I wrote a guest post on the AlphaPicks blog about my view that too many cuts are priced in the forward curve and how yields might be bottoming out from here. Here is a preview below.

Over the past month, asset managers have been piling into bonds, while CTAs and global macro funds have been building longs in Treasury futures. The main catalyst for this aggressive shift in positioning was the surprisingly weak unemployment rate print of 4.3% on Aug 3. The release triggered the Sahm rule, which observes that in every previous instance when the 3 month moving average of the unemployment rate rose 0.5% from the cycle low, the economy was in the early stages of a recession. I believe that the economy is not as weak as what the bond market suggests, and that the coming Fed rate cut cycle will be slower and shallower than expected.

This economic cycle has been different from many cycles that came before it, which makes it difficult to rely on tried and tested recession indicators that have worked previously, such as the Sahm Rule and the yield curve. Claudia Sahm, the inventor of the Sahm rule herself, pointed out that the labor market is in much better shape at the moment than in previous recessions. Labor market recessions are usually caused by a sharp increase in layoffs, yet right now the increase in laid off workers is smaller than most recessions.

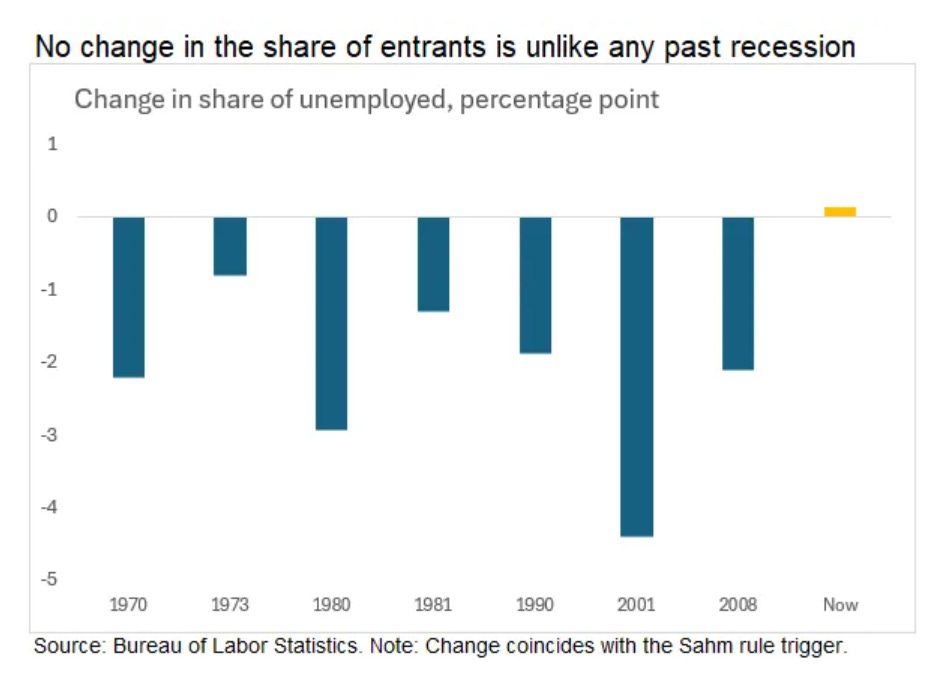

Previous recessions also saw fewer people enter the labor force and an increase in workers leaving it, resulting in lower participation. This time around, there has been no drop in net entrants into the labor force.

Thomas Barkin, in a recent interview on the Bloomberg Odd Lots podcast, said that in his conversations with companies, they are telling him that they are in a "low hiring, low firing mode." This suggests the economy is in a state of equilibrium and not on the verge of recession. Since unemployment data is often subject to large revisions, I like using jobless claims as a source of truth, and that data is not pointing to a significant increase in firings that is typical of a recession.

Against this economic backdrop, the Fed is set to deliver on some of the rate cuts that the market has eagerly priced into the forward curve. Expectations of cuts have resulted in a similar magnitude of easing in nominal and real yields as the Oct-Dec period of last year. The chart below shows how the decline in 5 yr nominal and real yields last year was followed by a jump in the US economic surprise index over the coming months. The improvement in data was accompanied by a reversal in yields higher, as well as a rally in risky asset classes such as equities, commodities, and crypto. I believe that the upcoming round of Fed easing will have the same reflationary consequences for the market.

For the rest of the article, proceed to the AlphaPicks blog post ahead: