Staying centered in your trading

In the high-stakes game of trading, there's an invaluable psychological concept: finding your emotional equilibrium while navigating the markets. When you're centered, you're primed to execute your strategy, apply your edge, and minimize costly blunders.

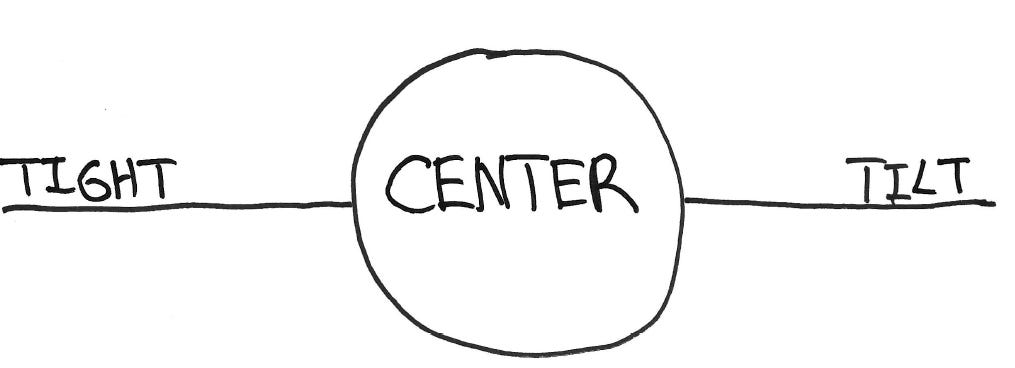

Achieving a centered state is like finding your balance on a tightrope. Losses, gains, personal challenges, and lifestyle factors all conspire to throw you off balance. When traders go off center, they tend to become tight in their trading or go on tilt. Sometimes they swing wildly between the two. The challenge is to remain composed and continue your tightrope journey.

When you’re tight, you’re in a constant state of fear of losing more money. You place your stops too close to the market, and you take profits too quickly because you’re afraid of letting them slip away. You second guess your decision making and are afraid to pull the trigger on trades even though your strategy and analysis give you the green light.

On the flip side, when you’re on tilt, impatience and recklessness take the wheel. The desire to recoup losses becomes the dominant driver behind your decisions. You ignore prudent risk management, disregard stops, and chase markets. Instead of waiting for opportune entry points, you either cling to a failing view or flounder between long and short positions, swayed by the day's momentum.

The longer you stray from your center, the more your emotional turmoil wreaks havoc on your performance. Trading tight guarantees a slow bleed of investment capital, while going on tilt makes you vulnerable to large and sudden drawdowns. That's why trading isn't your run-of-the-mill 9-to-5 job. Staying centered requires fostering a tranquil mindset, nurturing a healthy relationship with the market and money, maintaining a balanced diet, and squeezing in regular exercise.

Ever since I started trading my capital full-time five years ago, I’ve made innumerable adjustments to my life to maximize my time in that centered state. In future posts about trader psychology, I’ll share advice on how to maintain or regain your center. For now, consider this an introduction to the vital concept that'll become a recurring theme in our discussions.