The last two weeks were pretty dull in the markets, and I’m glad to have sat it out while I was on vacation. Things are getting interesting again, just as I get back to the trading desk.

I used to not believe in trading seasonal patterns in global macro, mainly because I felt like they were unreliable and trading them was difficult to risk manage. In recent years, trading seasonality has had a pretty good hit rate in various asset classes, and I’ve finally warmed up to using them as an input into my trading. It just so happens that mid-July sees some sharp inflections in the seasonal patterns of various markets.

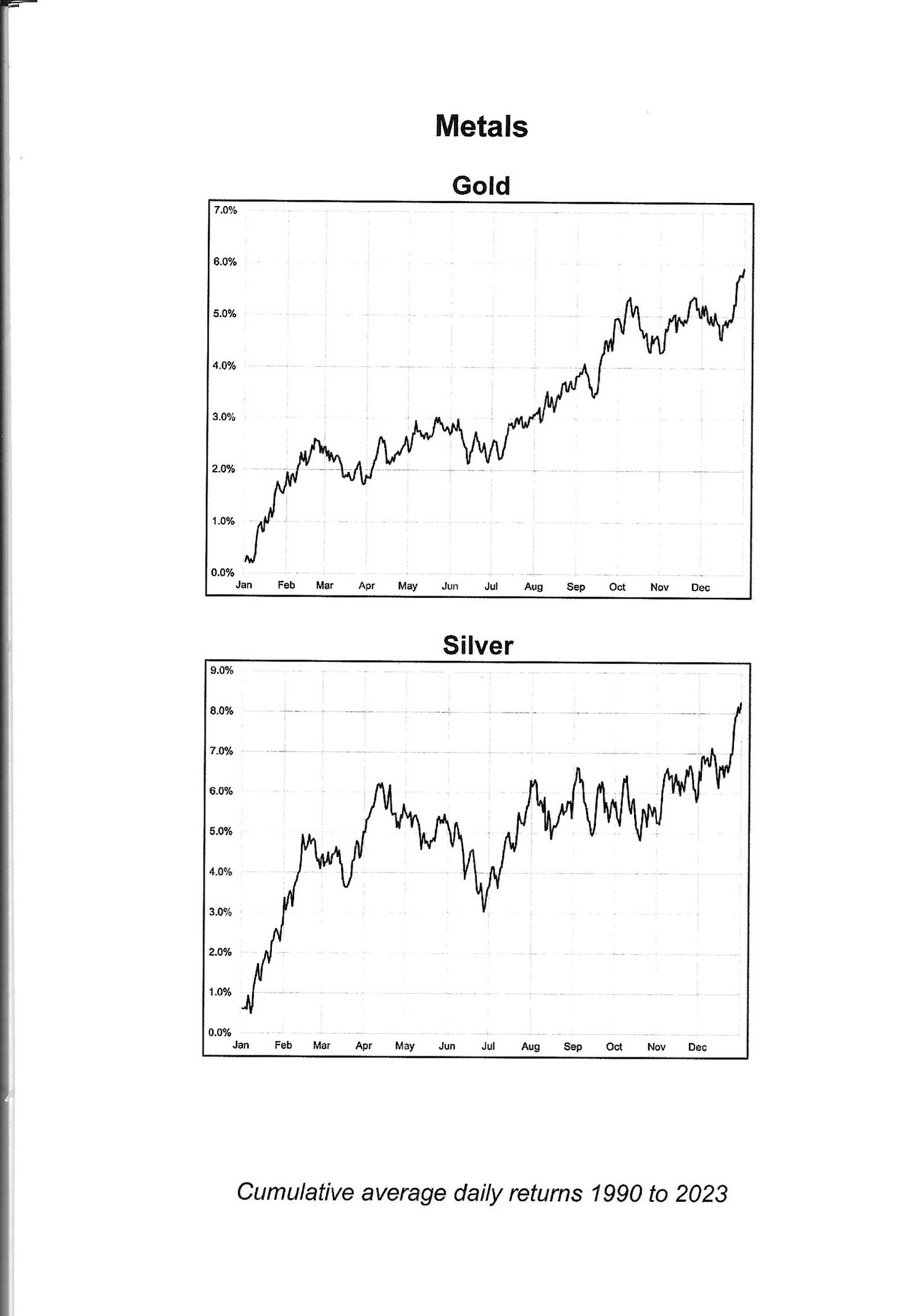

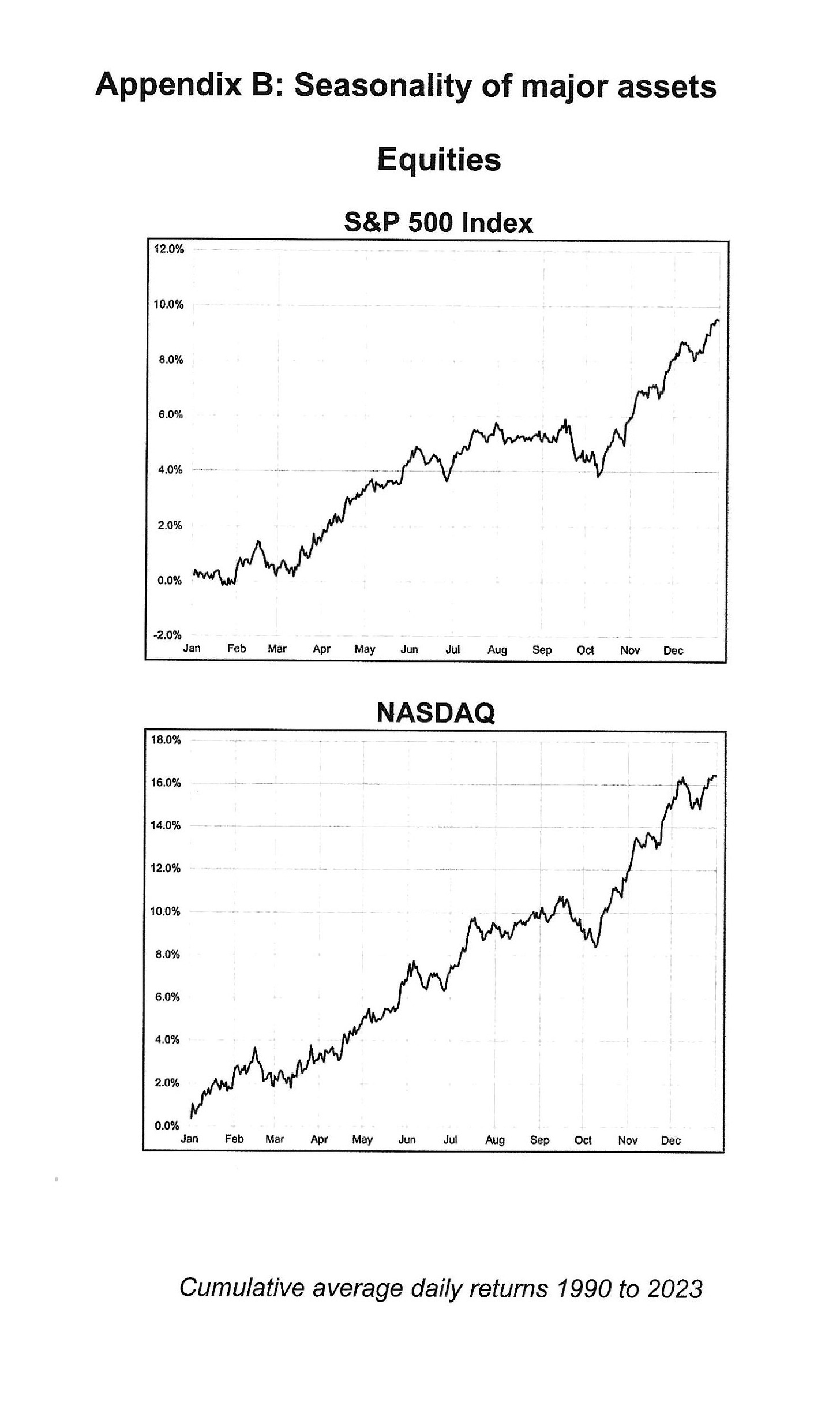

I have to first give Brent Donnelly the credit for doing the most work in tracking seasonal patterns in the major markets in his book Alpha Trader and The Trader Handbook and Almanac 2024. The seasonal charts below are from his almanac.

Gold and silver start a bullish seasonal trend from mid-July onwards. I will be trading precious metals from the long side for the next several months.

US Treasury yields started a bearish seasonal trend in June, and this should continue until October. I have been trading SOFRs and Treasuries from the long side, and given my bearish view on the US economy, my trading stance is in line with seasonals.

USD tends to weaken against EUR and JPY from July until August. Maybe that short USD/JPY trade will finally work out?

Crypto tends to perform well from mid-July to mid-August, although the sample size of six years for crypto isn’t significant. Maybe now that Germany is almost done selling their BTC stash, crypto can finally rebound?

US equities saw a strong seasonal trend going into mid-July, but that flips to negative or sideways until mid-October.

The VIX has been very subdued this year, but that might be about to change as seasonality turns very bullish until October.

On to the paid subscriber section, where I discuss my current stance on equities, as well as the implications of an equity rotation “pain trade”.

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.