The “higher for longer” narrative has been dominating this summer, with US yields close to cycle highs and bond vigilantes punishing the long bond market for the Treasury’s sins of overspending and overborrowing. We found out that too much of a good thing is bad for equities, as rising real yields triggered a minor correction in equities. However, the higher for longer narrative is now priced in and stale, and cracks are now forming in the labor market that could pave the way to a disinflation regime that would be bullish for both equites and government bonds.

What triggered the first inkling of a regime change was the JOLTS (Job Openings data) number that came out on Tuesday, which showed a sharper-than-expected decline to 8827k (9582k prior, 9500k expected).

The JOLTS Quit rate, a leading indicator for wage growth, returned to pre-pandemic levels.

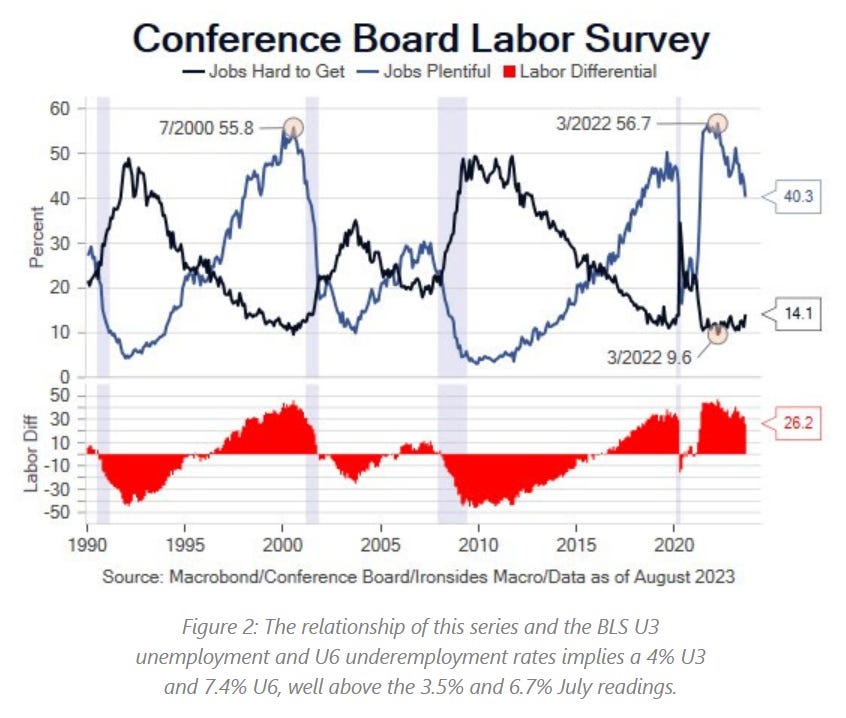

On the same day, Conference Board Labor data also showed that the differential between its “Jobs Hard to Get” and “Job Plentiful” surveys dived below pre-pandemic levels.

The differential of 26.2 (in red above and blue below) happens to be consistent with an unemployment rate above 4%, vs 3.5% in July.

Elevated WARN notices also point to more upside for jobless claims.

How did markets receive the weak jobs data? In the pullback this month, hot economic data and higher yields were bad news for stocks and good for USD, so the converse is true as well. The Fidenza Macro portfolio is long Nasdaq futures. For updates on when I’m entering and exiting positions and the rationale behind the trades, upgrade to a paid subscription.

Typically, JOLTS is considered second-tier data, but this time it produced an outsized drop in 2 yr yields.

Gold extended its recovery after the JOLTS number. The Fidenza Macro portfolio is long.

In my interview with Realvision earlier this week, I pointed out that if the gap between US economic data surprise and China’s economic data surprise started to close, that would be bearish for USD and bullish for risky assets. So far that has played out exactly as planned and I believe the gap will continue to close.

Systematic funds have been whipsawed in August’s equity pullback and subsequent recovery and may become forced buyers if equities continue higher. See here for more charts and analysis on this.

It is widely believed that excessive fiscal spending, as reflected in the current budget deficit of 7%, has been keeping inflation elevated for longer than the Fed would like. This acceleration in fiscal spending is what Alpine Macro calls “fiscal thrust”, and they believe that it’s about to roll over:

From now until the next presidential administration (or the next crisis), fiscal thrust is projected to decelerate, and the budget deficit is projected to partially close. Growth and inflation will no longer receive a tailwind from fiscal, therefore helping the Fed in its mission and opening the door to earlier rate cuts.

Student loan repayments are due to restart today, creating what will be a financial and administrative headache.

Geri Critchley, a 75-year-old former nonprofit employee, is among those attempting to navigate the system. She paid graduate-school loans for more than 20 years. She has $14,000 left, but no clarification as to what she will owe each month and how to pay.

75 years old and still paying off student loans. Sorry Geri, I feel for you…

Vanda Research takes the $1.6T in student debt amortized over 10 years at a 5% interest rate to arrive at an annual repayment number of $200b, which is a 1% hit to national disposable income. However, when they drill down to how loan repayments will affect the different income brackets, they found that middle-income earners will take the largest hit, estimated to be 3-7% of disposable income.

Vanda went a step further and determined the spending categories most likely to get cut will be dining out, new/used cars, travel, entertainment, and rent - all sizable components of core CPI.

This week’s two data points - JOLTS and Conference Board, don’t necessarily make a trend. However, leading indicators for the labor market, projections for fiscal spending, and the start of student loan repayments all point towards weaker labor and a weaker consumer from this point onwards. As weakness trickles into the economic data, it will result in a lower dollar and improving risk appetite as the market prices in earlier and deeper rate cuts.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.