Looking past the USD bull market

Those who have been reading my stuff for a while know I’ve been bearish equities, bullish yields, and bullish USD for a while. Today I am flipping that view and reorienting my portfolio towards long commodities (both long term and short term), long crypto, short USD, and neutral yields. If you’ve been following my Twitter (if you don’t, you’re missing some serious alpha), you’ll see I took profits on my long USD positions, went short usd/jpy, and turned bullish ETH. I’m also closing my puts in S&P 500 at a small loss, and covering my shorts in MSTR (sold at 332, now around 255). My trading book is now an empty canvas on which I can express my views of how global macro will play out in the next regime. The USD bull market is in the process of topping, and that will affect trends in every asset class.

The global macro community is split in two camps - the inflationary camp believes that inflation will remain sticky or keep rising, and the disinflationary camp that points at a lot of the leading indicators for inflation and says that we have seen the high water mark for cpi and that it will trend lower from here. As a trader, I found that it doesn’t serve me well to be married to one view or another. The reality is that there is a constant tug of war between the two narratives, and this tug of war will dominate the global macro landscape for many years to come. There are periods when economic data and the market make the inflationary camp feel like they are winning, and periods when economic data and the market make the disinflationary camp feel like they are winning. Our job is not to bet on the final winner of this never-ending game of tug of war, but to bet on which direction the rope will move next.

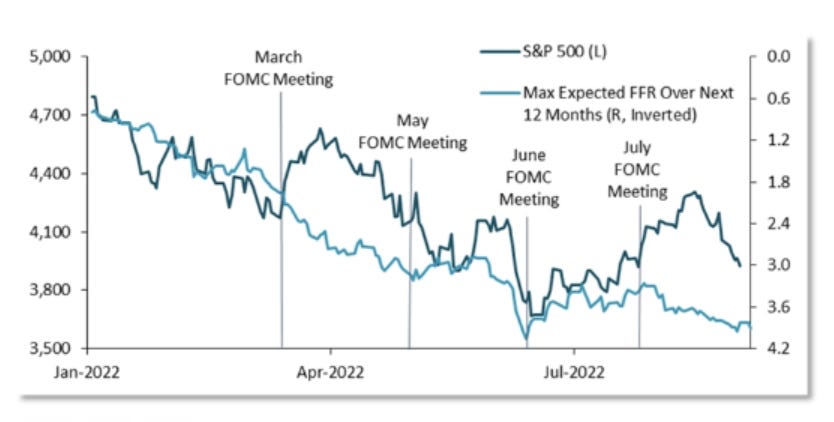

This past week I’ve noticed a few things in the charts and price action. Thrusts higher in USD have been quickly reversed. Some big levels have been tested and held - 145 in usd/jpy, a resistance going back to 1998, 1.14 in gbp/usd, a level going back to Mar 2020, and 7.00 in usd/cnh - a huge psychological level China is probably trying to defend ahead of the CCP’s National Congress in Oct. Gold also tested 1700 twice and held. In rates land, hawkish Federal Reserve rhetoric has failed to push 10 yr yields much higher than 3.35%. A 75 bp hike for this month’s FOMC is pretty much baked in the cake, and we are almost at the terminal rate of “just above 4%” that some Fed speakers have mentioned in their speeches. We are back in a situation where the market might actually interpret the next FOMC as dovish, despite Powell’s best efforts to sound hawkish. This has happened during every meeting since March.

Courtesy: Piper Sandler

On the European front, Russia has shut off all gas to Europe via the Nordstream pipeline (that news caused eur/usd to dip to 0.9900 before recovering). Russia is playing a game of chicken that they will likely lose, because they can’t afford to stop selling gas to their biggest customer forever. G7 nations are putting together a framework to cap prices on oil sold to Russia, and Europe’s ban on Russia energy takes effect in a few months. Meanwhile, Ukraine has staged a counter-offensive in Russia that has reclaimed some territory, while Europe has filled its natural gas storage to its 85% target. My view is that Europe will be able to outlast Russia in this game of chicken, and we have passed “peak fear” in the European energy crisis.

Gas prices and used car prices have continued to trend lower over the last month. These are two of the most sensitive components of CPI, and their downward trajectory imply we may see another downtick in headline CPI this month.

US Average Gasoline Prices

Used car prices

Variant Perception’s proprietary US headline CPI leading indicator is stabilizing

We also know that CTAs (systematic trend following funds) were influential in perpetuating the USD uptrend this year and were partly responsible for the pullback we saw this summer. CTAs are now back on the USD bull trend and government bear trend, and any flagging of momentum could trigger flows going in the opposite direction.

Courtesy of Vanda Research

Citi’s FX positioning index also shows USD positioning to be at levels where USD has historically mean reverted lower.

Eur/usd’s chart is looking more constructive and a daily close above 1.01 would be bullish.

Japan is also getting more serious about acting on yen weakness.

Overall, we may be entering a scenario where Fed and market estimates of the Fed funds terminal rate stop rising, while at the same time the European Central Bank, Bank of England, and Bank of Japan are getting more hawkish. European energy crisis fears are past their peak, and positioning is ripe for a reversal in the US dollar. So what’s the play here?

Long a basket of commodity ETFs XLE, XOP, DBA, and XME

I believe we are in a secular commodity bull market, and have been waiting for an appropriate dip to put on some long-term exposure. The rising dollar and fears of a cyclical downturn have kept commodity prices under pressure since this spring. If USD turns lower and the Fed slows down its rate hikes, then now would be the time to buy the dip in commodities.

Long Dec gbp/usd 1.2200 calls

Incoming PM Liz Truss has announced an energy bill cap of 2500 GBP per household per year. It is estimated that this cap will cost 130-150bn GBP, and it will be funded by increasing the UK’s budget deficit. The positives for GBP FX and asset prices are that this should decrease inflation in the short term for the average citizen, and it has the same effect as fiscal stimulus, which boosts economic growth and pushes yields higher. The negatives are that it puts the UK in a more precarious fiscal position and increases the risk of inflation in the long run, as the average citizen is no longer incentivized to cut energy consumption in response to lower supply. I think the positives will outweigh the negatives in the short run and manifest themselves in stronger economic data and higher yields in the UK. Gbp/usd has been whippy, so I’m playing this via options instead of spot.

Interest rate spreads are also no longer a headwind for gbp/usd.

Spread btwn GBP 2 yr and USD 2 yr interest rates in white, Gbp/usd spot in blue

Long gold and silver

Sentiment and positioning are pretty negative for precious metals due to the USD bull market and rise in real yields (the largest drivers for precious metal prices). However we are at a cluster of supports in XAU that make it attractive to accumulate it as a long-term allocation, and also go long as a medium term swing trade (with a stop below 1670 in spot). The fact that gold has held 1700 despite rising real yields and USD is a bullish signal, IMO.

Silver is gold’s more volatile and speculative cousin so I’m going long as a swing trade, with a stop below the pivot zone of 18.50-18.60 in spot.

Long ETH/USD

I was previous concerned about the overhang of long positions in ETH going into the Merge, which should happen around Sept 15-16. However my concerns were alleviated by the liquidation of longs from 2000 down to 1420, which should make positioning cleaner going forward. When the Merge date was announced, ETH/BTC cross was around 0.06, and today it is 0.08. If we convert BTC into ETH at those values, we can estimate that without the Merge on the horizon, ETH would be at 1300 instead of 1730 today. The Merge premium is only 33% - probably depressed due to the global macro backdrop and lack of recovery in global risk appetite. In a world where USD turns lower, triggering a recovery in risk appetite, that premium could grow to 100-200%. This uncaptured upside makes ETH my favorite crypto long at the moment. I went long at 1515 and hope market conditions will allow me to hold this for a few months or more.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.