This is the final part of my series on gold. If you missed the previous parts of this series, make sure you read Part 1 and Part 2. I’m also doing a Cyber Monday sale of 20% off an annual subscription (regular price of $300), which will go until Dec 3.

Bitcoin emerged over the last decade as a new store-of-value asset and has been called “digital gold” by its adopters. Its market cap sits at $730B today versus a market cap of $6.5T of gold that is used as a financial asset (as opposed to jewelry). Ardent supporters of bitcoin, aka “bitcoin maximalists” believe that bitcoin’s market cap will overtake gold’s, making it the world’s primary store-of-value asset. In this post, I discuss my framework for trading bitcoin, how it correlates to gold, and compare gold vs bitcoin as a store of value.

Behavior of price as a hedge against inflationary monetary policy and debasement of currency

Bitcoin is a unique asset in the sense that it trades in multi-year cycles, with each cycle’s high surpassing the previous one (so far) by a healthy multiple. It’s difficult to find another equity or commodity that exhibits cyclical behavior so violently skewed to the upside. Bitcoin forms bottoms on excessively bearish sentiment and tight monetary conditions, and accelerates into bull markets on growing adoption and FOMO that drives reflexive advances in price. Bitcoin forms tops on excessively bullish sentiment and loose monetary conditions, and accelerates into bear markets on deleveraging and the unwinding of previous crypto excesses. Gold provides a leading signal on whether monetary policy is acting as a tailwind or headwind to bitcoin at any particular point in the crypto cycle.

The origin of Bitcoin came from a whitepaper written by Satoshi Nakamoto that was released in the depths of the financial crisis of 2008. The first Bitcoin, known as the “genesis block”, was mined on January 3, 2009. In the coinbase parameter of the genesis block was the message, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”, a reference to a headline in The Times newspaper alluding to the instability of the fiat banking system. Bitcoin proponents believe that Satoshi intended to create an alternative financial system that is based on immutable cryptographic code and a hard supply limit. Satoshi imparted two characteristics onto bitcoin that make it similar to gold - its value is derived from its network of adopters and isn’t dependant on another party paying you back (such as the bank or federal government) and that it cannot be inflated with new supply at will.

Since bitcoin was created, the Federal Reserve has conducted three rounds of quantitative easing to fight deflation after the GFC, as well as a super-sized round of quantitative easing combined with fiscal stimulus and helicopter money during Covid. Gold performed well as a hedge against inflationary monetary policy, running up from $725 in October 2008 to 1900 in August 2011 during QE 1, QE 2, and the debt ceiling crisis of 2011. Bitcoin performed remarkably during that window, multiplying from being worth a few cents to as much as $21. However, one can’t attribute that price performance to Bitcoin’s usefulness as an inflation hedge. The price rise was more a function of increased awareness and adoption that took the price from a miniscule six-digit market cap to over $100m.

Bitcoin’s usefulness as a hedge against inflationary monetary policy can only be assessed after 2017, which is when it was discovered by the wider public. Bitcoin had a rough start to 2018 as the parabolic advance of 2017 gave way to a precipitous decline. The Fed’s rate hike cycle and quantitative tightening in 2017-2019 was not kind to the crypto market, and also sent gold selling off from $1350 to a low of $1174. Gold hit its low on August 16, 2019 - four months ahead of bitcoin’s low of $3236.

As the economy began to weaken and the market started to sense a limit to the Fed’s tightening campaign, gold embarked on a bull market run. The March 2020 interrupted gold and bitcoin’s advance as the volatility shock sent both sharply lower. However, gold recovered much faster than bitcoin, running up to $2060 by August 2020 as the Fed monetized trillions of US debt in what would be the biggest inflationary impulse in modern American history. Bitcoin recovered as well and hit its peak 8.4 months later on April 2021. That peak of $67k was surpassed marginally in November 2021 before bitcoin fell back to earth in the next crypto winter.

Could it be that bitcoin tracks gold’s property as a hedge against inflationary monetary policy, but with a variable lag? Let’s keep exploring this thesis.

Ever since the August 2020 high, gold has been in a wide and choppy range. It attempted to break to new highs after Russia invaded Ukraine, but failed. The low of gold’s range was $1622 on September 26, 2022, amidst the Fed’s back-to-back hikes of 75 bp. The low in gold represented peak Fed hawkishness and coincided with the low in equities. Even though the Fed continued hiking well into 2023, they did so at a slower pace in each meeting. Bitcoin marked its bottom of the bear market on November 21, 2022, just 56 days after gold.

These are a handful of data points that suggest that inflection points in gold tend to lead inflection points in bitcoin. Before you start thinking you’ve found the holy grail of trading bitcoin by simply following gold, I warn that it’s not that simple. Bitcoin can decouple from gold for months at a time, and its lag to gold can vary. I prefer to use gold as a long term leading indicator, especially on the bullish side.

Bitcoin as a store of value

Can bitcoin overtake gold as the world’s largest store-of-value asset? The more people who use bitcoin and hold it as an investment or store of value, the more bitcoin’s market cap must expand to support its wider adoption. If its market cap can exceed the total value of gold that is used as a financial asset (excluding jewelry), that would be a 9x return at today’s gold price.

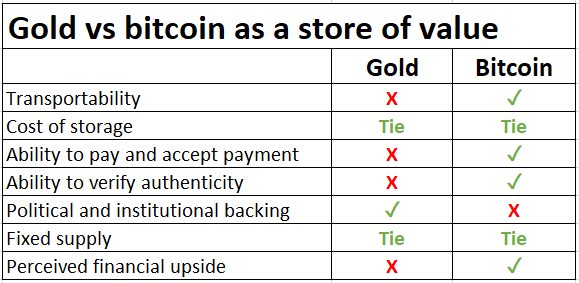

As a thought exercise, let’s take all the reasons gold excels as a store of value, and see how bitcoin stacks up.

Transportability and transferability - Throughout history, gold has excelled as a store of value because it takes up the least amount of weight and space per dollar of value, and therefore is the easiest way to physically transport wealth from point A to point B, or from person to person. However, bitcoin can be stored on a Ledger or thumb drive and transferred from wallet to wallet with a similar electronic transaction. In contrast, when central banks need to move gold from New York to London, they need to transport it on a plane. Bitcoin wins in this category.

Cost of storage - Gold can be stored for free in a personal safe or under the mattress. However, most institutions and large holders of gold store it in a vault, and that costs 50-150 bp per year (including insurance). Bitcoin can also be stored in a personal cold wallet for free, while the private key to the wallet can be stored in a safe. Institutional-grade custody for crypto costs roughly the same amount as storing gold in a vault. The cost and ease of storage are roughly the same for both bitcoin and gold.

Ability to pay and accept payment - There are few businesses, online and physical, that accept either bitcoin or gold as payment. However, there are significantly more that accept bitcoin than those that accept gold. In addition, there are now credit cards that allow one to spend bitcoin. Bitcoin wins this category.

Ability to verify authenticity - Gold can be faked by adding impurities, and often this can only be detected by using professional-grade chemical or electronic tests. Gold can be melted down to hide its origin. Bitcoin, on the other hand, cannot be faked, and every transaction is transparent on the public blockchain. If one views transparency and authenticity as a positive characteristic for a store of value to have, then bitcoin wins over gold.

Political and institutional backing - Until the Bretton Woods monetary system collapsed half a century ago, gold was the dominant reserve asset for governments and empires for millenniums. Even though fiat currency has since overtaken gold as a percentage of central bank reserves, governments still hold substantial amounts of gold in their treasuries and have a vested interest in gold maintaining its status as a store of value. Gold benefits from the “Lindy effect”, and is the incumbent store-of-value asset. Bitcoin, despite how far it has come, is still the underdog. Even though El Salvador adopted bitcoin as legal tender and has purchased bitcoin for its treasury, there are more countries than I can count on my hands that have outlawed or restricted the use of crypto. The launch of a bitcoin ETF would be a step forward in the institutional backing for bitcoin, but for now, gold wins this category.

Fixed supply - Bitcoin’s protocol sets a limit of 21 million bitcoins that can ever be mined. As of today, 19.5 million bitcoins are in the circulating supply, and as we reach the 21 million cap, the computational difficulty for miners to mine each additional coin will increase exponentially. At the moment, the supply of bitcoin inflates at approximately 2% per year.

Gold’s is difficult, costly, and damaging to the environment to mine out of the ground. Mining increases the supply of gold at roughly 2% per year, putting its annual inflation rate at the same level as bitcoin.

There are potential vulnerabilities to the supply of bitcoin that could pose a problem in the distant future. A 51% attack is when an attacker takes over 51% or more of the mining network, which would allow him to potentially spend the same bitcoin twice. The double spend would effectively increase the supply of bitcoin beyond the parameters of the protocol and severely damage the network’s reputation as a store of value. Today, the mining network is sufficiently decentralized and distributed geographically across many unrelated entities so present day computing power would be unable to attack the network. However, it is conceivable that the mining network can consolidate into the hands of a few actors or that quantum computing can become advanced enough to carry out a 51% attack in the future.

The discovery of a large and easily mined deposit of gold on earth (in the deep sea, for example) or in space would create fears of a supply glut of gold. A handful of companies are currently developing asteroid mining capabilities, and if they ever discover gold and have a reasonable chance of bringing it back, the threat of that supply reaching the global market would be enough to damage gold’s prospects as a store of value.

I would put both bitcoin and gold at a tie when it comes to their supply remaining relatively fixed.

Perceived financial upside - Some gold investors see the asset as a diversification tool in their portfolio, while more bullish investors hold gold because they believe it will appreciate relative to fiat currency over time and outperform other assets such as bonds and stocks. Many investors own bitcoin for the same reasons, but a much larger share buy bitcoin for speculation. The majority of bitcoin’s appreciation in a bull market can be attributed to increased network adoption and speculative fervor. Inflationary monetary policy simply provides the trigger and the narrative for the bull market to continue. As a vehicle for speculation and perceived financial upside, bitcoin wins over gold.

And the results are (drumroll)…

Bitcoin wins over gold in more categories, except for having the backing of governments and financial institutions worldwide. However, bitcoin improves its “Lindyness” every cycle in which it survives and reaches new levels of adoption. Not only is Blackrock launching its bitcoin ETF, but Fidelity also has 600 people working in its digital assets team! As more people and institutions adopt and hold bitcoin, the market cap should grow over time, further cementing bitcoin’s reputation as a superior store of value asset.

That said, it would take multiple violent cycles for bitcoin’s market cap to surpass gold’s, even in the best case scenario. Bitcoin’s ascent is not guaranteed, as many countries continue to shun bitcoin and thwart its adoption. The gold market is also adapting to the digital age by seeking to improve transparency, liquidity, and transportability via blockchain rails. If successful, the improvements in the gold market would help close some of the gaps in its functionality vs bitcoin.

I am fairly confident about one thing, which is that excessive government borrowing and spending will result in more inflationary monetary policy and financial repression for decades to come. Bitcoin and gold will feature prominently in society as faith in the fiat based financial system erodes over time. After all, US dollar has been free floating for only half a century - a blip in the long history of human civilization.

If you enjoyed this series, please share it with friends and colleagues!

Disclaimer: The content of this blog is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The blog is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this blog is not a registered investment advisor or financial planner. The information presented on this blog is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this blog are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this blog will be profitable or suitable for your specific situation. The author of this blog disclaims any and all liability relating to any actions taken or not taken based on the content of this blog. The author of this blog is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

Great read Geo! Thank you for the great 3 part series. It's helped me with my framework with gold as a new investor/trader.

Geo, while I think you make a series of excellent points across the 3 parts of this series, I believe that you may be underestimating just how powerful the government impact can be. as CBDC's begin to proliferate, and I am certain they will be doing so over the next several years, governments will be spending real time and effort to eliminate their competitors, namely bitcoin, and perhaps ether. and while they likely cannot shut down the network, they can absolutely close the exit ramps. enhanced KYC with stricter AML rules and an edict that banks cannot open accounts, or even keep accounts open, if there is a whiff of Bitcoin activity in the account holder's activities is very realistic, and something that governments around the world seem quite likely to implement if they feel they are losing some control on their monetary policy/system. in your chart I might weight the government issue at 3x or 5x and then add things up.