Don't rule out a Fed pause or rate cut

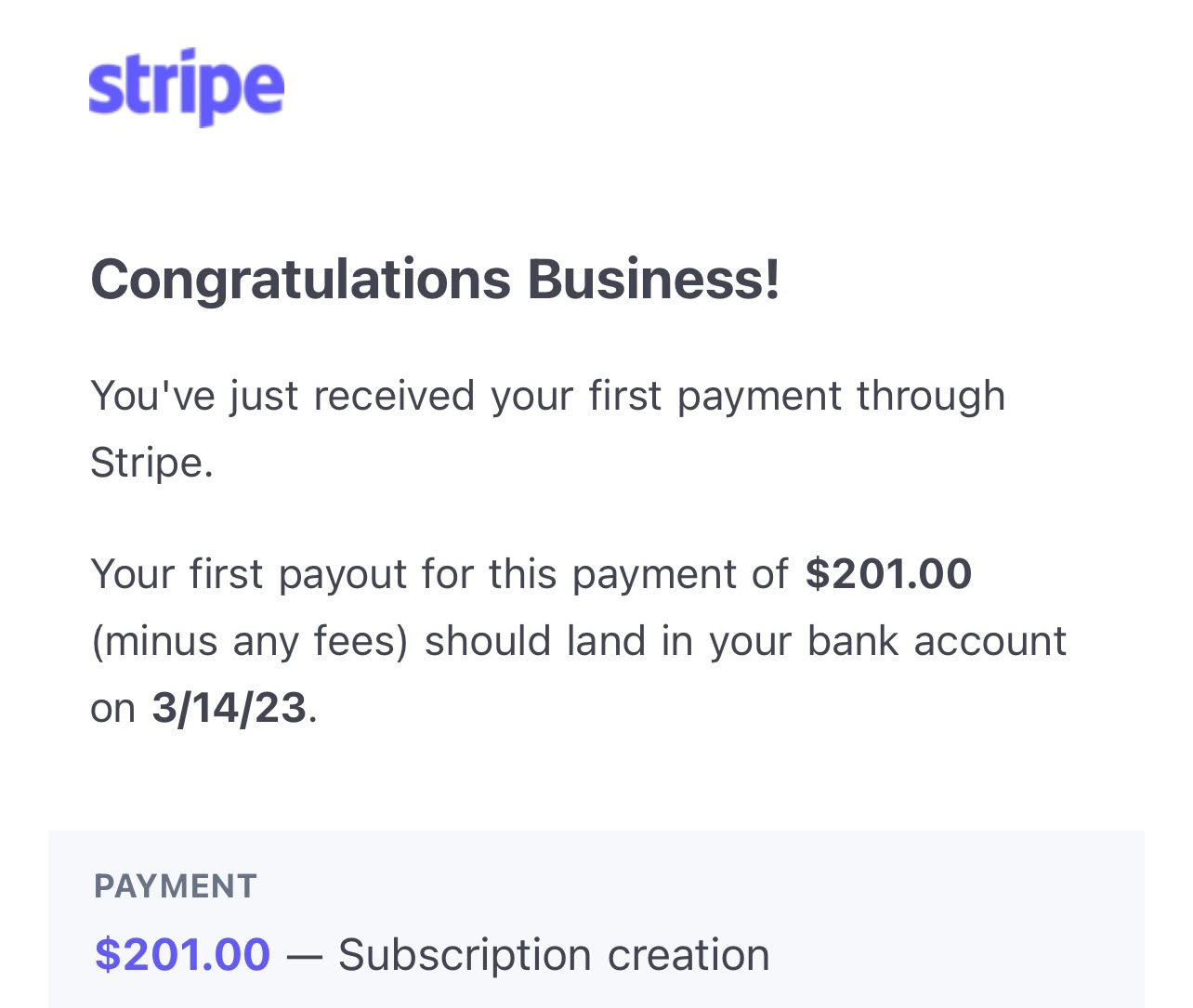

First, I’d like to thank those who signed up for my paid subscription. The reception has been greater than I expected, and it’s great to know that my content is valued. I’ve been a trader my whole life, so all the money I’ve made has been from salary or speculation. This is the first time I’ve ever created something and had people buy it. I have to say that it feels pretty damn good!

Screenshot of my first customer:

I read a good Twitter thread today about how the bank run on Silicon Valley Bank was much swifter than how the Great Financial Crisis played out, mainly due to social media. SVB announced their share sale on Thursday, triggering a wave of withdrawals by VC investors and startup founders who were alerted over chat and social media. By Friday morning, SVB was closed down by the FDIC.

Many people in the press and social media are now pointing fingers at SVB’s management, saying they made poor decisions and took improper risks in managing their debt securities portfolio. This blame is only valid in hindsight, as few people could have predicted in 2021 that the 2 year Treasury yield would reach 5% this year and that a portfolio of Treasuries deemed “safe” by regulators would suffer losses of 20-40%.

Imagine it’s 2021 and you’re SVB CEO Gregory Becker. Interest rates are at 0%, unemployment is at 6%, and Jerome Powell is telling the world that interest rates will be low for a long time (remember Average Inflation Targeting?). Your deposits are growing quickly due to the VC tech bubble, and you can’t loan it out fast enough, so what do you do? You go out and build a portfolio of Treasuries and mortgage-backed securities yielding 1.5-2% and lock in the interest margin. After the GFC, regulators writing the Basel III rules gave Treasury bonds a 0% risk-weighting, implying they are the safest assets a bank can hold (even though the price of longer maturities can fluctuate as wildly as tech stocks). You have both the Fed and regulators telling you that your balance sheet management strategy is sound banking practice. Even when inflation started surging at the end of 2021, you didn’t reduce the size and duration of your portfolio as quickly as you should have because you had the Fed still doing QE and Jerome Powell saying that inflation was “transitory”.

Fast forward to today and we have $600B in unrealized losses on investment securities in the US banking system. Gregory Becker can only be blamed for taking the message from Jerome Powell and the regulators too seriously when it came to balance sheet management. Much of the blame falls on the Federal Reserve being too complacent on inflation and Jerome Powell’s horrible messaging that left the entire world ill-prepared for the fastest rise in interest rates since the 1980’s.

We now have a situation where the fear of bank runs has become a viral phenomenon. Regional banks that would be in good shape in normal times are facing existential threats as the public withdraws their deposits in a frenzied panic. We knew there was a good chance that something in the financial system would break as the Fed hiked rates, and that day has finally come. If there is no response by the government or the Fed in the next day or two, more banks will come under pressure, while many startups will have problems meeting payroll and other expenses for an indefinite period.

Fortunately the argument for making SVB’s depositors whole is far greater than the moral hazard argument of doing nothing to intervene. The financial and political cost of interventions is a far cry from that during the GFC. I believe we will see one or more of the following interventions:

The government arranges a buyout of SVB by a larger bank. This would save depositors (and alleviate concerns around USDC and Circle), but it’s unclear whether this will prevent future bank runs from happening.

The Fed bails out SVB depositors by purchasing SVB’s securities portfolio at par. This would erase SVB’s losses and make depositors whole while restoring confidence in the banking sector. This bail out would be temporary and targeted QE echoing the purchase of gilts from pension funds by the Bank of England in October to stem the LDI crisis.

The Fed pauses rate hikes or cuts 50 bp in an emergency meeting. A rate cut would have the greatest impact with zero cost to taxpayers and few political roadblocks. It would bull-steepen the Treasury curve, increasing the recovery value of SVB’s investment portfolio while providing relief to other regional banks suffering from marked-to-market losses in their portfolios.

So far nothing has been announced, although Treasury Secretary Yellen said that something is in the works. It is intervention #3 that I’m most interested in as a trader. I think Jerome Powell knows what is at stake here and is about to remove his inflation fighting hat and put on his banking crisis prevention hat. As of Friday, the market was still pricing a terminal rate of 5.27%, well above the current Fed Funds rate of 4.57% right now. Perhaps the market has forgotten how forceful Powell was during 2020 when he cut rates to zero in an emergency meeting and announced open-ended QE to stem the crisis in the Treasury market. When faced with an uncertain path of inflation versus the certainty of further bank runs, I think Powell will choose to fix the latter. Fears of overtightening have been validated as the damage to consumer sentiment and credit growth has already been done. Customers, out of fear, are moving their deposits to SIBs (Systematically Important Banks like Citi, BofA, and JPM), but these large banks are not able to allocate credit to local economies as efficiently.

Paid subscribers can access the rest of this post, where I will be discussing how I’m thinking about positioning for a Fed pause or rate hike. You can immediately unlock that section by upgrading to paid. I’m offering a 33% discount until April 15.

I will also hold office hours on Monday (tomorrow) at 9 am Singapore time/Sunday 9 pm EST to discuss trading plans for next week. The Zoom conference details are available to paid subscribers only.

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.