At Jackson Hole, Jerome Powell delivered the speech that risk assets were clamoring for. The key lines were the following:

“It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. We do not seek or welcome further cooling in labor market conditions.”

“The upside risks to inflation have diminished. And the downside risks to employment have increased. “

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Rate cuts have already been priced in for September and every meeting thereafter, so Powell confirming the cuts was no surprise to the market. The key message was that he shifted the Fed’s focus from their inflation mandate to addressing downside risks in employment. As a result, markets interpreted his speech as dovish, pricing in over 100 bp of cuts over the next three meetings plus an additional 100 bp for 2025. Disinflation has won the day, and it will be at least a couple quarters before the fear of inflation moves the markets in a meaningful way. From here on out, I believe we will be persist in a disinflation regime, punctuated by occasional growth scares.

What Powell did NOT describe in his Jackson Hole speech was the pace of cuts - whether he would cut with urgency (50 bp in Sept) or gradually (25 bp in Sept and 25 bp every meeting). This will be determined by incoming data - specifically the employment numbers on Sept 6. Regardless of whether they go 25 or 50 in Sept, what’s most important is that the Fed plans to be ahead of the curve - cutting as early and aggressively as needed to stave off a recession. For that reason, I have flipped from my risk-off stance in my last post to a risk-on stance. Because risky assets have a tendency to trend higher, a risk off stance should always be tactical, with a price and scenario thresholds that would invalidate the position. Last week, those thresholds were met.

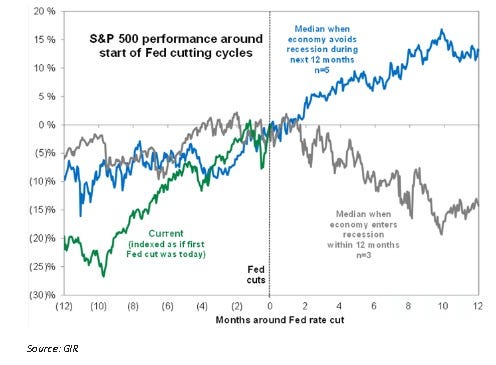

A proactive Fed that stays ahead of the curve is positive for risk as it increases the area of outcomes where equities and risk assets continue to rise:

Outcome 1: Economic data comes in line or better than expected over the next few months, the Fed will cut in a measured pace and likely end their cutting cycle earlier than what the market is pricing in, as the economy won’t need their support. Equities strengthen on increasing earnings.

Outcome 2: If data continues to weaken (UE inching higher from 4.3% to 4.4%), they will cut faster and deeper, and likely provide more liquidity to the financial system (such as ending QT earlier than expected). Equities strengthen on expanding P/E multiples.

Outcome 3: The only scenario I can envision where we get a repeat of the Aug 5 risk selloff is if UE gaps higher from 4.3% to 4.5%, triggering fears that a recessionary spiral is past the point of no return. However, this bearish scenario is not my base case anymore. I previously thought that the August jump from 4.1% to 4.3% marked a downward inflection point in the economy, but subsequent data and jobless claims have not confirmed this.

The chart below illustrates what happens in outcomes 1 and 2 (the blue line) vs a outcome 3 - a recessionary spiral (the gray line).

Fortunately I expressed my risk-off view via a USD/JPY FX short, and still made 3.5 big figures on it despite risk assets rallying. In hindsight, I covered it prematurely on Friday after the Powell speech, but I still made 2.8x the pnl that I put at risk - a respectable gain.

As a trader, I want to trade the views that I have the most conviction towards. I have conviction in Powell staying ahead of the economic curve and staving off recession, so being long risk assets makes sense. Long risk also gets exposure to the largest surface area of outcomes (1 and 2 above). At some point during this cutting cycle, the market will start to look through the economic weakness and price in a reflationary regime - a reacceleration of growth and inflation.

Where I have little conviction is whether economic data will improve or get worse, as recent data have been have been all over the place and impossible to predict, making it difficult to hold a position in yields or anything sensitive to yields, like USD/JPY.

What does this mean for USD FX? Most currencies have been appreciating against USD, and the short dollar trade has become a proxy for a risk-on regime fueled by expectations for more rate cuts. A month ago I would have blamed USD weakness on long positioning in USD, but the market is now net short USD in many measures. I have two theories on why USD has been weakening so persistently, and why it will continue to weaken:

The end of US exceptionalism

From 2022 until now, US capital markets delivered the highest “risk-free” yields across most developed economies, and also the best equity returns (thanks to the outperformance of S&P 500 and MAG7). The exceptional returns of US assets created a huge sucking sound from foreign markets that vacuumed up global capital into the dollar. The most obvious examples were the yen carry trade (borrowing JPY to be long US assets) and the divergence between Chinese equities and yields vs US equities and yields. Now that the Fed is cutting rates, the vacuum must go into reverse, with capital getting freed to pursue returns in foreign markets. Lower USD borrowing rates and higher liquidity also tends to be positive for global risk assets, resulting in a feedback loop.

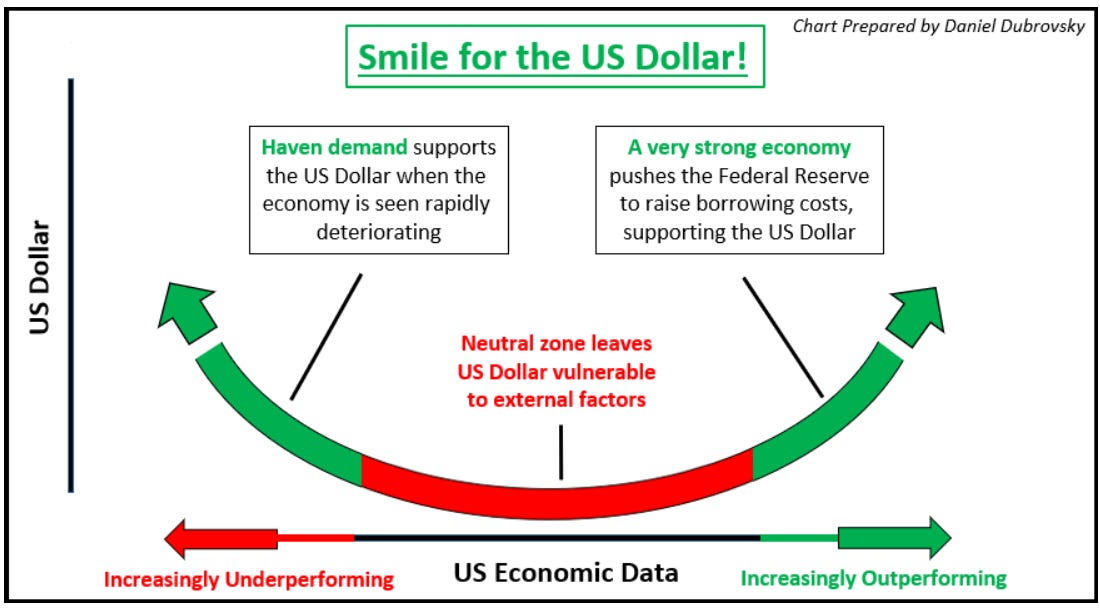

The dollar smile theory

The dollar smile theory originated from Stephen Jen, a currency strategist at Morgan Stanley, in the early 2000’s. It states that the US dollar tends to strengthen during times of severe economic stress or during periods of extraordinary strength (represented by the ends of the smile). It tends to weaken during periods of middling GDP growth, roughly 1.5-4.0%, to be exact.

The underperformance of the US dollar at the middle of the dollar smile is usually associated with a risk-on environment, and a result of capital flowing from US markets out the risk curve into foreign markets. The USD weakness today is the result of the market looking through this economic soft patch and gaining conviction that US GDP will remain in the 1.5-4.0% range for a while.

In the following paid subscriber section I’ll discuss my favorite risk assets and short USD trades, and my current view on BTC.

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.