The BoJ kept monetary policy on hold and didn’t change its band for the 10y JGB or any part of the curve. I have to admit I got this call wrong, as I assigned only a 20% probability of no action. Usd/jpy has only rallied 250 pips so far - less than I originally expected.

My sense is that Kuroda saw speculators (such as myself) getting overzealous and didn’t want to give them what they wanted. Unfortunately for him, his inaction doesn’t solve the problem that JGB yields are too low and that the market will resume selling into its bid in no time. The BoJ is committing to another month and a half of protecting the 50 bp yield cap - no easy feat when tens of billions USD worth of JGBs are getting sold every day. Kuroda knows this is unsustainable, the market knows it’s unsustainable, and the market knows Kuroda knows it’s unsustainable! We’ll see how this plays out, but I wouldn’t be surprised if usd/jpy squeezes a bit further from here and then rolls back over in the next few weeks.

Treasuries and equities are rallying on relief that the BoJ has staved off another collapse in the JGB market. Last night we saw a rally in both asset classes when a report came out (citing an unidentified official) hinting that the ECB might slow its pace of hikes to 25 bp next meeting. We’ve had two dovish surprises by global central banks in the last 24 hours so I’ll be watching closely to see if equities and Treasuries can continue upward momentum today or if they fail and reverse lower.

The ECB article dented the prospects of my eur/chf long, which has now revisited the original breakout level of 0.9950. My stop is not too far away in case it can’t hold here.

I’m re-entering my usd/cnh short here at 6.7820. Recall I went short at 6.9850 and then covered it at 6.8000 after three weeks. Usd/cnh extended further to 6.70 before rallying sharply back to current levels. The fundamentals behind the original trade still apply and have a lot of room to run, so I’m lowering my target to 6.45 and placing my stop at 6.85.

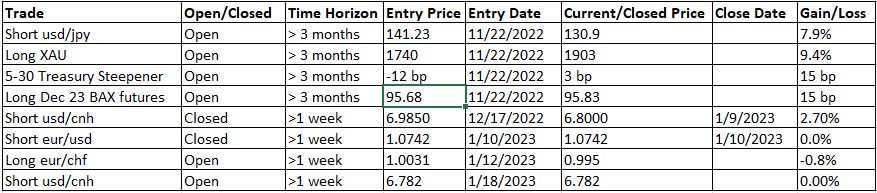

Current positions:

Disclaimer:

The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments.

The author of this blog is not a registered investment advisor, financial planner, or tax professional. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk.

Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.