If you missed the previous posts in my inflation series, you can find part 1 here. Follow me on Twitter for real time insights and trades. I wrote a thread about an interview of Mike Dooley, who was privy to policy discussions at the Fed during the 70s and 80s.

Thanks to Sam Shiffman for contributing to this article.

Inflation is both a global and local phenomenon. It has affected every country in the world, regardless of how much fiscal and monetary stimulus they injected during COVID. Each country, based on what it imports, exports, and consumes, has felt it in its own way. Today I’ll discuss how inflation has affected Singapore, the country where I live.

Singapore’s May YoY CPI number came in at a spicy 5.6% today. In the context of the last two decades, we aren’t in unfamiliar territory…yet.

Singapore imports most of its food, and the cost of food is going up. In April, food inflation was at 4.1% and it has likely gone up even more since then.

Food security is a real concern. We can’t get fresh chicken anymore without paying through the nose for it.

A friend who owns multiple mid-tier restaurants (let’s call him Harry) says the price of fish has gone up from $13/kg in 2022 to $22.50/kg today. Ancillary items like napkins and hygienic gloves have increased in price by 9%. He used to sell a salmon bowl for $9.90, but was forced to increase the price to $11.90. The higher price resulted in less customer traffic and revenue, showing that cost increases cannot be fully passed on to consumers.

Like every country, the cost of gasoline has been going up.

From motorist.sg

Ride-hailing prices have increased 100-200% from a year ago. A 5 km trip used to cost $6-8 SGD and now it costs $15-18. There has been a shortage of drivers due to the high cost of fuel eating into their margin, and a labor market shortage that has resulted in drivers finding other jobs.

In Singapore, buying cars is 3-4x more expensive than other countries. In addition to the price of the actual car (Open Market Value, or OMV), there are additional registration fees, excise tax, and GST piled on top that add another 130-220% to the cost. Another cost is the Certificate of Entitlement (COE) which allows a driver to drive the car in Singapore for 10 years, and this price fluctuates based on market demand. All these additional costs are intentionally created by the government to reduce the number of cars on the road and curb congestion and pollution (which it does effectively).

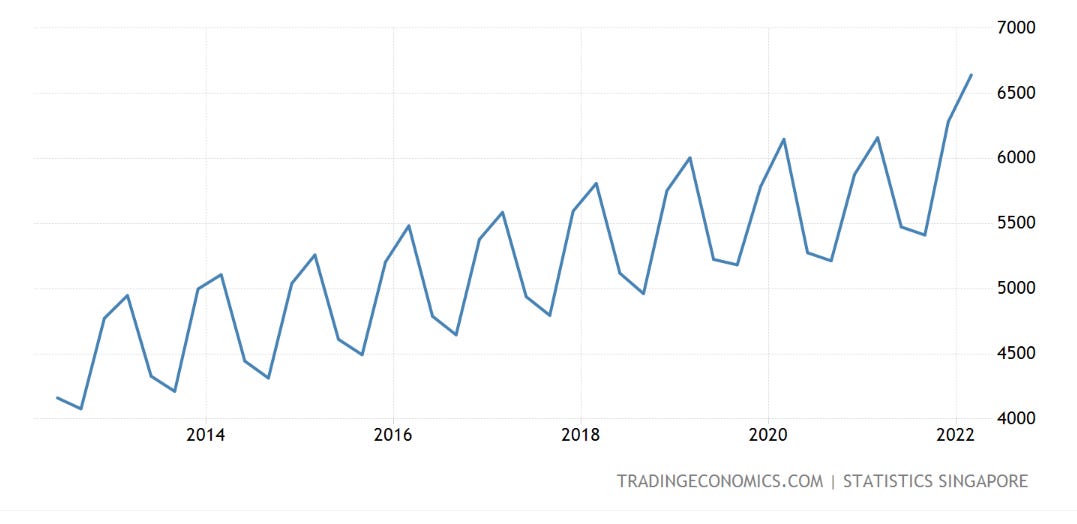

As you can see from the highs and lows on the chart below, COE prices reflect the economic cycle.

COE prices reflect demand for cars, and they are at all time highs. Buying a car has never been more expensive in Singapore!

The labor market has been incredibly tight. There is no sign of recession in employment.

Singapore unemployment rate

What is worrying from an inflation standpoint is that wages have surged higher.

Average monthly wage in Singapore

If you speak to any entrepreneur in Singapore, particularly those in the service industry, you’ll learn that there is a chronic labor shortage. Singapore has a small population that is affluent and well-educated compared to developing countries, so there are not enough people who want to work in F&B, hospitality, and other lower paying jobs. Most economies would fill this gap with foreign workers, so Singapore has this visa called an “S Pass” for mid-skilled foreign employees. However, in an effort to ensure jobs for locals, the Singapore government requires businesses to hire 9 locals for every S Pass foreign worker. This restricts the ability for business owners to overcome the labor shortage by hiring foreign talent.

The lack of competition from foreign talent results in artificial demand for local job candidates. Local candidates take advantage of this by asking for ever higher wages and hopping from employer to employer, based on who will compensate them more than the last one. Ironically, this policy has the side effect of making local talent less competitive on the global market, not more. Because locals are not subject to the Darwinian forces of a competitive and open labor market, there is no pressing need to learn new skills, take career risks, or out-work their colleagues to increase their earning power.

One owner and operator of preschools (let’s call her Amy) highlighted the difficulty of hiring and retaining new employees. According to her, “There is a war out there just getting warm bodies through the door to work for you.” 15% of her existing staff are asking for mid-year raises, and she expects the remainder to ask for raises at the end of the year. She sometimes questions whether investing the time and resources to train new teaching staff is worth it because she’s been burned so many times by new staff leaving after just a few months on the job.

Meanwhile, Amy recently had a teacher from Myanmar respond to an ad for an English teacher. The candidate is highly qualified, speaks perfect English (even better than most local teachers), and is willing to work for less than a local salary. However Amy doesn’t have any room in her S pass quota, and even if she did, the Ministry of Manpower would require her to pay the candidate well above her asking salary, according to the formula on its website.

Rising teacher salaries and rent are squeezing preschool operators, so the costs will get passed on to parents. Look out for tuition hikes by the end of the year. Students, parents, and preschool operators lose out from high teacher turnover and higher costs, while teachers benefit from higher salaries and career mobility. Is this the best set of trade-offs for society? I’ll let the reader decide.

Harry the restaurateur used to pay part-time staff $11/hr before the pandemic, and now pays $14/hr. Full time staff pay has risen 11% and overall compensation has gone up 15%. When trying to hire dishwashers, he’s lucky if an applicant bothers to show up for an interview, and even luckier if the dishwasher makes it to the second day of work.

During the pandemic, inbound migration was closed so restaurants could only employ local Singaporeans. According to Harry, those locals got burnt out having to deal with irate customers, enforcing complicated social distancing rules, and wearing masks all day. They got fed up left the F&B industry for good, leaving a hole in the labor market in their wake.

The unintended consequences of labor policies don’t reveal themselves until inflation and a wage-price spiral take hold. Policies that restrict labor supply can accentuate a wage-price spiral and make inflation much more entrenched than it needs to be. I predict that distortive policies like the 9:1 local to foreigner quota will cause inflation in Singapore to accelerate over coming quarters/years. I also predict that the quota will remain in place no matter how bad inflation gets. It’s politically impossible to change policy in favor of foreign workers at the expense of local voters (and also impossible to explain to voters why the policy is creating inflation in the first place).

Despite all of the above, Singapore has taken the crown of being the most attractive financial center in Asia to live in. The restrictive measures from the previous two years have almost been forgotten, and Singapore feels like the land of the free compared to Hong Kong and China. As a result, the city is seeing an influx of executives and high net worth individuals moving their families and their capital to this little island. My real estate broker has recently been fielding many clients from Hong Kong and China, some of whom are setting up family offices in Singapore. They prefer 3-4 bedroom condos in central Singapore, sometimes snapping up multiple units as a haven to park their wealth. I have heard anecdotally that rents and sale prices of benchmark properties in central Singapore have gone up by 50% since 2020. The supply of condos for sale and for rent has evaporated, with the remaining ones getting snapped up in bidding wars within days.

I don’t get the impression that the Singapore government is worried about inflation yet. They recently announced a $1.5b SGD fiscal package to support citizens through this inflationary period. This is a short term fix that will only result in more inflation down the road as the stimulus passes through the system and supports consumer spending.

It’s hard to see how a tight labor market and the injection of high net worth capital and will not exacerbate inflationary pressures in Singapore over coming years. Inflation is already a socially divisive issue on its own, but when you throw in a widening wealth gap, you end up with a politically combustive mix that could have serious long-term ramifications for this tiny country. When I think about all the possible things that could derail the stability and prosperity of this country, uncontrolled inflation is what keeps me up at night.

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

Great article. I agree and my impression is that if you look at history, taxes and inflation are the two factors that cause the most social unrest.

Ravi Menon, in last year's IPS-Nathan lecture series, made the case that it was better for Singapore to shift towards a high-wage, high cost, high productivity economy rather than rely on low cost labour. The challenge is how to achieve high productivity.

https://lkyspp.nus.edu.sg/ips/news/details/event-summary-9th-ips-nathan-lecture-series-lecture-ii-an-innovative-economy-by-ravi-menon