I was digging through some old notebooks earlier this year, and one particular I found from 2002 had some nice gems. Along with some old recipes and phone numbers from the UK, I unearthed some notes I had picked up from my first few years of trading and reading trading books such as Market Wizards, by Jack Schwager. A lot of these rules and observations still hold true today, although some of them only apply to global macro or to a certain style of trading (mine). It’s nice to read through these again and be reminded of how following these axioms can help one build a trading edge. For educational purposes I’m sharing these notes in this blog, along with my thoughts on what I wrote in 2002 vs what I think today in [brackets].

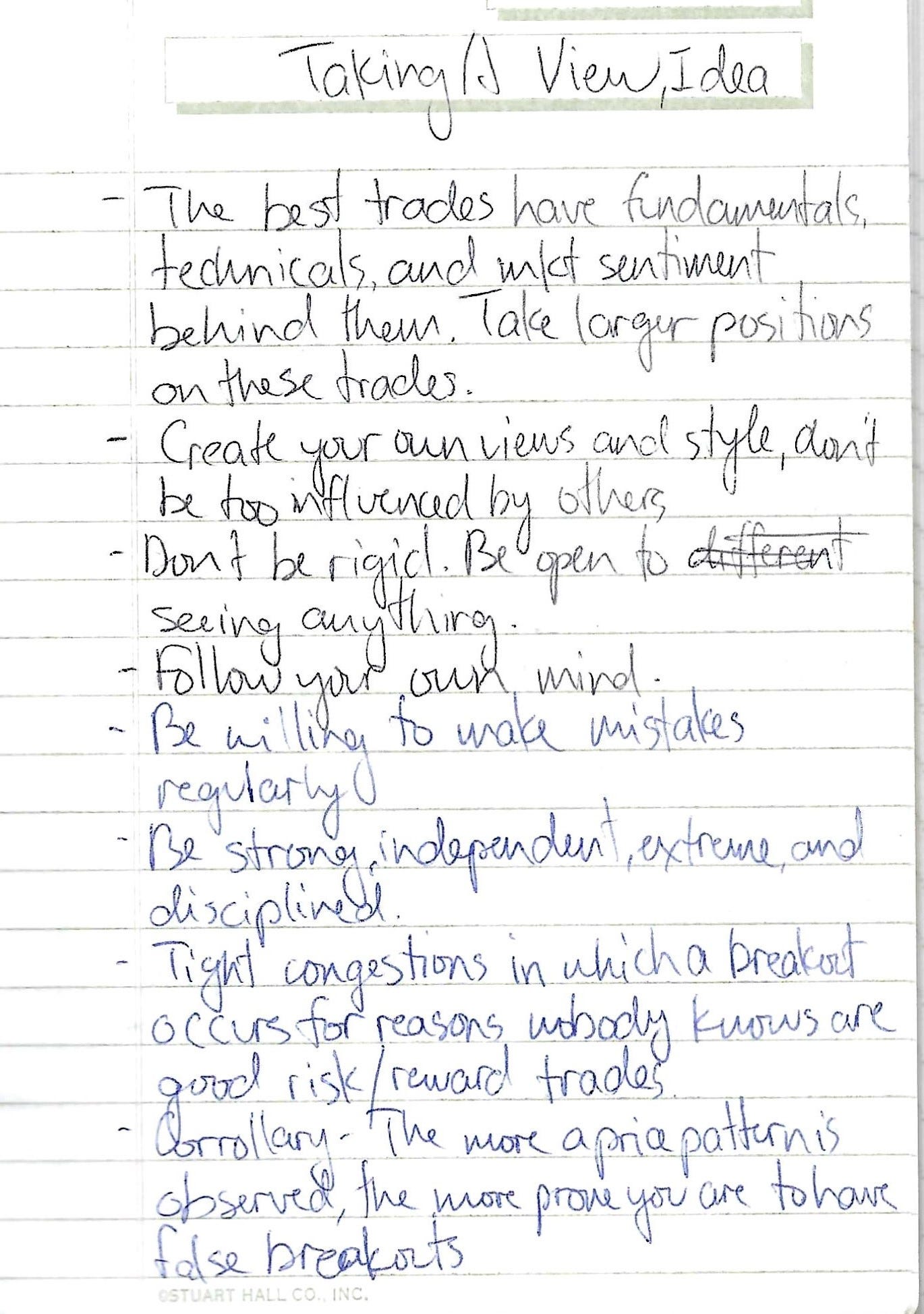

Taking a view, idea

The best trades have fundamentals, technicals, and market sentiment behind them. Take larger positions on these trades.

Create your own views and style, don’t be too influenced by others.

Don’t be rigid. Be open to seeing anything

Follow your own mind

Be willing to make mistakes regularly. [Mistakes are fine as long as lessons are learned from them. They also happen as a result of experimentation and the process of adaptation, which are always good things.]

Be strong, independent, extreme, and disciplined

Tight congestion in which a breakout occurs for reasons nobody knows are good risk/reward trades

Corollary - The more a price pattern is observed, the more prone you are to have false breakouts. [Example would be if there’s a level or chart pattern that is widely being looked at by the entire market - that technical setup is prone to fail.]

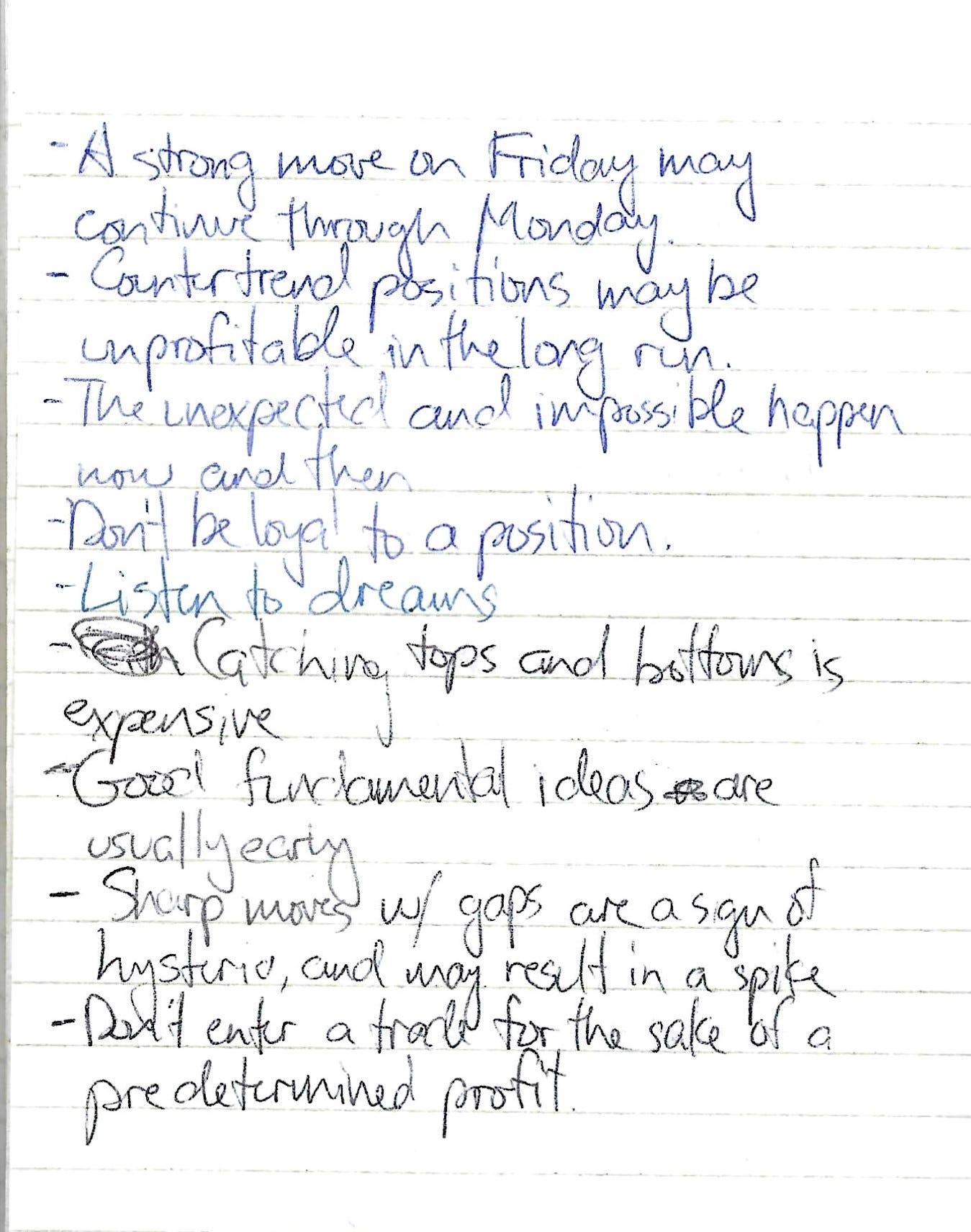

A strong move on Friday may continue through Monday. [An interesting phenomenon I observed back then but no longer holds true.]

Countertrend positions may be unprofitable in the long run. [What I meant is a strategy of going against a trend instead of with it usually ends up being a losing strategy]

The unexpected and impossible happen now and then

Don’t be loyal to a position

Listen to dreams. [In Market Wizards, one trader talked about how dreams can be your subconscious giving you clues about where the market is going. I personally haven’t found dreams to be that helpful in trading.]

Catching tops and bottoms is expensive [everyone know this but still loses money trying].

Good fundamental ideas are usually early [If you’ve done your homework and have seen a fundamental shift before others in the market have, most likely you are too early and need to wait until the market comes around to agreeing with your idea.]

Sharp moves with gaps are a sign of hysteria, and may result in a spike [by spike, I mean a spike reversal]

Don’t enter a trade for the sake of a predetermined profit [Don’t think “I need to make X amount of money today, so I’m going to put this trade on”]

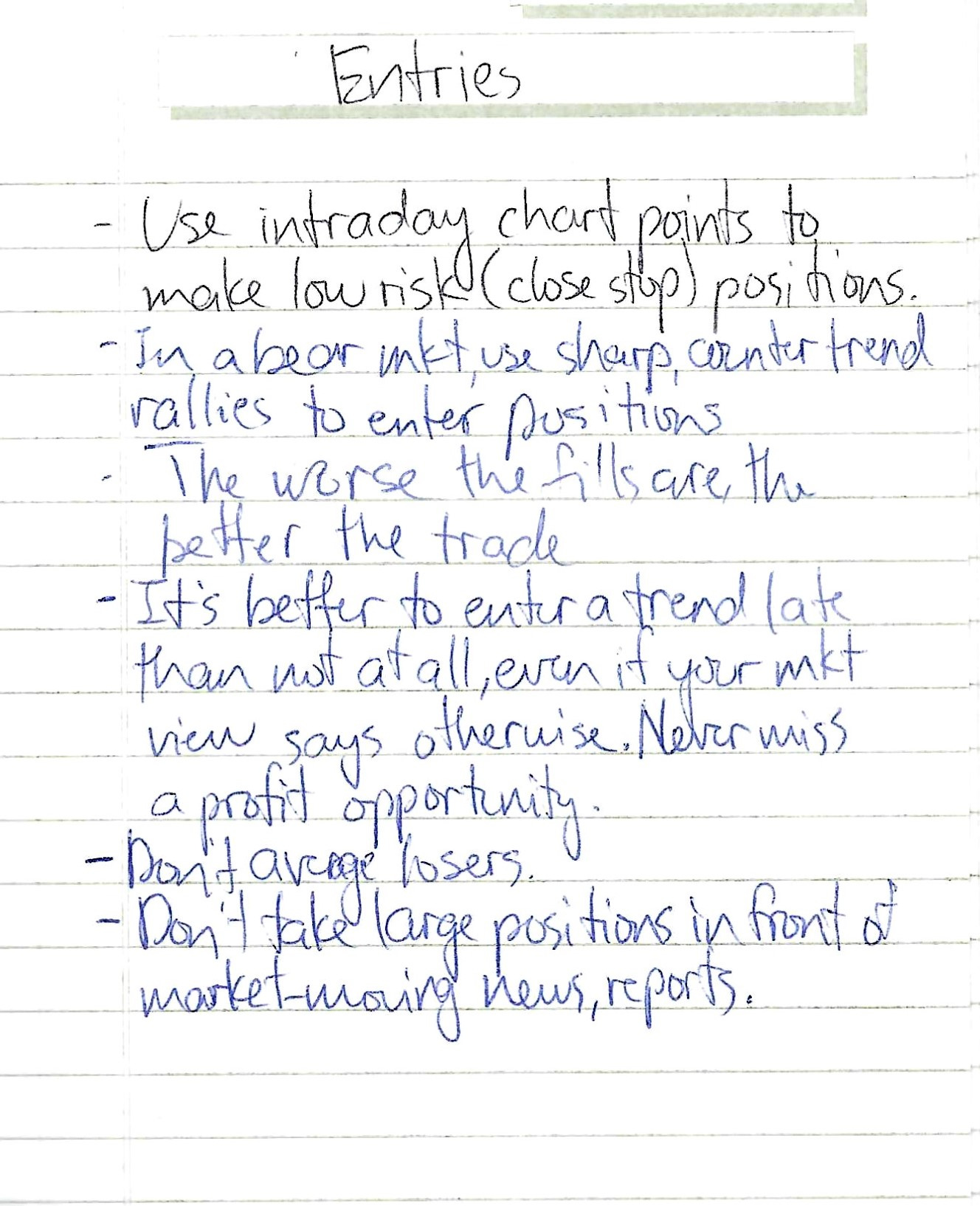

Entries

Use intraday chart points to make low risk (close stop) positions

In a bear market, use sharp, countertrend rallies to enter positions

The worse the fills are, the better the trade [If you are trading in the direction of the market, like buying when the market is going up, and there is a lot of slippage in the execution, it means a there is a large supply/demand imbalance in your favor.]

It’s better to enter a trend late than not at all, even if your market view says otherwise. Never miss a profit opportunity. [I have to disagree with this one - trade in the direction of your market view, and being a latecomer to a trend isn’t a high value strategy.]

Don’t average losers [unless the plan was to scale into a position in the first place].

Don’t take large positions in front of market-moving news, reports [ie subject yourself to large gap risk]

Exits

Never exit a position until you know the trend has changed [“never” is too strong of a word, there are lots of good reasons to exit a position even if the trend hasn’t changed].

Choose a stop before you get in, and also a tentative take profit point [this contradicts the previous rule. I think having a target in mind is helpful as it prevents you from getting too greedy on a trade].

Hold winners, cut losers

Put stops behind a technical barrier where it’s hard to reach. Adjust position size accordingly

If you have a loss or are breakeven on a trade after a week, you’re probably wrong [applicable to swing traders only].

If I’m covering a loss beyond an area with many stops, liquidate part of the position in front of the stops and the rest behind [this is to front run dealers who will likely attempt to trigger clusters of stops. However I don’t think this works as well anymore.]

If you’re worried about a position but your worst fears aren’t realized, you might be right [when the left tail risk for a position or view gets removed, that helps the position more than you’d think].

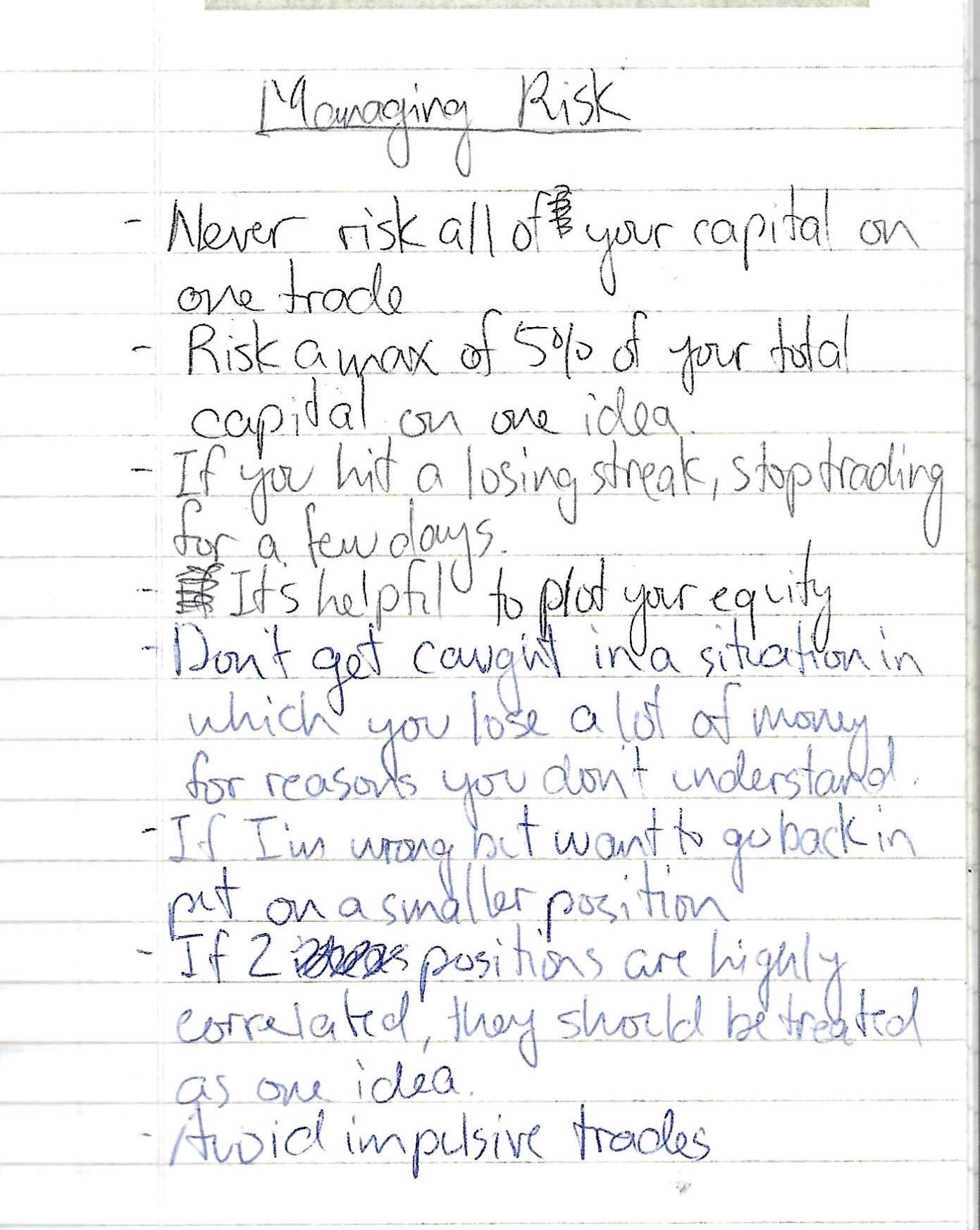

On Managing Risk

Never risk all of your capital on one trade

Risk a max of 5% of your total capital on one idea [these days it’s max 2%].

If you hit a losing streak, stop trading for a few days [applicable to short term traders only]

It’s helpful to plot your equity.

Don’t get caught in a situation in which you lose a lot of money for reasons you don’t understand. [In other words, figure out the mistake and lesson, and learn from it].

If I’m wrong but want to go back in, put on a smaller position.

If 2 positions are highly correlated, they should be treated as one idea

Avoid impulsive trades [The best trades are the ones you’ve been planning to put on, given the right fundamental trigger or technical level, and when the trade happens it’s just executing on a plan.]

After a loss or losing streak, trade smaller, and think more

Never become cocky or overconfident [Another rule that is obvious in theory but difficult in practice]

The most dangerous period is after a good winning period - reduce position size

Psychological Attributes

Disciplined

Unemotional [It’s more nuanced than being unemotional. It’s separating emotion from your decision-making process. Emotion and self-awareness of how you are feeling is important.]

Patient - wait for the pieces to come together

Wants to win and make money (as opposed to gaining utility from losing). [Some people have issues with their subconscious self, which can interfere with trading by sabotaging yourself when you are doing well].

Analytical

Introspective

Obsessed with managing risk

Able to view different configurations of the world. [If you can’t imagine all the different ways the world and markets can look tomorrow, you probably won’t do well as a directional global macro trader].

Humble

Contrary

Strong-minded, decisive, unswayable [but not stubborn. I think what I meant by this was to believe in your own view and analysis and not let other people convince you otherwise without good reason].

Flexible, can change view immediately

Extreme ability to imagine markets doing the unimaginable

Independent, follows own mind

Numeric, good quant skills

Thrives under pressure

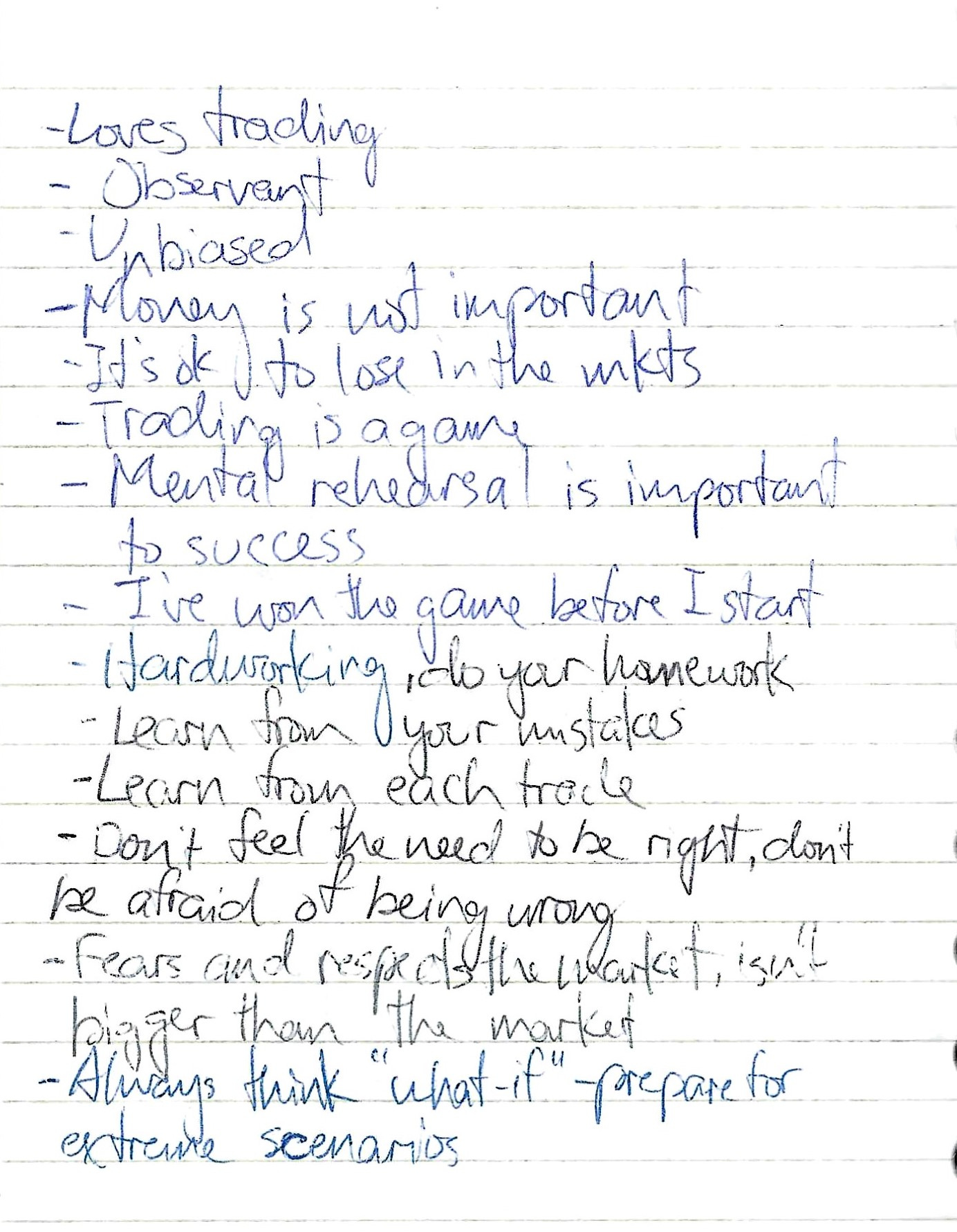

Loves trading

Observant

Unbiased [you need to identify your biases and constantly correct for them. One common bias is frequently leaning towards risk-off views, or risk-on.]

Money is not important. [to clarify, money is important, but what’s important in trading is separating the real-life utility and importance of money from your pnl]

It’s ok to lose in the markets [accepting losses is part of the game].

Trading is a game

Mental rehearsal is important to success [I sometimes rehearse taking a loss, so that when it comes time to stop myself out, I actually do it].

I’ve won the game before I start [optimism is pretty helpful in a trading career]

Hardworking, do your homework

Learn from your mistakes

Don’t feel the need to be right, don’t be afraid of being wrong [I’d rather make money than be right].

Fears and respects the market, isn’t bigger than the market [I have seen traders with large risk limits or large flow try to bully the market, and it often doesn’t end well].

Always think “what-if” - prepare for extreme scenarios

Still applicable today

this is awesome and time-tested! Would love to hear about those old recipes too at some point