I’ve shifted to a bearish stance on risk assets lately, and this view deserves a full post to go over my rationale. It’s not often when I turn bearish, as I recognize that equities have an upward drift and that shorts tend to suffer from the constant auto-bid in the S&P 500. The current environment reminds of previous pauses in long-running bull markets that saw equities move sideways with violent drawdowns of 10-20%. Today my view is that we may see a peak to trough drawdown of 10-15%, which means a dip in the cash S&P 500 to 5200-5500.

The backdrop

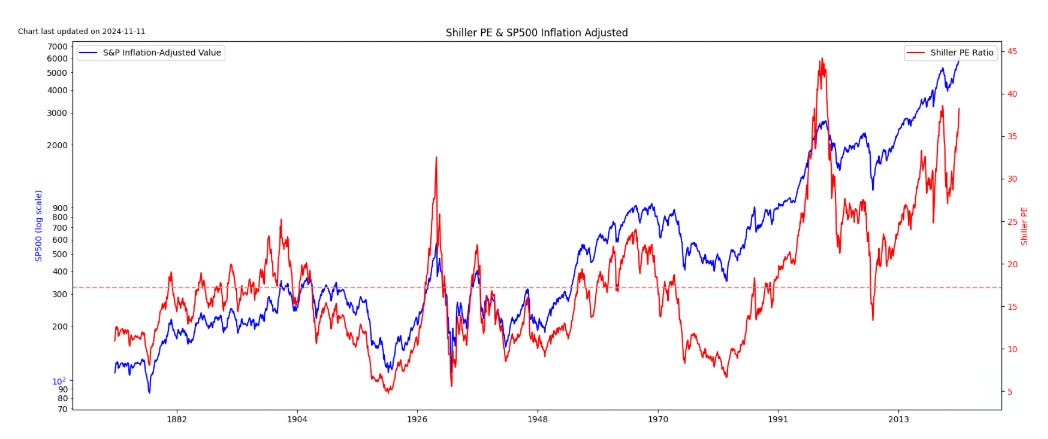

Let’s start with the basics - the Shiller PE ratio is at levels on par with 2021, only eclipsed by the levels seen during the dot-com bubble.

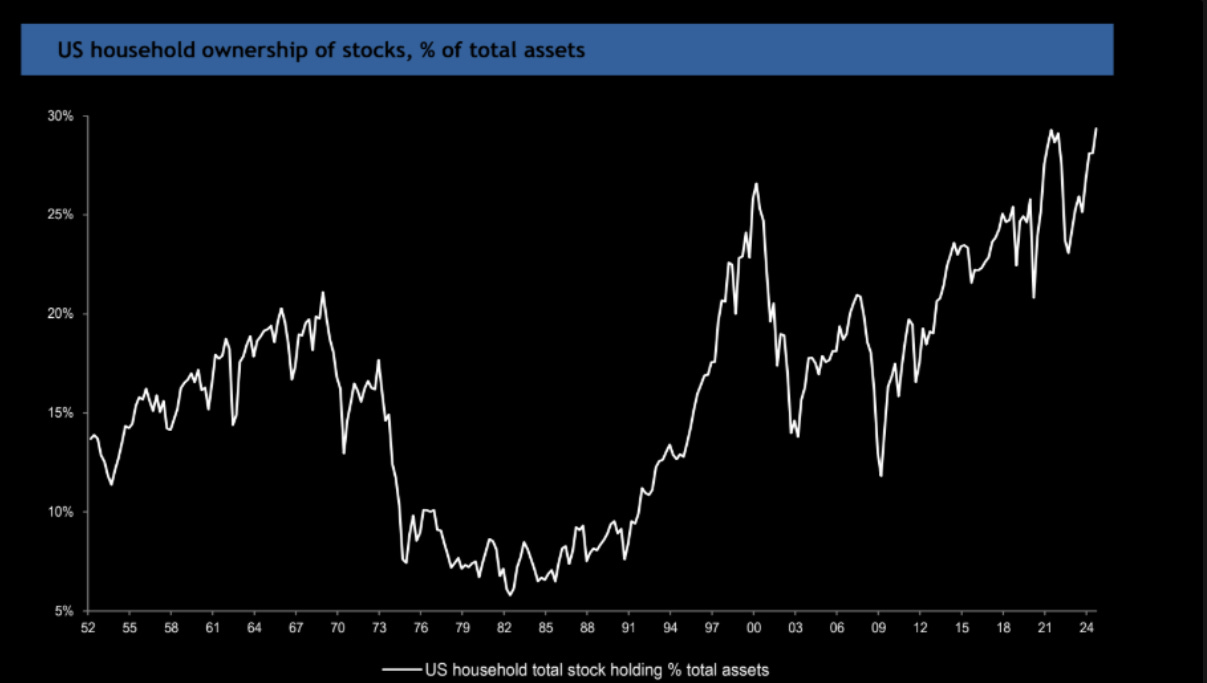

Retail owns more stocks than ever before.

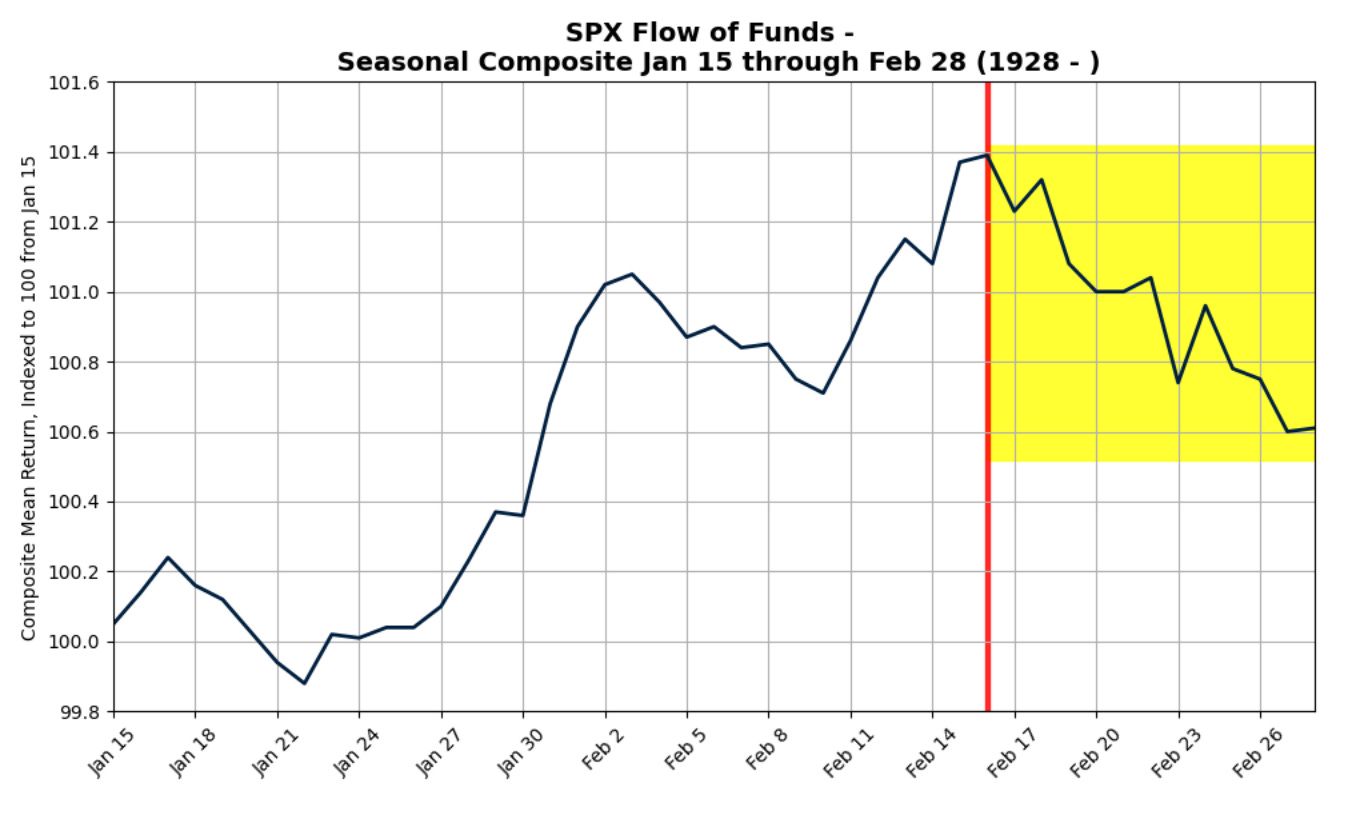

And the retail flow data confirms how long retail is:

Meanwhile, we are about to enter the 2nd-most difficult seasonal period of the year for the SPX (with the most difficult being the second half of September).

Meanwhile, the unexpectedly strong performance of Deepseek is probably making the hyperscalers wonder whether their AI businesses have a moat.

On the surface, the hyperscalers are plowing ahead with spending…

…But one has to wonder whether they are having second thoughts behind closed doors. With open source models (like Llama and Deepseek) competing neck and neck with closed source models (ChatGPT and Google), the cost per inference token is quickly trending toward zero. The incremental improvement with each subsequent upgrade is also getting smaller. No trend can accelerate indefinitely, and I wonder how a deceleration in AI spend and AI revenue would impact a market that is priced for a lot of future growth and no downside shocks.

Finally, we just got an unexpectedly hot CPI print as I was writing this (3.3% core vs 3.1% expected), which reduces the chances of additional Fed easing.

The Catalyst

I hope I haven’t worried anyone yet, because I haven’t even mentioned the risk that concerns me the most, which is Trump’s tariffs. I wrote about why tariffs are bearish for growth prospects and the markets last week. SPX futures are still trading above 6000, which reflects the complacent view that Trump won’t end up imposing tariffs. Yes, I know he announced them and then delayed them by a month only a couple days later. That doesn’t mean they’re not coming. The markets impression that tariffs are just a bargaining tool to extract concessions from trading partners is misguided. Take a look at Trump’s team of economic advisors, and you’ll see why:

Stephen Miran, Chair of Council of Economic Advisors - “Sweeping tariffs and a shift away from strong dollar policy can have some of the broadest ramifications of any policies in decades, fundamentally reshaping the global trade and financial systems.”

Howard Lutnick, Commerce Secretary - “We are treated horribly by the global trading environment. They all have higher tariffs, non-tariff trade barriers and subsidies," Lutnick said. "They treat us poorly. We need to be treated better. We need to be treated with respect, and we can use tariffs to create reciprocity, fairness and respect.”

Peter Navarro, Senior Counsel for Trade and Manufacturing - “President Trump's vision is channeling President McKinley way back when tariffs were the primary source of revenue to run the government. That's why he has established the External Revenue Service.”

Treasury Secretary, Scott Bessent, who advocated for smaller, graduated tariffs is the exception, not the rule. For Trump and most of his team, tariffs are not just a means to extract concessions from trading partners - they are the end goal.

I think 25% tariffs on Canada, Mexico, and Europe will come back on the table, and that even if they get negotiated lower, some portion of the tariffs will remain permanent. After all, Trump plans to generate revenue from taxes to pay for tax cuts, and you can’t generate revenue if you don’t make them permanent.

The timing of tariff announcements may come as soon as the next two weeks, as we approach the one month deadline that started counting down when Trump agreed to delay the initial tariffs.

Why the bull market is due for a pause

It is typical for the S&P 500 to take a pause after 2-3 years of strong gains. 2015 saw a growth scare due to China.

2018 saw a 10% drawdown on the VIX blowup and US-China trade war, and then a deeper 20% selloff on a Fed that insisted on hiking into slowing growth (due to tariffs).

Do I think this is the end of the equity bull market? Absolutely not. If Trump succeeds in reducing government spending and lowering corporate taxes, this should boost corporate profits, bring down the cost of borrowing, and improve productivity - all bullish factors that will support the next leg of the bull market. Unfortunately these are outcomes that will take 1-2 years to play out, while tariffs are an immediate and early threat.

I’m raising cash in my equity and crypto portfolios and looking for a 10-15% drawdown in equities to happen before I start buying the dip. For active crypto traders, the opportunity to double or triple your capital with a high probability of success doesn’t come from being long today, but from having the dry powder to buy a panic low (similar to Feb 3, but worse) and holding it through the recovery. I believe that Trump intends to make good on his promise to create a Strategic Bitcoin Reserve. This might end up being a late 2025/early 2026 story.

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

Prescient

Great post! If I may, for argument's sake, the sentence of "I’m raising cash in my equity and crypto portfolios and looking for a 10-15% drawdown in equities to happen before I start buying the dip." is possibly the reason why drawdown may not even come. All bears I hear about are saying this.