“There an enormous amount of information in our senses, feelings, emotions which are only degrees of intensity of the same physical experience. You get knowledge out of your body - a sense, a feeling, an emotion….The trick is to learn to see that as a dataset, and to analyze it in an organized way, which can be done once you understand how the system’s really working.” - Denise Shull

When you get to a certain level of experience in trading and investing, a large part of success is about optimizing the quality of your decisions. This starts with making sure the data and logic of the decisions are robust and sound - that comes with having a sound process, doing your homework, and updating your mental map of the markets.

The next part is figuring out what are the underlying emotions motivating you to make this decision, and whether those emotions are additive or subtractive to your decision process. This takes tremendous self-awareness, and like my wife always points out, self-awareness is not an innate trait for me. Fortunately, it’s a skill that can be learned. Denise Shull talks about how labeling your emotions is a helpful way to better identify them and use them as a dataset in your decision process. Labeling helps you identify immediately what emotions are motivating a decision and determine whether the emotion is additive or subtractive to your process so you can adjust your decision accordingly. In this blog post, I’ll go through a list of emotions I encounter and give them some labels.

FOMO (Fear Of Missing Out) - You’re seeing the price moving in your direction but you’re not on the trade. Everyone else is making money on the trade except you. At some point, watching the train moving without you on it gets too painful and you find some excuse, any excuse, to get on the trade. Of course by the time you enter, early entrants are already getting out and using you for exit liquidity. Game over.

ROMO (Regret of Missing Out) - You missed your entry to the trade, maybe because you weren’t watching the market or because you found out about the idea too late. Perhaps you stopped out or took profit right before the market went massively in your favor without you on board. Either way, you’re pissed at yourself for missing it, but vow to be better about staying on top of opportunities going forward. ROMO sucks, but disciplined traders experience it all the time. Feeling ROMO is better than losing money from FOMO. You can’t catch them all!

Winner’s complacency - When you’ve had a hot streak, or when you have a large open profit on your portfolio. It feels like nothing can go wrong. You don’t worry about the market moving against you because you’re up so much already and you’re just playing with the house’s money. You ignore new information that suggests the fundamentals are changing against your favor, or that your trade has gotten crowded. You start overriding your process and put on trades that are not properly planned or well thought out. This usually ends badly as you overstay your welcome on a trend and give back a lot of pnl.

The urge to take profit - Sometimes you’re up on a position, and even though it hasn’t hit your target or your trailing stop, you have a subconscious urge to take profit. As the quiet urge rises to your consciousness, you start to wonder whether you should get out of the position earlier than planned. Take a note of this feeling and study whether it delivers positive alpha to your trading. I know it does for me.

Crouching Tiger Hidden Dragon - You are patiently lying in wait for the next opportunity. You know that a good trade is around the corner so you are in no hurry to immediately deploy your capital. You are prepared for various scenarios that could play out in the market, and know what levels and conditions will make you put on a trade again. This is the perfect mindset to have when you are in between trades or are running a light portfolio. When opportunity meets preparation, you are able to spot it and capitalize on it.

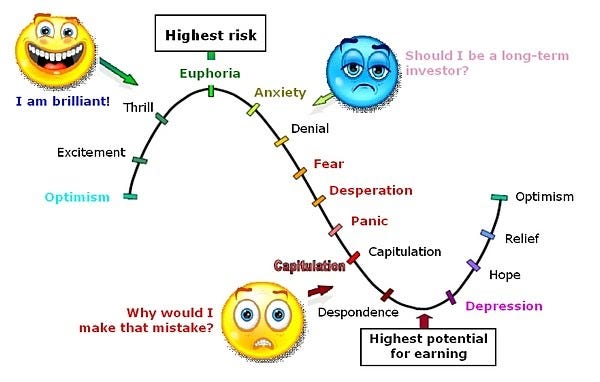

Revenge trading - Traders put on revenge trades after they have lost a chunk of pnl and have not yet accepted or psychologically acclimated to their lower NAV level. For those who have seen this graphic before, revenge trading usually happens in the denial and desperation phase.

You know you’re revenge trading when you override your process and put on trades that are suboptimal, or increase the risk of your portfolio despite having just taken a pnl hit. Revenge trading at its worst is called going on tilt.

In every trading blowup, revenge trading is often at the scene of the crime. Kyle and Su at Three Arrows Capital notoriously went on tilt after having lost hundreds of millions on the Terra/Luna meltdown. They doubled down on their long crypto exposure by going massively long perpetual futures on despite the market being in freefall. This accelerated their demise and left a larger hole in their balance sheet than if they had followed proper risk management.

Itchy trigger finger - A result of either winner’s complacency or revenge trading. This can also happen when you are simply bored or hooked on the dopamine rush of trading. Maybe you are spending too much time in front of your screens, or you have an addictive personality that is not well-suited for disciplined trading.

Premature ejection - There is a saying in the markets, “If you’re going to panic, panic early”. Sometimes you get a bad feeling about a position that you’re running. Perhaps incoming data doesn’t support your thesis, or the reasons you put it on in the first place didn’t have much conviction behind it. You cut the position and take a loss before it reaches your stop loss level, and move on.

5 More Minutes - You know when kids are playing and they beg their parents for five more minutes, even though it’s time to leave? And five minutes later they beg for another five minutes? Yea…it happens to traders too. Sometimes the market reaches your stop level and you want to give it a little more room. Maybe you move your stop a bit further, or you’re waiting for that next catalyst to save your position. Sometimes this line of thinking works in your favor, but more often than not, it doesn’t. I track in my journal when I do this, and many years of data tells me that disregarding my initial stop loss costs me money in the long run.

On the Defensive - You're on a losing streak and are uncomfortably close to your drawdown limits. You’re hesitant to put on trades, and when you do, you place stop loss and take profit orders tighter than usual. As a result you keep getting stopped out, and even though your market view plays out, you’re not participating in the move because of how conservative you are trading. Being on the defensive is a state of mind that can hurt your performance, and you can snap out of it by either taking some time off from trading or by reducing your position sizes to a fraction of what they were.

Ostriching - When you are down so much on your portfolio that you just can’t face the facts anymore. You stop looking at your account and just bury your head in the ground like an ostrich. The time for risk management has passed, and all that’s left is a huge hole in your net worth that only hope and a miraculous rebound in the markets can fill.

The acceptance phase - You’ve had a bad run -maybe it started with winner’s complacency, and the resulting drawdown snowballed into revenge trading, which put you deeper into a hole. It takes a while to come to terms with your situation - maybe you had to take a few weeks off or go on a vacation. But after you’re back to the screens, your high water mark and the desire to return to it are now in the back of your mind. You’ve emotionally accepted your current NAV, have a trading plan and a market view, and are ready to trade again in smaller size.

Most traders go through significant, sometimes multi-month drawdowns every year. The best thing they can learn is how to bypass the revenge trading and on the defensive phases and go straight to the acceptance phase. Without entering the acceptance phase, you are still vulnerable to mistakes and it’s hard to dig yourself out. The process of surviving many drawdowns in my career and coming back strong has made me a survivor and a better trader overall.

If you want to learn more about trading psychology, the two best books I’ve read are Trading Psychology 2.0 by Brett Steenbarger and Trading In The Zone by Mark Douglas.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.