The past week in global macro has kept us on the edge of our seats, with events such as the Bank of Japan tweaking its yield curve control policy, the Treasury’s quarterly refunding announcement, and the FOMC. I won’t waste any time and will dive right into how I see these events affecting the global macro landscape. For paid subscribers, I’ll write about how I’m fading these moves in bonds via other proxies that have less downside risk.

The Bank of Japan removed its long-standing policy of defending a set level in yields in the JGB bond market and shifted to a softer stance of intervening in the vicinity of 1.00% in 10-year JGBs. The market interpreted this change in stance as dovish, with JGBs rallying and usd/jpy strengthening above 150 on the day. The reaction was partially caused by expectations that the BoJ would lift the upper range of its YCC band to 1.50%, a move that did not materialize.

The announcement heralds a shift from firm yield curve control, where the BoJ defends a fixed level by buying an unlimited amount of bonds, to soft yield curve control, where the BoJ smooths downside volatility in bonds with its purchases without being obligated to defend any particular level. Firm YCC created a quandary for the BoJ, as it put them on the hook for buying an unlimited amount of bonds to defend a fixed level of yield, thus stoking inflationary pressures by expanding money supply and weakening the yen. Soft YCC will remove the market’s attention from fixed levels and allow the market to set the appropriate price of yields in a controlled and gradual manner. Less intervention and distortion by the central bank is always a good thing for the bond market, so I applaud this step.

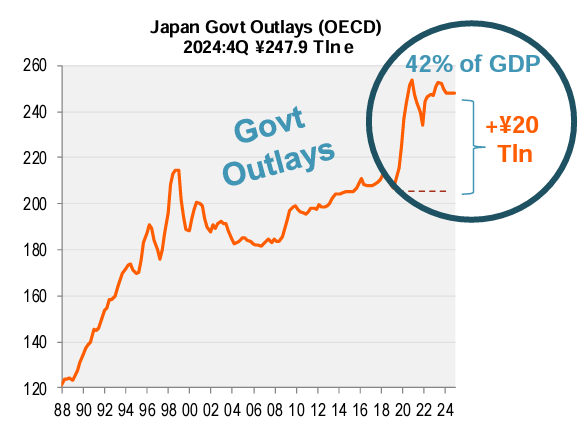

Monetary policy is still very loose relative to inflation and growth in Japan, and has a long way to tighten before it can effectively slow down inflation and the weakness in the yen. Core CPI is a blistering 4.2% and rising, while nominal GDP is 5.0%. What's startling is that Japan is still enacting pro-cyclical fiscal and monetary policy, with government outlays remaining at a whopping 42% of GDP.

The government has extended subsidies for gasoline, gasoil, fuel oil, and kerosene, and just put forth a $113B fiscal package to help the economy deal with inflation. At current levels in usd/jpy and JGB yields, it is difficult to bet on this theme as the BoJ has been normalizing policy at a snail’s pace, while slowing the yen’s decline with the threat of intervention. Without the threat of intervention, usd/jpy would probably be above 160 by now. I admit to missing opportunities to capture this theme (such as when usd/jpy dipped from 145 to 137 in July), but I’ll be on the lookout for pullbacks in the future.

The Treasury announced a slower pace of borrowing for Q4 than expected ($776B vs $852B expected) and shifted some of its coupon issuance from the long end to the short end and belly of the curve. These changes were cheered by the bond market, triggering a bull flattening move. I covered my short position in US long bond futures, harvesting a respectable 20 bp on the trade, and am waiting for better levels to short again.

The QRA might have been short-term bullish, but in the medium term, the underlying drivers for the selloff in duration remain. If the long bond market had trouble absorbing the $178B of coupon issuance in Q3, I don’t see how it will fare any better in Q4 just because the increase in issuance on the long end is smaller than expected. Perhaps the market is cheering the Treasury’s proactive stance in shortening the duration of their issuance in order to lessen their market impact. The problem is that borrowing is expected to increase to $816B in Q1 2024 so the market won’t see any relief from the flood of supply until Q2. What bond market bulls need for a sustained turnaround is a material reduction in issuance, a credit event or episode of market dysfunction, or a recession that will compel the Fed to shift to a cutting stance.

A weak set of ISM manufacturing numbers followed the bullish quarterly funding announcement. The headline number of 46.7 disappointed expectations of 49.0, while ISM employment undershot at 45.5 vs 49.8 expected. ADP employment was also a slight miss, at 113k vs 150k expected. This set of numbers helped extend the rally in bonds and equities, and increases expectations for a downside miss on NFP Friday.

The weak data doesn’t dissuade me from my bearish position in long bonds. Throughout this inflationary cycle, we have seen data undershoot and overshoot multiple times, stoking concerns of recession and inflation alike. Soft data like the ISM has been unreliable, while hard data has been volatile. It has been difficult to trade momentum off data prints, and in any case, my bearish bond view is more about Treasury issuance rather than economic fundamentals.

Jay Powell had both dovish and hawkish moments in his FOMC conference, but it was the dovish bits that the market latched on to. Yes, he maintained their hiking bias and kept the December meeting live, but he also downplayed the September dots, acknowledged tightening financial conditions via Treasury yields, and was more attuned to downside risks in the economy from the lagged effects of tightening. The dovish comments sent the bond market higher, helping 10 yr and 20 yr Treasuries extend gains above their range highs.

Each of the above events on its own would have triggered only a modest rally in bonds, but the confluence of all four resulted in a durable short squeeze that has attracted some follow-through buying from trend-following CTAs today. I do not think any of what happened this week meaningfully changes the negative fundamental picture for long end Treasuries, so I remain bearish.

I’ll now proceed to the paid subscriber section, where I’ll discuss several ways I’m trading against the rally in bonds via other proxies that have less downside risk.

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.