elon Musk and Vivek Ramaswamy have been chosen by Trump for the “DOGE” - the Department of Government Efficiency - to reduce bureaucracy and bloated government spending.

Why are 10 yr yields pushing back towards 4.5% despite all this? I believe we are undergoing another USD/CNY reflexive doom loop where China needs to sell Treasuries to fund sales of USD/CNY in order to smooth the depreciation of CNY. The sale of Treasuries pushes yields higher, causing USD to strengthen, requiring further sales of Treasuries to slow the move. This becomes a vicious cycle that tightens financial conditions and provides a headwind to further gains in risk assets. I would not be surprised if equities, crypto, and the economic surprise index pull back from here going into inauguration day.

Tightening financial conditions explains the 9% drawdown in gold since early November. In the runup from 2500 to 2790, gold decoupled from its usual drivers of USD FX and US yields. The presidential election ushered in a regime change where gold had to recouple with the dollar and yields, both of which suggested a total unwind of that move from 2500. On Oct 23 I wrote about the possibility and implications of this regime change, and on election day I shorted gold futures, resulting in me capturing a 200 pt move on which I took profit on today.

Now that I’ve cleared a lot of positions in my book, my plan is to wait for the USD/CNY doom loop to run its course so I can buy further weakness in Treasuries and sell USD FX. If USD/JPY gets anywhere near 160, it’s a screaming sell as the threat of intervention provides good risk-reward for shorts.

I am still long-term bullish crypto, and will be looking for dips towards 80k in BTC to reload longs. There should also be opportunities to buy dips in equities. While there are risks in the near term, a Trump administration should nevertheless result in an extension of the bull market, as the people he is appointing to his cabinet are predominantly from Wall Street and will likely enact policies that support corporate America.

Here are a few good podcast interviews by traders I respect that I’ve listened to over the past week. I agree with some but not all of the views.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.