The raft of weak US economic data this month has been impossible to ignore. We’ve had downside misses in ISM manufacturing, ISM services, non-farm payrolls, CPI, and jobless claims. Adding to the crescendo was a sharp drop in the price of oil yesterday, and Walmart’s CEO mentioning the “D” word in his earnings call:

“In the U.S., we may be managing through a period of deflation in the months to come and while that would put more unit pressure on us, we welcome it, because it’s better for our customers,” he said.

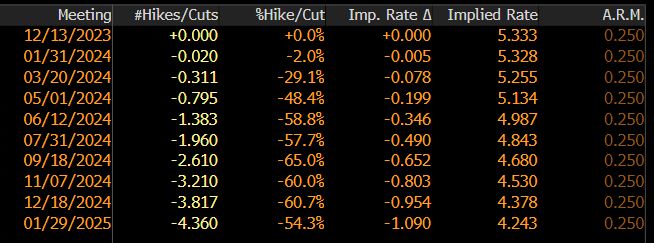

My core view previously was that the Treasury supply weighing on the bond market was the most important driver in global macro, but the focus is now shifting towards softening employment and inflation, coupled with the growing consensus that the Fed is now done hiking.

This year has seen streaks of hot and cold data, and disinflation and stagflation regimes. The noise to signal ratio has been high, resulting in choppy market conditions and head fakes. However, I think the momentum in this month’s disinflation trend has legs, as the likelihood of an end to the Fed hiking cycle has never been higher.

Further softening in employment is the key driver for disinflation that I’m looking out for. WARN notices tend to lead jobless claims by 2 months, and they are pointing higher.

The Fed pivot narrative triggered squeezes in bonds and equities, markets that were positioned heavily short going into this month. Now the disinflation regime is spilling into FX and precious metals, where USD is losing ground. In the following paid subscriber section, I’ll go over the two trades I’m putting on to position for a further weakening of data and a continuation of the disinflation regime.

Keep reading with a 7-day free trial

Subscribe to Fidenza Macro to keep reading this post and get 7 days of free access to the full post archives.