The last two weeks saw a 10% drawdown in Nasdaq, led by the MAG7 and stoked by fears that the so-called “AI bubble” is bursting. The Nasdaq also suffered on a relative basis to the Russell 2000, stoked by a quantitative factor unwind in the hedge fund world. I’m seeing signs that the drawdown in the S&P 500 and Nasdaq has bottomed, but that the outperformance of the Russell 2000 has plenty of runway to go. This makes long RTY futures (or the IWM ETF) the standout trade in this disinflationary regime.

Positioning in the most speculative sectors of tech is back to normal levels:

Long/short hedge funds have de-grossed a lot of their exposure, both on the long and short side:

The ratio of 3-month VIX vs 1-month VIX is at lows typically seen near interim bottoms.

Looking at the big picture - the Fed is likely to cut in September and three times this year (based on market expectations). Global liquidity is inching higher, inflation is trending lower (led by rents and goods deflation), oil and copper are selling off, and the base case outcome for the US elections is currently a Trump win with a split Congress - ideal for a goldilocks economy. If one had a checklist for whether fundamentals support a bull market, most of the boxes would be ticked. For the above reasons, I shifted my trading stance in the S&P 500 to bullish from neutral in my paid subscriber chat on Friday morning.

Despite my bullish view, I don’t see the Nasdaq and SPX outperforming the Russell 2000 for the next few months. Russell 2000 outperformance was seen as a Trump and Republican sweep trade, yet it has been persistent despite a sudden shift in election odds in favor of Kamala Harris.

It certainly helps that front end yields are trending lower and that the Fed is a couple months from cutting rates. However, the move hasn’t been a straight line, and being long SOFRs or steepeners has been a choppy trade. Betting on Russell 2000 outperformance has been a superior expression of the disinflation trade over the past month.

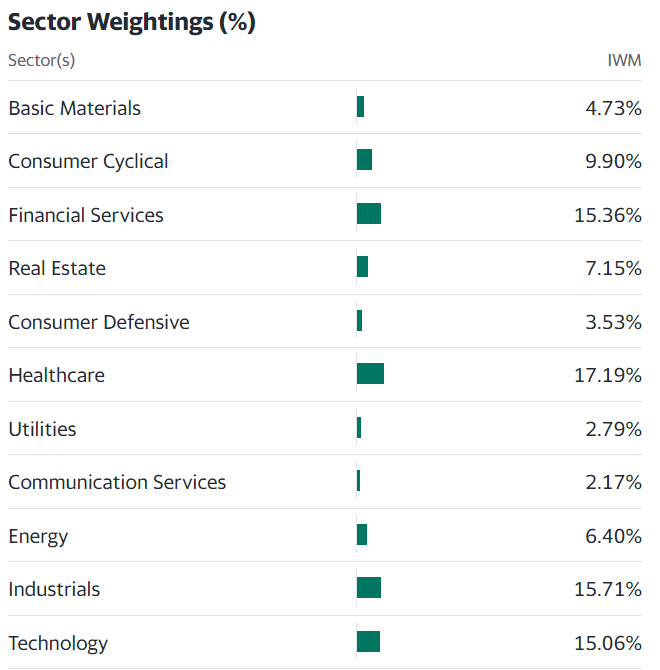

Almost 70% of the Russell 2000 is in sectors that are sensitive to interest rates. Financial services and real estate were heavily hit by the Fed tightening cycle, and those sectors make up almost a quarter of the index. Yes - the economy is weakening and unemployment is rising, and there is a school of thought that says that one should not be long the Russell 2000 in a cyclical slowdown because of its cyclical exposure. However, when the source of the slowdown is high interest rates and those interest rates are finally being brought down, this should be a bullish driver for the Russell, not a bearish one.

Until recently, the narrow leadership and lack of breadth in the bull market were reasons for market technicians to be bearish. Logic dictates that a broadening in leadership and improving breadth should be positive for the broad equity market. The last time the Russell 2000 outperformed the S&P 500 was in November 2020 until March 2021. The SPX rose by 25% during that period, and the Russell outperformed the SPX by 26%! SPX remained in an uptrend for another nine months until January 2022, when the Fed embarked on its rate hike cycle. In no way was small cap outperformance a negative for overall market performance, during or after the period of outperformance.

Crypto

Crypto traders speculated going into the weekend that Trump would announce his intention to create an official strategic reserve of bitcoin at the 2024 Bitcoin Conference. He fell just short of that, and instead announced that the government would not sell the 210,000 bitcoin (worth $14.5b today) that the government owns from law enforcement seizures. His speech fell slightly short of expectations, and bitcoin pulled back 2000 pts over the weekend before rallying up to 70k today.

Let’s back up a bit. The mere possibility of bitcoin becoming a national reserve asset has been every bitcoin maxi’s wet dream. This was not on anyone’s bingo card for this cycle, and the fact that politicians are considering it is massively bullish. The rally from 55-60k to the current level of 69k is just noise compared to the amount of upside we would see if a strategic bitcoin reserve became a reality.

If Trump wanted to create an official strategic reserve of bitcoin, he wouldn’t be able to do it via executive order. He would need the backing of Congress - and sure enough, Senator Lummis of Wyoming announced shortly thereafter a plan to introduce new legislation to create a strategic reserve of bitcoin. The crypto industry is now one of the largest donors to both parties, with the pro-crypto super-PAC Fairshake being the largest super-PAC of the election cycle. This makes it likely that momentum towards a strategic bitcoin reserve will continue. If this happens, bitcoin’s journey to become a legitimate financial asset and sovereign store of value would be complete, and would likely result in the market cap of bitcoin ($1.36T) surpassing that of gold ($15.7T) over the coming decade.

Been looking to park some cash, thank you for the Russell tip Bro Geo!